PayNow QR

Step-by-step guide to make payment via PayNow QR Code

ON THIS PAGE:

IRAS does not send PayNow QR codes to members of the public via physical and digital notices and letters, emails, SMSes and WhatsApp messages. Taxpayers can only generate PayNow QR codes for payment by logging into myTax Portal or upon selecting the "Make Tax Payment" option in the chatbot located on the IRAS website.

1. Payment for Individual's Income Tax and/or Property Tax

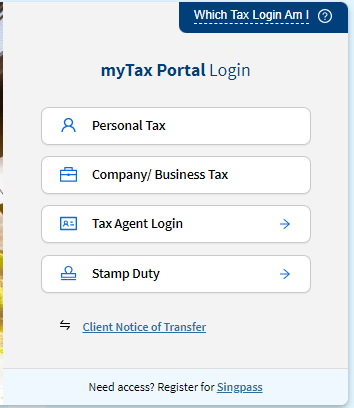

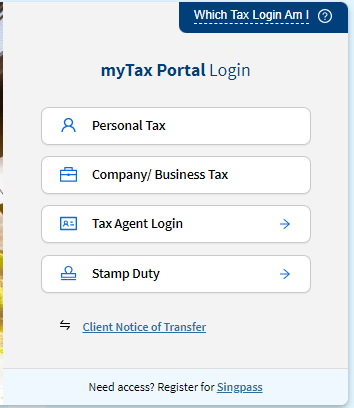

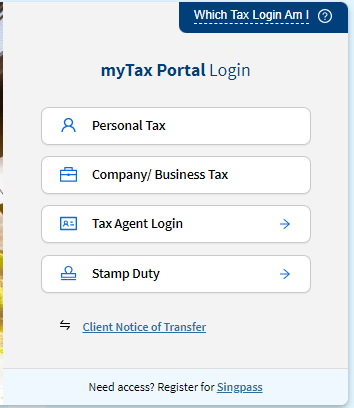

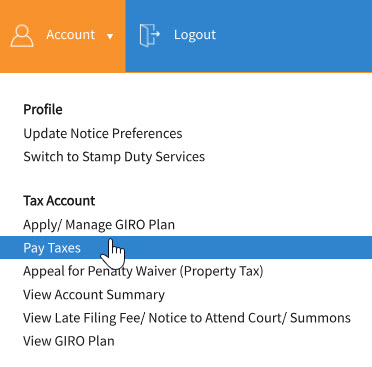

Step 1. Log in to myTax Portal via Singpass or Corppass.

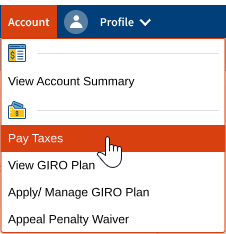

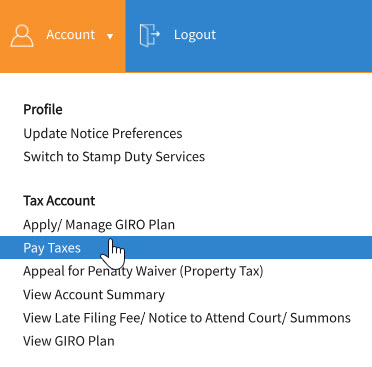

Step 2. Click on "Account" and select "Pay Taxes" option.

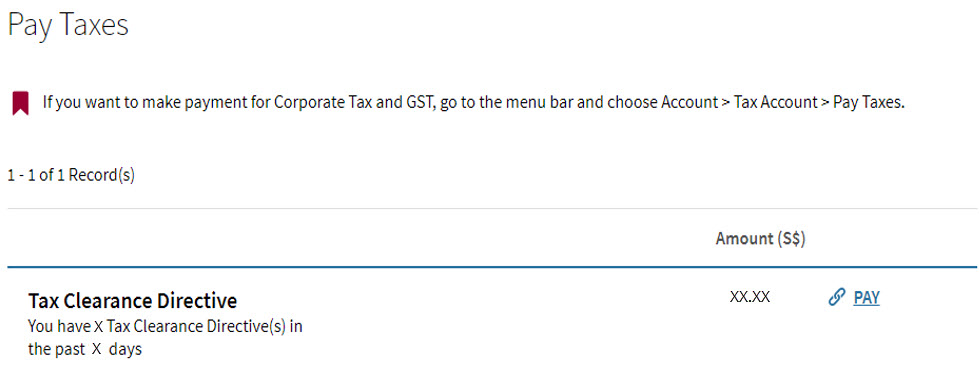

Step 3. Click on "PAY" beside the Tax Type you wish to make payment for.

