Sample bills and valuation notices based on different scenarios with annotations on how to read these sample bills and valuation notices.

Note: The tax rates reflected in these sample bills and valuation notices are based on the property tax rates effective from 1 Jan 2024 to 31 Dec 2024.

Annual Property Tax Bill

Property tax is payable yearly in advance. At the end of each year, IRAS sends property owners the property tax bill for the following year.

Owners who have opted for GIRO payment will receive their instalment deduction plan with their property tax bills.

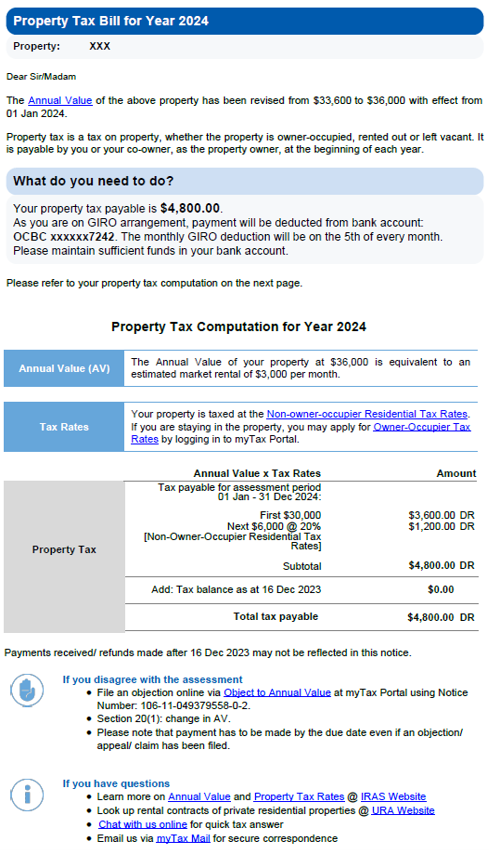

Sample 1A: Annual Property Tax Bill with Annual Value (AV) Revision for a Residential Property

This is a sample property tax bill showing the revised Annual Value (AV) of the property where the owner is paying by GIRO.

Sample 1B: Annual Property Tax Bill for a Non-Residential Property

This is a sample property tax bill for a non-residential property where the owner is not paying by GIRO.

![]()

Valuation Notices

During the year, IRAS may send you a Valuation Notice with the Annual Value (AV) for new properties or revised AV for existing properties.

Sample 2A: Valuation Notice for a New Property

This is a sample Valuation Notice for a newly completed non-residential property which is taxed from the TOP date of 18 Aug 2023. Property tax is payable at 10% per year for all non-residential properties, regardless of whether the property is let, vacant or for own use.

![]()

Sample 2B: Valuation Notice on amended Annual Value (AV) for an Existing Residential Property

This is a sample Valuation Notice for a residential property which AV has been revised due to the completion of improvement works. As the property is owner-occupied, property tax payable is calculated based on the owner-occupier tax rates of the AV of the property. You can refer to the property tax rates page for the full property tax rates table.

![]()

Other Notices

If you have demolished and rebuilt your property for subsequent owner-occupation and have applied for Property Tax Remission for Residential Property (Replacement Owner-Occupied House under Construction) Remission Order 2013, IRAS will send you a Valuation Notice with the Remission granted.

Sample 3A: Valuation Notice with Remission granted for a Residential Property

This is a sample Valuation Notice for a residential property which is granted with remission. Owners of residential properties who demolish their house in order to build a new house for owner-occupation may be eligible to apply for this remission.

![]()

If you are a new property owner, IRAS will send you a Property Tax Notification Upon Transfer of Property.

Sample 3B: Property Tax Notification Upon Transfer of Property

Once a property is transferred to you, you will be liable for any outstanding property tax including arrears that should have been paid by the previous owner. If there is an outstanding tax amount, your lawyer will assist you to settle the outstanding amount with the seller. Your lawyer will also apportion the current year tax between the seller and yourself. IRAS does not apportion property tax liabilities between the parties. The seller's lawyer will file a Notice of Transfer to IRAS within one month of the sale or property transfer. If any information is incorrect, please inform your lawyer to correct the information submitted to IRAS.

![]()