Tax reliefs and rebates are allowable if:

- You are a Singapore tax resident; and

- You meet the qualifying conditions in the year preceding the Year of Assessment (YA).

For example, if your child was born in 2024, child-related reliefs and rebates in respect of him/her will be considered with effect from YA 2025. Please note that a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed for each YA.

Please refer below for a summary table of tax savings for married couples and families:

| For Daddy and Mummy | For Mummy only | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

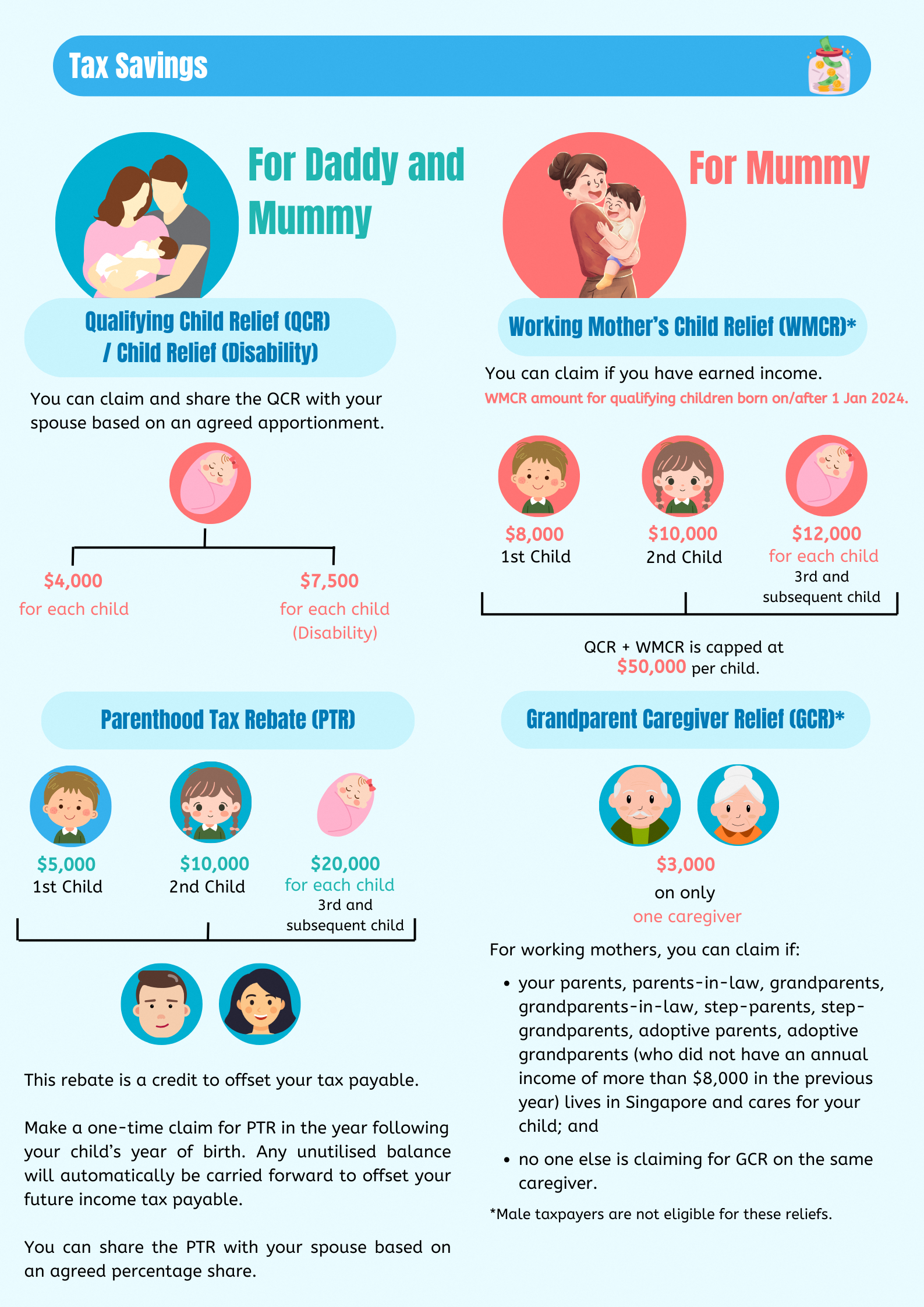

Qualifying Child Relief (QCR)

| Working Mother's Child Relief (WMCR)

| ||||||||||||

Parenthood Tax Rebate (PTR)