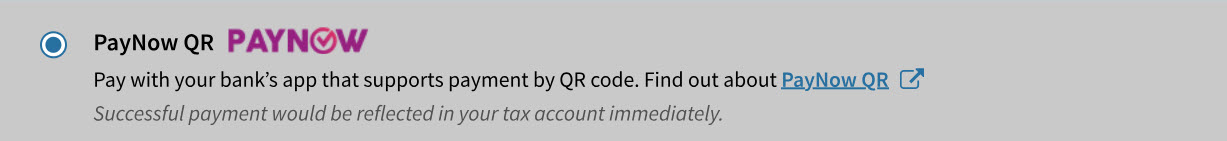

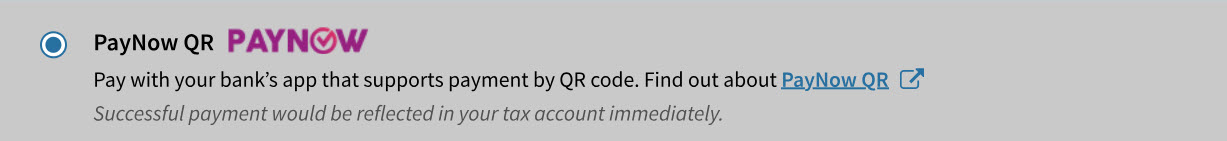

Step 4. Select "PayNow QR" and click "Continue".

Once a QR code is generated, you will see a countdown timer on the screen. If you complete the payment transaction within 15 minutes, you will be directed to the acknowledgement page.

If you are unable to complete the transaction within 15 minutes, you have until the end of the next day to make payment with this generated QR code.

If you are using your mobile phone, take a screenshot of the generated QR code.

Step 5. Using your mobile phone, log in to your preferred mobile banking app.

Step 6. Scan or upload* the generated QR code using your mobile banking app.

*If you have used your mobile phone to take a screenshot (mentioned in Step 4), upload the screenshot of the QR code from your mobile phone photo gallery.

Step 7: Approve the payment in your mobile phone. If your bank account is set up with dual control, please inform your authoriser(s) to approve the payment.

