Before filing your GST F5 return

- The form GST F5 Return has fifteen boxes that you must fill.

- You can access your GST returns by logging in to myTax Portal.

- All figures reported in the GST Return must be in Singapore Currency.

- If you have transactions in foreign currency, please refer to Foreign currency transactions on how you should report them in Singapore currency.

- Even if you do not have any transactions during the prescribed accounting period, you are still required to e-File a nil return (i.e. fill in '0' for all boxes).

For more details, you may also refer to the e-Tax Guide on How Do I Prepare My GST Return (PDF, 790KB).

Filing of GST F8

Filing of a GST F8 is like that of a GST F5 except that you need to account for GST on:

- business assets held on the last day of registration; and

- supplies where goods/services are delivered/performed before your date of cancellation but invoice and payment is only issued/received after your date of cancellation.

The value of assets and supplies of goods/services should be reported in Box 1 of the GST F8 and the corresponding value of GST to be accounted should be reported in Box 6 of the GST F8.

For more details, please refer to the IRAS webpage on Cancelling GST registration.

Errors commonly made by businesses

Form Completion

Box 1: Total value of standard-rated supplies

Box 1 refers to the value of the supplies which are subject to GST at the standard rate of 9%. The value you enter in this box should not include the GST amount charged.

For example, if you sell goods for $100 and charge $9 of GST, you should only enter $100 in box 1. The GST of $9 should instead be included in box 6 (Output Tax Due).

| What to include | Example/details |

|---|---|

Supplies of goods made in the course of your business | Sale of goods to customers, including relevant supplies made by you that are subject to customer accounting ( at net discounted price if discount is given ) Deposits received as part payment Net takings from betting and gaming transactions Construction of residential or commercial properties Lease of commercial properties or hotel rooms Sale of new motor vehicles (value should exclude ARF, COE, RF and road tax) Hire purchase (applicable to seller of goods and financier) Sale of used vehicle under Discounted Sales Price Scheme (full value) Sale of used goods under the Gross Margin Scheme (full value) Inter-company sale of goods (if not under group or divisional registration) Sale of Low-Value Goods by local/overseas suppliers, local/overseas electronic marketplace operators and redeliverers to customers who are not GST-registered customers (w.e.f. 1 Jan 2023) |

Supplies of services made in the course of your business | Lease of machinery Management fee Commission Maintenance fee Digital services (and non-digital services w.e.f. 1 Jan 2023) supplied by overseas suppliers or local/overseas electronic marketplace operators to consumers in Singapore |

Supplies to staff | Takings from in-house vending machine, canteen takings, etc. |

Sale of factory building Sale of private car registered under employee's name but account as company's asset | |

Deemed supplies | Gift of goods where credit for input tax has been allowed to you and which costs >$200 (include free gift given as employee benefit) Business assets put to personal use Use of business premises by third party for free Business assets held on the last day of registration if the total value exceeds $10,000 and input tax has been allowed to you (applicable for GST F8 only) |

Others | Trade-in of goods (value of supply is the full value of the goods traded-in) Sale of goods imported on behalf of an overseas principal (i.e. you are acting as a section 33(2) agent) Reimbursement of expenses from third party (e.g. subsidiary, customer) Relevant supplies received by you that are subject to customer accounting Imported services subject to reverse charge |

| What to deduct | Example/details |

|---|---|

Reduction in the value of standard-rated supplies for which a credit note has been issued or a debit note has been received |

Items you should not fill in box 1

- Out-of-scope supplies

The sale of goods delivered from a place outside Singapore to another place outside Singapore is an out-of-scope supply. An example of this is the sale of chocolates that are shipped directly from your factory in China to your customer in Japan. - GST that is wrongfully collected before your effective date of GST registration

Do not include this amount in box 1. Instead, please write to us and provide details of these transactions together with payment via Internet Banking Fund Transfer for the wrongful GST collection. Please refer to voluntary disclosure for wrongful collection of GST for more details

Box 2: Total value of zero-rated supplies

Supplies of international services as listed in section 21(3) of GST Act

| What to include | Example/details |

|---|---|

Supplies of goods which are exported | Exporting goods out of Singapore (must maintain required documents to support your zero-rating) |

