Conditions for claiming input tax

You can claim input tax incurred on your purchases only if all the following conditions are met:

1. You are GST-registered;

2. The goods or services are supplied to you or imported by you;

3. The goods or services are used or will be used for the purpose of your business;

Determining goods and services "for the purpose of business"

Goods and services are considered to be used "for the purpose of business" when they can be attributed to business activities mainly concerned with making supplies for a consideration (e.g. payment in either money or in kind).

Examples of non-business activities:

- Activities with non-business objects in philanthropic, religious, political, patriotic or public domain

- Free activities provided without commercial reasons

- Activities that are purely private or personal If you have both business and non-business activities, you can only claim input tax attributable to business activities relating to taxable supplies.

Please refer to GST on Non-Business Receipts (PDF, 183KB) on determining your business and non-business activities, and how to apportion your input tax claims (where necessary).

4. Local purchases are supported by valid tax invoices addressed to you, or simplified tax invoices, at the time of claiming of the input tax;

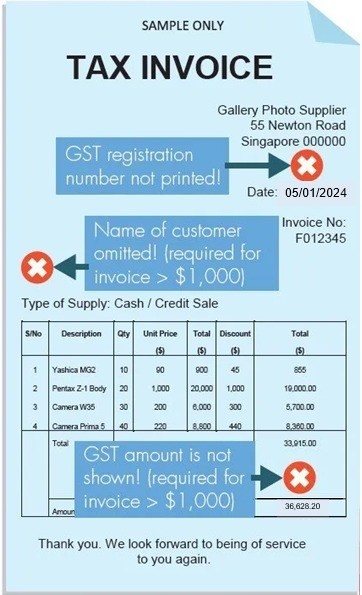

Examples of invalid tax invoice

Some common examples of tax invoices which are not valid are:

Missing details on the tax invoice |

|

|---|---|

Supplier is not GST-registered |

|

Illustration of an invalid tax invoice

If the invoice issued by your supplier contains the above errors or has any other missing details, you should request that your supplier re-issues you a valid tax invoice before you proceed to make the input tax claim. You do not need IRAS’ approval to make the request from your supplier for a valid tax invoice.

5. Imports are supported by import permits that show that you are the importer of the goods and other supporting documents such as the supplier's invoices and relevant transport documents;

6. The input tax is directly attributable to taxable supplies (i.e. standard-rated supplies and zero-rated supplies), or out-of-scope supplies (e.g. third country sale of goods), that would be taxable supplies if made in Singapore;

7. The input tax claims are not disallowed under Regulations 26 and 27 of the GST (General) Regulations; and

Disallowed input tax claims

Regulations 26 and 27 of the GST (General) Regulations do not allow you to claim input tax incurred on the following expenses:

- Benefits provided to the family members or relatives of your staff;

- Costs and running expenses incurred on motor cars that are either:

- registered under the business' or individual's name, or

- hired for business or private use, except where the car is excluded from the definition of a 'motor car' in Regulation 25(1) of the GST (General) Regulations. For more information, please refer to the section on "Motor Vehicles" below;

- registered under the business' or individual's name, or

- Club subscription fees (including transfer fees) charged by sports and recreation clubs;

- Medical expenses incurred for your staff unless

- the expenses are obligatory under the Work Injury Compensation Act or under any collective agreement within the meaning of the Industrial Relations Act; or

- the medical treatment in respect of expenses incurred on or after 1 Oct 2021 is provided in connection with any health risk or requirement arising on account of the nature of the work required of your staff or his work environment; and

- the medical expenses are incurred pursuant to any written law of Singapore concerning the medical treatment or the provision of a medical facility or medical practitioner; or

- the medical treatment is related to COVID-19 and the staff undergoes such medical treatment pursuant to any written advisory (including industry circular) issued by, or posted on the website of, the Government or a public authority of Singapore.

- Medical and accident insurance premiums incurred for your staff unless the insurance or payment of compensation is obligatory under the Work Injury Compensation Act or under any collective agreement within the meaning of the Industrial Relations Act;

and

- Any transaction involving betting, sweepstakes, lotteries, fruit machines or games of chance.

8. You have taken reasonable steps to ascertain and concluded that the goods or services were not part of a Missing Trader Fraud arrangement and the conclusion is one that a reasonable person would have made.