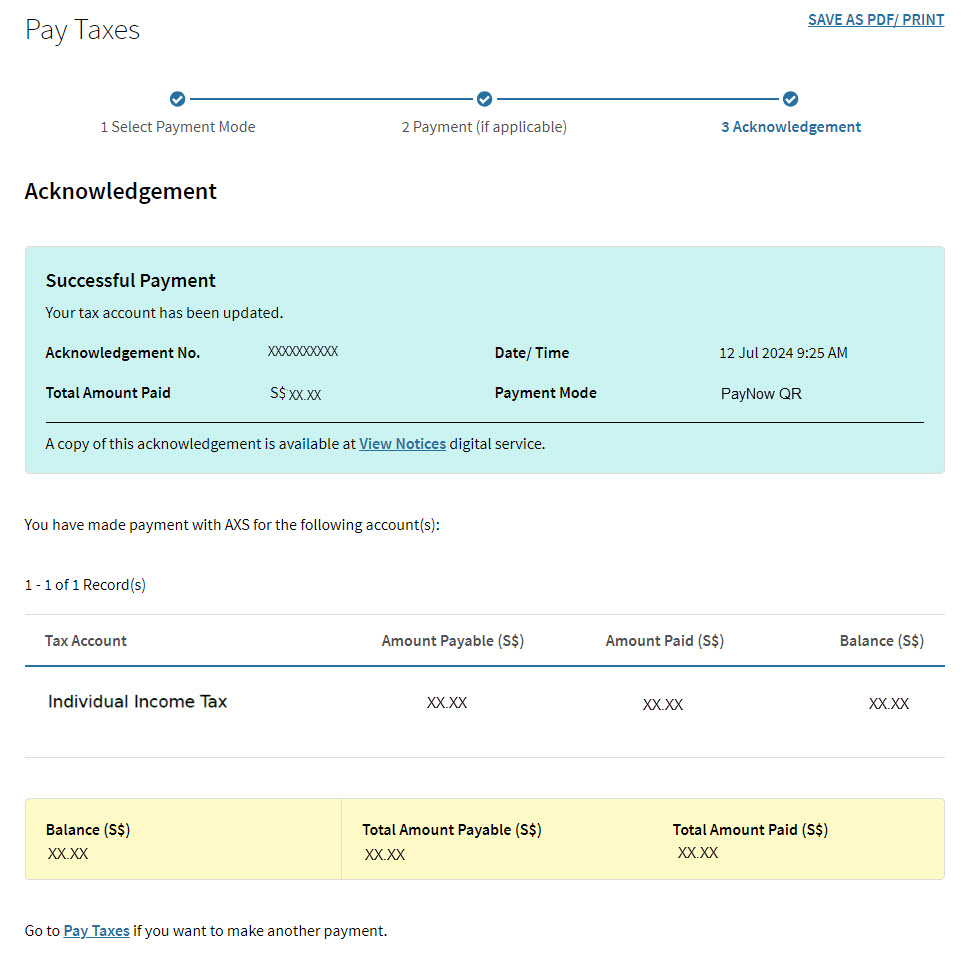

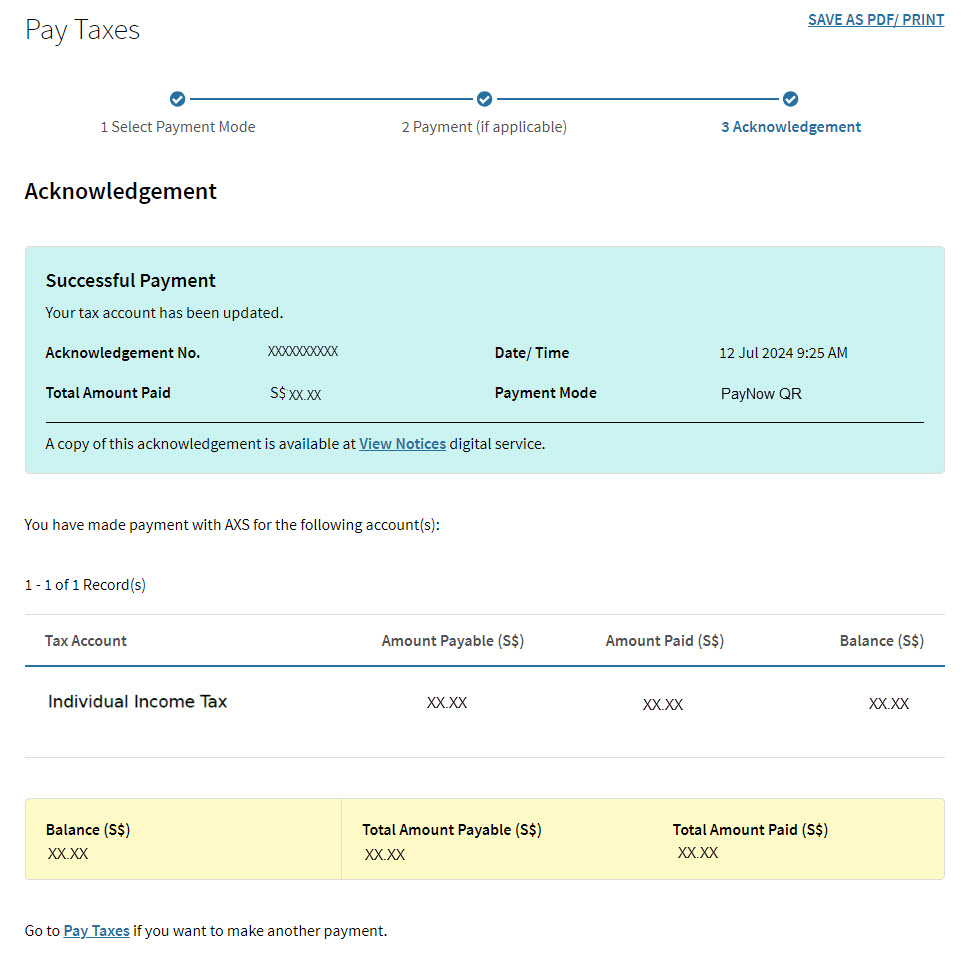

Step 8: Once the payment is successful, the page will be refreshed, and you will see the Successful Payment acknowledgment page.