Providing international services (not all services provided to overseas customers are zero-rated supplies) |

| What to deduct | Example/details |

|---|---|

Reduction in the value of zero-rated supplies for which a credit note has been issued or a debit note has been received |

Box 3: Total Value of exempt supplies

A GST group can calculate its total value of exempt supplies for a prescribed accounting period by summing the value of each type of exempt supplies (i.e. to compute the total value of each type of exempt supplies made by all members of the group then sum up the absolute value of each type of exempt supplies).

| What to include | Example/details |

|---|---|

Sale and lease of residential properties | |

Supplies of financial services under Fourth Schedule to GST Act | Interest relating to bank deposit/loan/trade debt Issue, allotment or transfer of ownership of any equity or debt security Absolute value (i.e. drop negative sign, if any) of net realised exchange gain/ loss for each prescribed accounting period |

Sale of investment precious metals in Singapore | |

| Supplies of digital payment tokens with effect from 1 Jan 2020 | Exchange of digital payment tokens for fiat currency or other digital payment tokens |

Box 4: Total value of boxes (1) + (2) + (3)

The amount in this box is your total supplies made for the accounting period. It will be automatically computed after you have filled in the amounts for box 1, box 2 and box 3.

Box 5: Total value of taxable purchases

Box 5 refers to the value of your standard-rated purchases (including imports) for which the GST incurred can be claimed, and zero-rated purchases. The value to be entered in Box 5 should exclude any GST amount.

For example, if you buy or import goods for $100 with $9 of GST, you should include $100 in box 5 and $9 in box 7 (Input tax and refunds claimed).

You should track the value of each purchase for box 5 separately from its input tax to claim. In other words, the value in box 5 should not be computed by re-grossing the value of input tax to claim (box 7).

| What to include | Example/details |

|---|---|

Value of standard-rated purchases (i.e. purchases which your supplier charge GST) Your declaration should be based on the amount reflected in the tax invoice. | Purchase of goods or services for business purposes from GST-registered businesses Purchase of goods at net discounted price Purchase of used goods under the Gross Margin Scheme (full value inclusive of GST since the GST amount is unknown to you) |

Imports Where the value reflected in the invoice issued by your supplier is different from this value, you should reconcile the 2 values. For over-declaration or under-declaration of value of import, please refer to Mistakes in import declaration for what you should do. | Import of goods for business purposes Import of goods under MES / IGDS / approved third party logistics company scheme Import of goods under licensed warehouse or zero GST warehouse scheme Removal of goods from licensed warehouse or zero GST warehouse scheme Import of goods brought in under GST (Import Relief) Order (e.g. goods imported by parcel post) Goods imported on behalf of an overseas principal (e.g. you are acting as a section 33(2) agent) |

Value of zero-rated purchases from GST-registered suppliers | International freight charges International call charges Purchase of air tickets

|

Value of purchases made before date of GST registration for which you wish to claim the GST incurred (applicable to your first GST return only) | GST incurred on business purchases (input tax) before your GST registration can be claimed if you satisfy all the conditions in Pre-registration GST: Checklist for Self-Review of Eligibility of Claim (XLXS, 1178KB). You do not need to submit the checklist to us but you need to maintain it as part of your records. |

| Value of imported services and Low-Value Goods w.e.f. 1 Jan 2023 subject to reverse charge | Imported services and

Low-Value Goods

w.e.f 1 Jan 2023 subject to GST under the reverse charge regime are to be reported as your taxable purchases. |

| What to deduct | Example/details |

|---|---|

Reduction in the value of taxable purchases for which a credit note has been received or a debit note has been issued | Purchase returns Discount given by your supplier |

Value of taxable purchase where you need to repay the input tax claimed to the Comptroller of GST | If you have not paid your supplier within 12 months from the due date of payment and have claimed input tax, you are required to repay the input tax claimed to the Comptroller of GST. Please refer to If I have claimed GST before paying my supplier for more details. |

Items you should not fill in box 5

- Expenses where input tax is disallowed.

These include:

- Benefits provided to the family members or relatives of your staff;

- Costs and running expenses incurred on motor cars that are either:

- registered under the business' or individual's name, or

- hired for business or private use,

except where the car is excluded from the definition of a 'motor car' in Regulation 25(1) of the GST (General) Regulations. For more information, please refer to “Input tax treatment for common expenses”.

