Advantages of e-Filing

- Filing taxes is easier

You may e-File via myTax Portal with your Singpass or Singpass Foreign user Account (SFA). An acknowledgement page will be shown after you have e-Filed successfully. - 24/7 access to your account

Access your account anytime, anywhere! - Longer filing period

The filing due date for paper tax form is on 15 Apr each year. However, if you e-File, you have up to 18 Apr to do so.

Steps to e-File your Income Tax Return

"Save as draft" option

If you are not able to complete your filing at one session, please save your Income Tax Return as ‘draft’. The draft will be retained in the portal for 14 days. Please note that this draft is not a submission of your Income Tax Return. You are required to submit your Income Tax Return within 14 days of saving your draft or before 18 Apr, whichever is earlier.

You may access the draft and make the necessary amendments before you submit your Income Tax Return. To retrieve the draft copy of your Income Tax Return, log in to myTax Portal using your Singpass or SFA. On the top menu, click "Individuals" and select "File Income Tax Return". Follow the instructions shown on the screen to retrieve your Income Tax Return and continue to file.

Timeout

Please do not leave your filing session idle for more than 20 minutes. Otherwise, the session will expire and you will be required to log in to the portal again. If you are unable to complete your filing, you may save a ‘draft’ of your filing before you log out from the portal.

Step 1: Get a Singpass or Singpass Foreign user Account (SFA)

Singpass is a common password that you use to access all Government e-Services. You may apply for Singpass online and you should receive it within 4 working days. 2-Step Verification (or 2FA) is required when you use Singpass. Find out more about Singpass.

If you are not eligible for Singpass, you may apply for a SFA online.

Step 2: Prepare the required documents

Before you log in to myTax Portal, make sure you have these documents ready:

- Singpass/SFA

- Form IR8A (if your employer is not participating in the Auto-Inclusion Scheme)

- Particulars of your dependants (e.g. child, parent) for new relief claims

- Details of rental income from your property (e.g. gross rent, expense claims) and other income, if any

- Business registration number/partnership tax reference number (for self-employed and partners only).

Step 3: Log in to myTax Portal

Log in to myTax Portal with your Singpass/SFA. Click on "Individuals" > "File Income Tax Return" to start. This electronic tax form may take about 5-10 minutes to complete. Please clear your cache (temporary internet files) before and after filing.

There are software requirements for accessing myTax Portal. Please refer to the operating systems and browsers that are supported.

Your session will expire if you leave it idle for more than 20 minutes. When this happens, you have to log in to the portal again.

Step 4: Verify your pre-filled income sources and personal reliefs in the main tax form

IRAS will pre-fill the following information in your main tax form:

- All income, deductions and reliefs information provided by the relevant organisations directly to IRAS. For example, employment income from employers participating in the Auto-Inclusion Scheme, donations, NSman Relief.

- Rental income based on your declaration in last year's Income Tax Return or e-stamped tenancy records.

- Reliefs allowed to you in the previous year (e.g. Qualifying Child Relief).

Verify that all the pre-filled information (i.e. income, deductions and reliefs) is accurate and complete. Please check with the relevant organisations directly for any discrepancy. The organisation will resubmit the information to us if there are errors in the original submission and this will be included in your tax assessment. In the meantime, please proceed to e-File your Income Tax Returns by 18 Apr each year.

Step 5: Declare other sources of income

If you have received any other sources of income which are not pre-filled (e.g. rental income), you need to declare the income in your Income Tax Return. Select "+ADD NEW" to open details page and enter your income in the boxes provided to declare your additional income. After filling the details, select "UPDATE" to save the details into the main form.

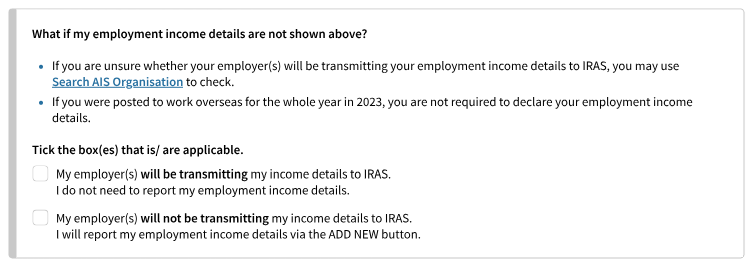

If your employer is participating in the Auto-Inclusion Scheme (AIS) for Employment Income but details are not shown in the main tax form, tick the box(es) that is/are applicable:

- My employer(s) will be transmitting my income details to IRAS. I do not need to report my employment income details.

- My employer(s) will not be transmitting my income details to IRAS. I will report my employment income details via the ADD NEW button.

Step 6: Update existing tax reliefs

Enter your deductions/reliefs in the boxes provided or click on the relevant hyperlinks to:

- Remove the pre-filled reliefs which you no longer qualify

- Change/amend the amount of reliefs which are shared with other claimants

- Make new claims for deductions/reliefs.

Find out more from the Quick Guide for e-Filers (PDF, 330KB).

Step 7: View Consolidated Statement

A Consolidated Statement will be displayed and fields that are manually updated are shown as '(Updated)'.

Check the declaration box and select "Submit" to proceed with the submission of your tax return.

Step 8: Receive an acknowledgement receipt

An acknowledgement page will be shown after you have e-Filed successfully. You are advised to save a copy or print the page for future reference.

Re-filing before receipt of your tax bill (i.e. Notice of Assessment)

You may only re-file once. Re-filing must be done within 7 days of your previous submission or before 18 Apr, whichever is earlier.

When you re-file, you must include all your income details (excluding information provided by employers participating in the Auto-Inclusion Scheme (AIS) for Employment Income and other relevant organisations) and expenses/donations/reliefs claims. Once you have re-filed successfully, your new submission will override the previous submission.

However, if you wish to make amendments after you have re-filed, you may email us.

Update Contact & Notification Preferences

Most IRAS notices are digitised. Stay informed by updating your contact details or notification preferences via the 'Update Contact & Notification Preferences' digital service at myTax Portal to receive timely notifications when your notices are ready for viewing.