Determining input tax claims on common items

Employee benefits

Item | Can I claim input tax? |

|---|---|

| Staff medical expenses | Input tax claims are disallowed under Regulation 26 of the GST (General) Regulations. However, subject to the conditions for input tax claim, these claims are allowed if:

To determine whether the medical expenses are obligatory under WICA, please visit the Ministry of Manpower (MOM) webpage on WICA or contact MOM at +65 6438 5122. For clarification on collective agreements under IRA, please consult your trade union. You may claim input tax on the first aid kits (including ART kits and personal protection equipment) purchased for employees' use. Input tax incurred to replenish medication in the first aid kit is also claimable as it is self-administered and not part of the provision of any medical treatment. Examples:1) Can I claim input tax on Primary Care Plan (PCP)? No, GST incurred on PCP will not be claimable. Based on the nature of the medical expenses covered under the PCP, the medical treatment is not provided in connection with any health risk or requirement arising on account of the nature of the work required of your staff or his work environment (e.g. employees exposed to radiation in the course of their work are required to undergo prescribed medical examinations by an approved medical practitioner). As such, it does not fall under any of the exceptions above and thus GST incurred on PCP will not be claimable. 2) Can I claim input tax on Migrant Worker Onboarding Centre (MWOC) expenses? The Onboard Programme fee comprises of various elements provided to foreign workers (e.g. medical examination, accommodation, meals, settling-in programme). Input tax claims on medical examination are disallowed under Regulation 26 of the GST (General) Regulations. However, subject to the conditions for input tax claim, you are allowed to claim the input tax if the medical expense was incurred as part of the pre-employment process to assess whether the candidate is suitable for employment. You may claim input tax on GST incurred on other components of MWOC, if the conditions for claiming input tax are met. You should obtain a detailed breakdown of the charges if it is billed as one price. If you require more information on MWOC, please visit the Ministry of Manpower (MOM) webpage on MWOC or contact MOM at +65 6438 5122. |

| Medical and accident insurance premiums for your staff | Input tax claims are disallowed under Regulation 26 of the GST (General) Regulations. However, subject to the conditions for input tax claim, you are allowed to claim input tax if such insurance or the payment of compensation is obligatory under the Work

Injury Compensation Act (WICA) or under any collective agreement under the Industrial Relations Act (IRA). For example, you can claim input tax for work injury compensation insurance that is obligatory under WICA for both local and foreign employees performing:

If you require more information on WICA, please visit the Ministry of Manpower (MOM) webpage on WICA, contact MOM at +65 6438 5122 or contact your insurance agent. |

| Employee benefits | You can claim the GST incurred on the provision of employee benefits as your input tax: 1) only if it is for the purpose of your business, and 2) if the other input tax claiming conditions are met. The provision of an employee benefit will be considered as incurred for the purpose of your business if it has a close nexus to your business activities. The indicators are: 1) Necessary for the proper operation of your business 2) Directly maintains or increases the efficiency of business operations 3) Primarily promotes staff interaction 4) Encourages the upgrading of employee’s skills and knowledge relevant to your business 5) Given in recognition of employee’s contributions towards the business 6) Promotes corporate identity Please refer to Annex C of the e-Tax Guide on GST: Fringe Benefits (PDF, 444KB) for the examples of employee benefits. Examples: 1) My company gives away goods as door gifts and lucky draw prizes during Dinner and Dance. Each door gift costs $50 while the cost of the goods given away as lucky draw prizes range from $30 to $1,000. I have claimed input tax on the purchase of these goods. Do I have to account for output tax on the gifts? No, you do not have to account for output tax on the door gift since the cost of each gift is less than $200. However, for the lucky draw prizes, you will have to account for output tax on each prize that costs more than $200. 2) Can I claim the GST charged on medical examinations incurred for the purpose of renewing my employees’ work permits? No, the input tax on such examinations is blocked as medical expenses under Regulation 26 of the GST (General) Regulations. 3) Can I claim the GST charged on professional membership fees, education and training expenses? Yes, you can claim the input tax if you have a valid tax invoice and fulfil the conditions for claiming input tax. Professional membership fees, fees for graduate/post graduate courses and training expenses have a close nexus to the business activities if the course, training or qualification is relevant to your employee’s job or career progression in your business. |

| Accommodation and related expenses | No, input tax incurred for accommodation and related household expense provided to employee are not claimable as they are primarily for your employee's personal benefit. However, where it is necessary to provide accommodation to ensure minimal disruptions to your business operations, the provision of the accommodation can be regarded as having a close nexus to your business activities. Example: Can I claim the GST charged on household expenses (e.g. utility and broadband expenses) if my employees work from home? No, GST is not claimable as the household expenses are personal and private expenses. |

| Family benefits for staff | No, such input tax claims are disallowed under Regulation 26 of the GST (General) Regulations (e.g. school fees for children of your expatriate staff). |

Club subscription fees charged by sports and recreation clubs | No, such input tax claims are disallowed under Regulation 26 of the GST (General) Regulations (e.g. joining fee, subscription fee, membership fee and transfer fee). However, input tax claims are allowed for expenses related to the use of club facilities if the conditions of claiming input tax are met (e.g. green fees, buggy fees, rental of golf bag locker and dining at club restaurants). |

Motor vehicles

Input tax claims on purchase and running expenses of motor cars are disallowed under Regulation 27 of the GST (General) Regulations unless the car is excluded from the definition of a ‘motor car’ in Regulation 25(1). In addition, input tax incurred for specific scenarios is also excluded from the scope of Regulation 27. The input tax incurred in such specific scenarios will be claimable, subject to the conditions for input tax claim.