- Club subscription fees (including transfer fees) charged by sports and recreation clubs;

- Medical expenses incurred for your staff unless –

- the expenses are obligatory under the Work Injury Compensation Act or under any collective agreement within the meaning of the Industrial Relations Act; or

- the medical treatment in respect of expenses incurred on or after 1 Oct 2021 is provided in connection with any health risk or requirement arising on account of the nature of the work required of your staff or his work environment; and

- the medical expenses are incurred pursuant to any written law of Singapore concerning the medical treatment or the provision of a medical facility or medical practitioner; or

- the medical treatment is related to COVID-19 and the staff undergoes such medical treatment pursuant to any written advisory (including industry circular) issued by, or posted on the website of, the Government or a public authority.

- Medical and accident insurance premiums incurred for your staff unless the insurance or payment of compensation is obligatory under the Work Injury Compensation Act or under any collective agreement within the meaning of the Industrial Relations Act; and

- Any transaction involving betting, sweepstakes, lotteries, fruit machines or games of chance

- Purchases for purely private use (i.e. not for business use)

- Purchases which are exempted from GST (e.g. purchase or lease of residential properties, bank charges, import or purchase of investment precious metals)

- Purchases from non GST-registered businesses

- Wages and salaries paid to your employees

Box 6: Output tax due

The amount to fill in box 6 is the GST you have charged on your standard-rated supplies.

For example, if you sell goods for $100 and charge $9 of GST, you should include $100 in box 1 (Total Value of Standard-Rated Supplies) and $9 in box 6.

Since differences may arise due to different rounding methods used during computation, do not calculate the value of the output tax due by using the value of standard-rated supplies in box 1. You should instead track the value for box 6 separately from the value of standard-rated supplies.

| What to include | Example/details |

|---|---|

|

GST charged on the items included in box 1 |

GST charged on your sale of goods to local customers, government, tourist, etc. GST charged on your provision of services to local customers, government, tourist, etc. GST on relevant supplies received by you that are subject to customer accounting GST on services imported by you and Low-Value Goods w.e.f. 1 Jan 2023 that are subject to reverse charge (i.e. where you, as the customer, account for the GST instead of the supplier) GST charged on digital services (as well as non-digital services w.e.f. 1 Jan 2023) as supplied by GST-registered overseas suppliers or local/overseas electronic marketplace operators to consumers in Singapore. GST charged on Low-Value Goods w.e.f. 1 Jan 2023 as supplied by GST-registered local/overseas suppliers (including

electronic marketplace operators and redeliverers) to consumers in Singapore. |

|

GST on debts that are recovered after you have claimed bad debt relief |

You should repay IRAS the amount calculated in accordance with the following formula:

|

| What to deduct | Example/details |

|---|---|

|

Reduction in GST charged for which a credit note has been issued or a debit note has been received |

Reduction in GST amount for: |

Items you should not fill in box 6

- GST on relevant supplies made by you subject to customer accounting. The output tax is to be accounted for by your GST-registered customer instead.

Box 7: Input tax and refunds claimed

The amount you fill in box 7 includes:

- GST incurred for your purchases, subject to the conditions for claiming input tax. For example, if you buy or import goods for $100 with $9 of GST, you should include $100 in box 5 (Total Value of Taxable Purchases) and $9 in box 7.

- Other GST refunds to claim (e.g. bad debt relief) in box 7.

Please do not calculate the value of the input tax by using the value of taxable purchases in box 5. You should instead track the value for box 7 separately from the value of taxable purchases.

| What to include | Example/details |

|---|---|

GST incurred on the standard-rated purchases included in box 5 | GST incurred on the purchase of goods or services for business purposes |

GST incurred on imports included in box 5. Your declaration should be based on the GST amount reflected in the import permit. Refer to Mistakes in import declaration if you declared the wrong import value or importer. | GST incurred on the: Import of goods for business purposes Goods imported on behalf of an overseas principal (e.g. you are acting as a section 33(2) agent) |

| GST claimable on imported services (and/or Low-Value Goods w.e.f. 1 Jan 2023) that has been subject to reverse charge | Where reverse charge is applied (i.e. output tax accounted for) on a supply of imported services (and/or low-value goods w.e.f. 1 Jan 2023), a portion of the input tax may be claimable and this is subject to the input tax recovery rules. Refer to the e-Tax Guide GST: Reverse Charge (PDF, 946KB) for more details. |

