Sale / purchase of electricity

| Transactions | GST Treatment |

|---|---|

| Sale of electricity | Standard-rated supply |

| Purchase of electricity | Taxable purchase |

Contract for differences

| Transactions | GST treatment |

|---|---|

| Net realised gain or loss by electricity generation company (Genco) / retailer = hedge quantity x (contract reference price - hedge price) | Exempt supply |

| Settlement through market operator = hedge quantity x uniform Singapore energy price (USEP) | No supply |

| Payment for bilateral contract outside market operator = hedge quantity x hedge price | No supply |

Vesting contract

| Transactions | GST treatment |

|---|---|

| Net realised gain or loss by Genco / market support services licensee (MSSL) = hedge quantity x (vesting contract reference price - hedge price) | Exempt supply |

| Passing of vesting gains / losses by MSSL to retailer | No supply |

| Passing of vesting gains / losses by MSSL / retailer to contestable consumer | Taxable supply |

| Passing of vesting gains / losses by MSSL to non-contestable consumer | Taxable supply |

| Passing of vesting gains / losses by retailer to Genco (as part of the contract for differences between them) | Exempt supply |

| Settlement through market operator = hedge quantity x (vesting contract reference price - hedge price) | No supply |

Price neutralisation

| Transactions | GST treatment |

|---|---|

Price neutralisation for companies with embedded generator | No Supply |

For more information on the supply of electricity in the wholesale market, please refer to GST Guide for the Market Participants in the National Electricity Market of Singapore (NEMS) (PDF, 167KB).

Supply of electricity to master-metered and sub-metered consumers in the retail market (under en-bloc electricity purchase arrangement)

Under the en-bloc electricity purchase arrangement, the licensed electricity retailer sells electricity to the landlord of a building or Management Corporation Strata Title (MCST) (i.e. master-metered consumer). The landlord / MCST in turn sells electricity to the tenants / unit owners (i.e. sub-metered consumers).

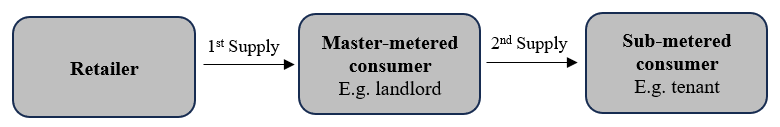

There are two separate supplies of electricity under this arrangement.

The first supply is from the electricity retailer to the master-metered consumer. The second supply is from the master-metered consumer to the sub-metered consumer.

For the first supply of electricity to the master-metered consumer, the GST-registered electricity retailer must charge the master-metered consumer GST on all the electricity used in the entire building.

For the second supply of electricity, the master-metered consumer (if GST-registered) must charge each sub-metered consumer GST on the respective portion of the electricity that the consumer used.

The retailer may, on behalf of the master-metered consumer, issue invoices to and/or collect payments from the sub-metered consumers. However, the GST-registered master-metered consumer is still liable to account for GST on its supply of electricity to the sub-metered consumers in its GST returns.

For more information, please refer to GST: Supply of Electricity to Master-Metered and Sub-Metered Consumers (PDF, 250KB).

FAQs

I am a GST-registered master-metered consumer. Am I entitled to recover the GST charged by the seller of electricity?

Yes. You can claim the GST incurred as your input tax if you satisfy all the conditions for claiming input tax.

My landlord (master-metered consumer) is not GST-registered. Am I or is my landlord entitled to claim the GST incurred on purchase of electricity?

No. Neither you nor your landlord is entitled to the input tax claim. Your landlord is not entitled to input tax claim because he is not GST-registered. As your landlord is not GST-registered, he should not charge any GST on his supply to you. Hence, you would not have incurred any GST on the purchase of electricity, i.e. there is no GST for you to claim.

I am GST-registered and my landlord has charged me GST for the purchase of electricity. Am I entitled to claim input tax?

Yes. The input GST can be claimed if you can satisfy all the conditions for input tax claim.