1st child: $5,000 2nd child: $10,000 3rd and subsequent child: $20,000 for each child | Grandparent Caregiver Relief (GCR)

i. your parents, parents-in-law, grandparents, grandparents-in-law, step-parents, step-grandparents, adoptive parents, adoptive grandparents (who did not have an annual income of more than $8,000 in the previous year) lives in Singapore and cares for your child; and ii. no one else is claiming for GCR on the same caregiver.

|

Qualifying Child Relief (QCR)/Child Relief (Disability)

QCR and Child Relief (Disability) are given to recognise the efforts of families in supporting their children.

Example 1: Sharing QCR on a child

Mr and Mrs Tan have a child born. They have agreed to share the QCR of $4,000 equally.

Hence, they will each claim QCR of $2,000 in their respective Income Tax Returns.

Working Mother's Child Relief (WMCR)

WMCR is given to:

- Encourage married women to remain in the workforce after having children

- Encourage parents to take up Singapore Citizenship for their children

- Reward families with children who are Singapore Citizens

Example 2: Claiming WMCR on the first child

Mr and Mrs Lim had their first child in 2024. Mrs Lim was working and had an earned income of $100,000 for that year. The amount of WMCR she may claim for the Year of Assessment 2025 is $8,000.

Parenthood Tax Rebate (PTR)

PTR is given to Singapore tax residents to encourage them to have more children. If you are married and have a child who is a Singapore Citizen, you may claim for PTR in the relevant year.

Example 3: Claiming PTR on the first child

Mr and Mrs Koh had their first child (Singapore Citizen) in 2024. They are entitled to PTR of $5,000 for their first child and have agreed to share the PTR equally.

Mr and Mrs Koh’s tax payable after personal income tax rebate for the Year of Assessment (YA) 2025 are $2,730 and $1,602.30 respectively. The PTR to be utilised for YA 2025 are as follows:

| Mr Koh | Mrs Koh | |

|---|---|---|

| Tax Payable on Chargeable Income | $2,930 | $1,802.30 |

| Less: Personal Income Tax Rebate | $200 | $200 |

| Tax Payable after Personal Income Tax Rebate | $2,730 | $1,602.30 |

| Less: Parenthood Tax Rebate | $2,500* | $1,602.30* |

| Net Tax Payable | $230 | $0 |

* Mr Koh has fully utilised his share of the PTR in YA 2025, while Mrs Koh only utilised $1,602.30. The unutilised amount of PTR (i.e. $897.70) in Mrs Koh’s account will be automatically carried forward to offset her income tax payable for the subsequent YA(s), until it has been fully utilised.

Grandparent Caregiver Relief (GCR)

GCR is given to working mothers who engage the help of their parents, grandparents, parents-in-law or grandparents-in-law (including those of ex-husband) to take care of their children. Single taxpayers or male taxpayers are not eligible for this relief.

Example 4: Mother-in-law helped to take care of child

Mr and Mrs Sim had their first child (Singapore Citizen) in 2024. Mrs Sim is a working mother and has engaged the help of her mother-in-law to take care of the child. Her mother-in-law was living in Singapore and not earning trade, business, profession, vocation and/or employment income exceeding $8,000 in 2024. In addition, no one else is claiming GCR on her mother-in-law. Hence, Mrs Sim may claim GCR of $3,000 on her mother-in-law for the Year of Assessment 2025.