Tourist refund | If you operate the Tourist Refund Scheme (TRS) and satisfy all conditions, you may claim the amount of GST refunds that you made to your tourist customer. For details on the conditions and procedures, please refer to Tourist Refund Scheme. |

Bad debt relief | If money owed to you cannot be recovered, you can claim the output tax which you have previously accounted for and paid to IRAS. Please ensure that you satisfy all the conditions in the Self-review of Eligibility to Claim Bad Debt Relief (DOC, 130KB) checklist before you make the claim. You do not need to submit this form to IRAS but you are required to keep this self-review form as part of your accounting records. |

| Refund claims for reverse charge transactions | If you have applied reverse charge (i.e. output tax accounted for) on a supply of imported services but did not make payment to your overseas supplier within 12 months from the due date of payment, you can make a GST adjustment subject to certain conditions. Refer to the e-Tax Guide GST: Reverse Charge (PDF, 946KB) for more details. |

GST incurred for purchases made before date of GST registration which you wish to claim (applicable to your first GST return only) | Please ensure that you satisfy all the conditions in Pre-registration GST: Checklist for Self-Review of Eligibility of Claim (XLXS, 1178KB). You do not need to submit the checklist to us but you need to maintain it as part of your records. |

| What to deduct | Example/details |

|---|---|

Reduction in GST incurred for which a credit note has been received or a debit note has been issued | Reduction in GST amount for: Purchase returns Discount given by your supplier |

Repayment of input tax claimed to Comptroller of GST | If you have not paid your supplier within 12 months from the due date of payment and have claimed input tax, you are required to repay the input tax claimed to the Comptroller of GST. Please refer to If I have claimed GST before paying my supplier for more details. |

Items you should not fill in box 7

- GST incurred on the purchase of goods and services for private use (i.e. not for business use)

- Input tax claims which are disallowed.

For example, GST incurred on the following expenses:

- Benefits provided to the family members or relatives of your staff;

- Costs and running expenses incurred on motor cars that are either:

- registered under the business' or individual's name, or

- hired for business or private use,

except where the car is excluded from the definition of a 'motor car' in Regulation 25(1) of the GST (General) Regulations. For more information, please refer to “Input tax treatment for common expenses”.

- Club subscription fees (including transfer fees) charged by sports and recreation clubs;

- Medical expenses incurred for your staff unless –

- the expenses are obligatory under the Work Injury Compensation Act or under any collective agreement within the meaning of the Industrial Relations Act; or

- the medical treatment in respect of expenses incurred on or after 1 Oct 2021 is provided in connection with any health risk or requirement arising on account of the nature of the work required of your staff or his work environment; and

- the medical expenses are incurred pursuant to any written law of Singapore concerning the medical treatment or the provision of a medical facility or medical practitioner; or

- the medical treatment is related to COVID-19 and the staff undergoes such medical treatment pursuant to any written advisory (including industry circular) issued by, or posted on the website of, the Government or a public authority.

- Medical and accident insurance premiums incurred for your staff unless the insurance or payment of compensation is obligatory under the Work Injury Compensation Act or under any collective agreement within the meaning of the Industrial Relations Act; and

- Any transaction involving betting, sweepstakes, lotteries, fruit machines or games of chance

- GST incurred on purchases made under the Gross Margin Scheme (since GST payable is unknown)

Box 8: Net GST to be paid to or claimed from IRAS

The amount in this box is the difference between box 6 (Output Tax Due) and box 7 (Input tax and refunds claimed). It will be automatically computed after you have filled in the amounts for box 6 and box 7.

If the net GST to be paid to IRAS is less than $5, you do not need to make any payment. Similarly, if the net GST to be claimed from IRAS is less than $5, no refund will be made to you. The amount will also not be carried forward to the next accounting period.

Box 9: Total value of goods imported under the MES/ A3PL/ other approved schemes

This box is to be filled only by businesses under the Major Exporter Scheme, Approved Third Party Logistics Company Scheme or other approved schemes only. If you come under any scheme(s):

- Please fill in the value of your imports under the scheme(s).

- The value of your imports should be based on the import permit that Singapore Customs issued to you.