The successful payment would be reflected in your tax account immediately.

2. Payment for Business’s Property Tax/ Clearance Directives and Employer Deduction

Step 1. Log in to myTax Portal via Company/ Business Tax.

Step 2. Click on "Account" and select "Pay Taxes" option.

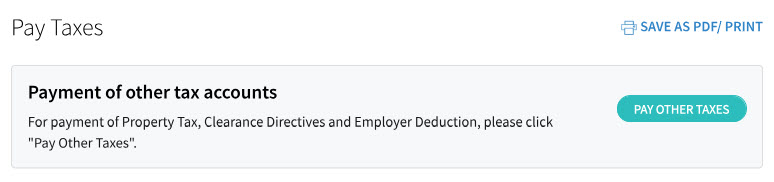

Step 3. Select "PAY OTHER TAXES".

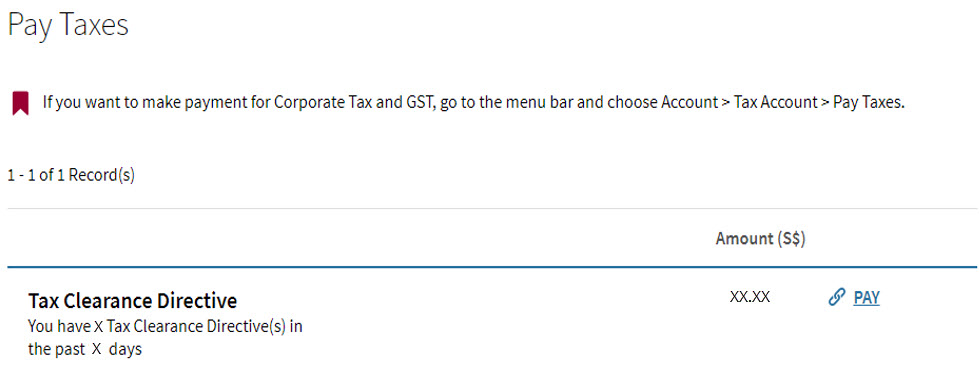

Step 4. Click on "PAY" beside the tax type you wish to make payment for.

Step 5. Select "PayNow QR" and click "Continue".

Once a QR code is generated, you will see a countdown timer on the screen. If you complete the payment transaction within 15 minutes, you will be directed to the acknowledgement page.

If you are unable to complete the transaction within 15 minutes, you have until the end of the next day to make payment with this generated QR code.

If you are using your mobile phone, take a screenshot of the generated QR code.

Step 6. Using your mobile phone, log in to your preferred mobile banking app.

Step 7. Scan or upload* the generated QR code using your mobile banking app.

*If you have used your mobile phone to take a screenshot (mentioned in Step 5), upload the screenshot of the QR code from your mobile phone photo gallery.

Step 8. Approve the payment in your mobile phone. If your bank account is set up with dual control, please inform your authoriser(s) to approve the payment.

Step 9. Once the payment is successful, the page will be refreshed, and you will see the Successful Payment acknowledgment page.

The successful payment would be reflected in your tax account immediately.

3. Payment for Corporate Tax and Goods and Services Tax

Step 1. Log in to myTax Portal via Company/ Business Tax.

Step 2. Click on "Account" and select "Pay Taxes" option.

Step 3. Click on "PAY" beside the tax type you wish to make payment for.

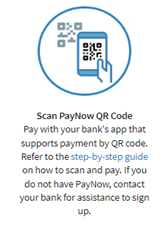

Step 4. Select "Scan PayNow QR Code".

If you are using your mobile phone, take a screenshot of the generated QR code.

Step 5. Using your mobile phone, log in to your preferred mobile banking app.

Step 6. Scan or upload* the generated QR code using your mobile banking app.

*If you have used your mobile phone to take a screenshot (mentioned in Step 4), upload the screenshot of the QR code from your mobile phone photo gallery.

Step 7. Approve the payment in your mobile phone. If your bank account is set up with dual control, please inform your authoriser(s) to approve the payment.