NSman Wife Relief

NSman Wife Relief of $750 is given to the wives of NSmen to recognise the support they give to their husbands. You will be entitled to this relief if the following conditions are met:

- You are a Singapore Citizen in the year preceding the Year of Assessment; and

- Your husband is eligible for NSman Self Relief.

Widows of deceased NSmen will still be eligible for the relief unless they have re-married.

You do not need to claim this relief as IRAS will automatically grant it to you based on your eligibility.

Example 5: Summary of reliefs and rebates

Mr and Mrs Ng had their first child (Singapore Citizen) in 2024. They agree to share the Qualifying Child Relief and Parenthood Tax Rebate equally.

In 2024, Mr Ng had performed NS activities and Mrs Ng who is a working mother had engaged the help of her mother-in-law to take care of her child.

The tax computation for Year of Assessment 2025 is as follows:

| Mr Ng | Mrs Ng | |

|---|---|---|

| Employment Income | $100,000 | $100,000 |

| Less: Personal Reliefs | ||

| - Earned Income Relief | $1,000 | $1,000 |

| - Qualifying Child Relief | $2,000 | $2,000 |

| - Working Mother's Child Relief | - | $8,000 |

| - Grandparent Caregiver Relief | - | $3,000 |

| - NSman Self / Wife Relief | $3,000 | $750 |

| - CPF Relief | $20,000 | $20,000 |

| Total Personal Reliefs | $26,000 | $34,750 |

| Chargeable Income | $74,000 ($100,000 - $26,000) | $65,250 ($100,000 - $34,750) |

| Tax on First $40,000 | $550 | $550 |

| Tax on Next $34,000 / $25,250 @ 7% | $2,380.00 ($34,000 x 7%) | $1,767.50 ($25,250 x 7%) |

| Tax Payable on Chargeable Income | $2,930.00 | $2,317.50 |

| Less: Personal Income Tax Rebate (60% capped at $200) | $200 | $200 |

| Tax Payable after Personal Income Tax Rebate | $2,730.00 | $2,117.50 |

| Less: Parenthood Tax Rebate | $2,500.00* | $2,117.50* |

| Net Tax Payable | $230.00 | $0 |

* Mr Ng has fully utilised his share of the PTR in YA 2025, while Mrs Ng only utilised $2,117.50. The unutilised amount of PTR (i.e. $382.50) in Mrs Ng’s account will be automatically carried forward to offset her income tax payable for subsequent YA(s) until it has been fully utilised.

Example 6: Summary of reliefs and rebates with relief cap of $80,000

Mr and Mrs Chua have 3 children (Singapore Citizens) aged 7, 10 and 12 in 2024.

Mrs Chua has agreed to allow Mr Chua to claim the full amount of Qualifying Child Relief on the 3 children for the Year of Assessment 2025.

Mr Chua had also performed NS activities in 2024.

The tax computation for Mrs Chua in Year of Assessment 2025 is as follows:

| Mrs Chua | |

|---|---|

| Employment Income | $120,000 |

| Less: Personal Reliefs | |

| - Earned Income Relief | $1,000 |

| - Working Mother's Child Relief (WMCR) on 1st child | $18,000 ($120,000 x 15%) |

| - WMCR on 2nd child | $24,000 ($120,000 x 20%) |

| - WMCR on 3rd child | $30,000 ($120,000 x 25%) |

| - NSman Wife Relief | $750 |

| - CPF Relief | $20,400 |

| Total Personal Reliefs | $94,150 |

| Total Personal Reliefs after capping | $80,000 |

| Chargeable Income | $40,000 ($120,000 - $80,000) |

| Tax Payable on Chargeable Income | $550 |

| Less: Personal Income Tax Rebate (60% capped at $200) | $200 |

| Tax Payable after Personal Income Tax Rebate | $350 |

| Less: Parenthood Tax Rebate | -* |

| Net Tax Payable | $350.00 |

* Mrs Chua has fully utilised her Parenthood Tax Rebate in prior YAs.