- GST payable on the imports will be suspended. Therefore, you should not have any input tax to claim. Do not include any GST in box 7 (Input Tax and Refunds Claimed) of your GST return.

Example

You have imported goods (including goods belonging to your overseas principal) using your Major Exporter Scheme status. You should declare the value of the goods imported in box 5 (Total Value of Taxable Purchases), as it is still a taxable import even though GST is suspended under the scheme, and in box 9.

Box 10: Did you claim GST you refunded to tourists?

If you have claimed any GST refunds made to tourists under the Tourist Refund Scheme in box 7 (Input tax and refunds claimed), please indicate 'Yes' for this box and indicate the amount claimed.

Box 11: Did you make any bad debt relief claims and/or refund claims for reverse charge transactions?

From, 1 Jan 2020, there are changes made to this box to include adjustments made from implementation of reverse charge. Box 11 will cover the following:

(a) Bad debt relief claims made - Ensure that you satisfy all conditions of the Self-review of Eligibility to Claim Bad Debt Relief (DOC, 130KB) checklist; and/or

(b) Refund claims made for reverse charge transactions where you did not make payment to the overseas suppliers within 12 months - Ensure that you satisfy all the conditions listed in the e-Tax Guide GST: Reverse Charge (PDF, 946KB).

If you have made claims relating to (a) and/or (b) in box 7 (Input tax and refunds claimed), indicate 'Yes' for this box and state the amount claimed.

Box 12: Did you make any pre-registration claims?

This box only applies when you file your first GST return. It will no longer be available for subsequent GST returns. If you have made pre-registration GST claims in box 7 (Input tax and refunds claimed), indicate 'Yes' for this box and state the GST

amount claimed.

Before you make the claim, make sure you satisfy all conditions of the Pre-registration GST: Checklist for Self-Review of Eligibility of Claim (XLXS, 1178KB).

Box 13: Revenue

Revenue refers to income derived from your main income sources such as:

- Provision of services

- Sale of goods

- Other operating income (i.e. gross sales/ gross income/ turnover)

Please exclude non-operating income such as:

- Income from sale/disposal of fixed assets

- Grants received

- Gross receipts collected on behalf of others

The value of revenue earned can be extracted from the revenue items (e.g. sales) in your profit & loss accounts, whether they have been audited or not.

As this value is based on your accounting treatment, it may be different from the amount declared in Box 4 which is your total supplies based on GST requirements.

If you are unable to provide an accurate value at the point of your GST reporting, you are allowed to report the figure based on your best estimate.

Revenue figure should be reported according to the prescribed accounting period covered in the GST return.

For more information on this revenue item, please refer to our Frequently Asked Questions (FAQs) (PDF, 153KB).

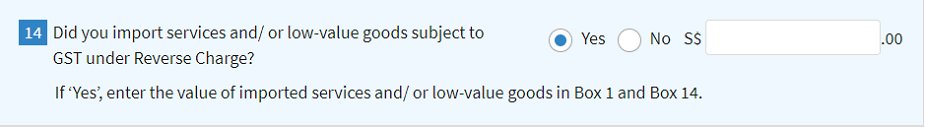

Box 14: Did you import services and/or Low-Value Goods subject to GST under reverse charge?

If you are required to account for GST under the reverse charge regime, indicate ‘Yes’ and state the value of imported services and/or low-value goods that is subject to GST in box 14. The same amount should also be included in the total value of standard-rated supplies reported in box 1.

From 1 Jan 2020, businesses that are not entitled to full input tax claims are required to account for GST on services procured from overseas suppliers under the reverse charge regime (“RC Business”). For example:

- banks and other financial institutions

- investment-holding companies that derive dividend income

- companies that derive substantial interest income from providing inter-company loans

- residential or mixed-used property developers

- charity/non-profit organisation that provides free or subsidised services

With effect from 1 Jan 2023, RC Businesses will also have to account for GST on Low-Value Goods purchased from overseas suppliers, local suppliers, electronic marketplace operators and redeliverers and include the value of Low-Value Goods in box 14.

If you are not an RC Business (e.g. you make only taxable supplies), you are not required to complete box 14.

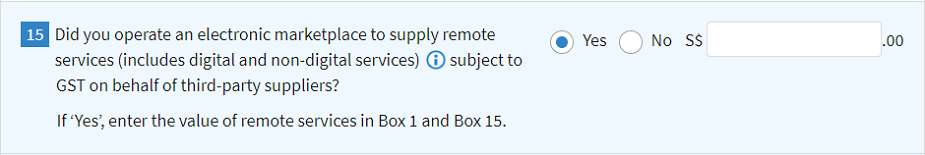

Box 15: Did you operate an electronic marketplace to supply remote services subject to GST on behalf of third-party suppliers?

If you are an overseas/local electronic marketplace operator supplying digital services on behalf of suppliers listed on your platform, indicate ‘Yes’ and include the value of such digital services that are subject to GST in box 15. The same amount should also be included in the value of standard-rated supplies reported in box 1.

From 1 Jan 2023, you will also have to include the value of non-digital services supplied on behalf of suppliers listed on your platform in boxes 1 and 15.

You are not required to complete box 15 if you are not an electronic marketplace operator.

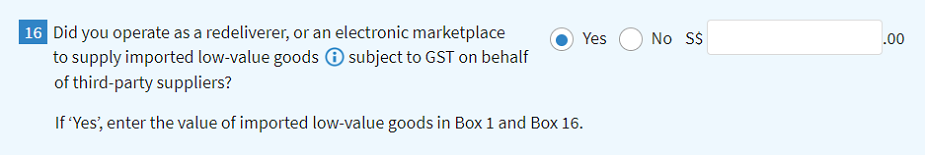

Box 16: Are you a redeliverer or electronic marketplace operator supplying imported Low-Value Goods on behalf of third-party suppliers?

From 1 Jan 2023, if you are a redeliverer or an electronic marketplace operator who is regarded as the supplier of Low-Value Goods, you have to indicate ‘Yes’ and include the value of the Low-Value Goods subject to GST in box 16. The same amount should also be included in the value of standard-rated supplies reported in box 1.

You are not required to complete box 16 if you are not a redeliverer/ electronic marketplace operator.

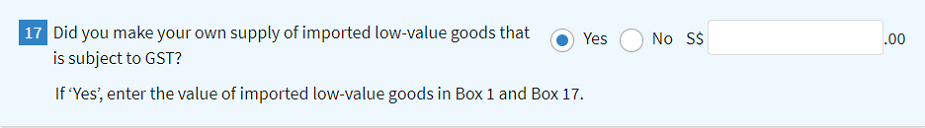

Box 17: Did you supply imported Low-Value Goods that is subject to GST?

From 1 Jan 2023, if you are a supplier of Low-Value Goods, you have to indicate ‘Yes’ and include the value of the low-value goods subject to GST in box 17. The same amount should also be included in the value of standard-rated supplies reported in box 1.

You are not required to complete box 17 if you are not a supplier of Low-Value Goods.

Box 18 to box 21: Import GST Deferment Scheme (IGDS) section

These boxes are not available in the GST return for most businesses as only businesses approved under IGDS are required to complete them. For more information on completing these boxes, please refer to e-Tax Guide on GST: Import GST Deferment Scheme (PDF, 334KB).

FAQs

If I have submitted an incorrect value of my revenue as well as other value(s) in the GST return, what should I do?

If you have made a mistake in your past GST return(s), you can correct the error(s) in your current GST F5 return if:

(a) The net GST amount in error for all the affected prescribed accounting periods is not more than $3,000. Net GST amount in error refers to the difference between the additional output tax to be paid in Box 6 and the additional input tax to be claimed in Box 7;

(b) The total amount in error for all other boxes except Box 6, 7 and 12 (pre-registration input tax claims) for each of the affected accounting period(s) is not more than 5% of the total value of supplies (Box 4) declared in the submitted GST return. In the case where there was no supply made in the affected accounting period, the 5% rule applies to the total value of the taxable purchases (Box 5).

In such circumstance, if you have reported an estimated value of your revenue in Box 13 of an earlier GST F5 return, you are not required to adjust the revenue figure in the current GST F5 return. Please ensure that you report the correct value of your revenue for the subsequent GST returns.

If you failed to satisfy any of the above conditions, please correct the errors, including the value of the revenue by submitting a GST F7 return (“Disclosure of Errors on GST Return”) for the affected prescribed accounting periods.