Item | Can I claim input tax? |

|---|---|

| Purchase of private hire car transportation services | Yes, from 1 Apr 2022 onwards, you can claim input tax incurred on the purchase of services to transport passengers from point A to point B (pay-per-trip) in a chauffeured private hire car (e.g. airport transfer services), if the conditions for claiming input tax are met. This includes ensuring that your purchases are supported by valid tax invoices or simplified tax invoices with GST charged to you. For example, for limousine services, you will need to keep an invoice from the GST-registered business showing that GST has been charged on the services. |

| Expenses on motor car used by a third party | Yes, from 1 Jan 2023, where you incur expenses on a motor car that is used by a third party, you will be allowed input tax claims on the cost and running expenses of the motor car incurred, if the conditions for claiming input tax are met (e.g. parking fees charged to you when your customers park their motor cars while visiting your business premises; or repair cost of your customer’s motor car which was damaged by faulty lighting at your carpark).

|

| Expenses on motor car used by a connected person | No, from 1 Jan 2023, where you incur expenses on a motor car used by a person connected to you (e.g. your subsidiary), you cannot claim input tax on the cost and running expenses of the motor car, unless you satisfy both of the following conditions (in addition to the conditions for claiming input tax): 1. You recover the motor car expenses from the connected person. Where you recover only a portion of the motor car expenses incurred, you can only claim input tax to the extent of the portion recovered; and. 2. The recovery is not ancillary to any primary supply made by you to the connected person. To determine whether the recovery is considered as ancillary to a supply made by you, please refer to “GST: Guide on Reimbursement and Disbursement of Expenses” (PDF, 584KB). In instances where both conditions (1) and (2) are met, the connected person will not be able to claim input tax on the motor car expenses recharged by you. Where the connected person is GST- registered, the input tax claims are disallowed under Regulation 27 of the GST (General) Regulations. |

Other motor vehicles | Yes, input tax claims are allowed on motor vehicles (e.g. lorry, van, motorcycle) that do not fall under the definition of a 'motor car'*, if the conditions for claiming input tax are met. *Constructed or adapted for the carriage of not more than seven passengers excluding the driver, and the weight of which unladen does not exceed 3,000 kilograms. |

Goods given away for free or for private use

|

Item |

Can I claim input tax? |

|---|---|

|

Goods that you gave away for free to customers, suppliers, staff etc. |

Yes, input tax claims are allowed, if the conditions for claiming input tax are met. However, you may be required to account for output tax on the Open Market Value (OMV) of the gifts and samples (e.g. gifts, samples and lucky draw prizes) if its cost exceeds $200. |

| GST incurred on free use of assets | Yes, if you pay the GST for the free use of assets owned by a GST-registered supplier, and the conditions for claiming input tax are met. You must maintain a tax certificate to support your claim. |

Grants, donations or sponsorships

Item | Can I claim input tax? |

|---|---|

Grants/Donations/Sponsorship | Yes, you can claim input tax on the expenses incurred for which you have received grants, donations or sponsorship if the conditions for claiming input tax are met. Examples of grants are Productivity Solutions Grant, SkillsFuture Enterprise Credit and Progressive Wage Credit Scheme.

|

Other common expenses

Item | Can I claim input tax? |

|---|---|

Expenses incurred by employees on behalf of the company | Yes, you can claim input tax on the expenses incurred by employees on behalf of the company if you can prove that the employee is acting as an agent of the taxable person (i.e. the business) in receiving the supply of goods or services (e.g. expenses incurred for making

business calls using employee's personal mobile phone) and the conditions for claiming input tax are met. For example, you are able to provide evidence of reimbursements made to the employee and have recognised the bills as business expenses in your accounts etc. You need to segregate the business expenses from the private expenses. GST incurred for private expenses is not claimable. |

| Entertainment expenses | Subject to the conditions for input tax claim, these claims are allowed if you have the supporting tax invoice addressed to you or the simplified tax invoice if the purchase value (including GST) is not more than $1,000. As an administrative concession, a receipt which contains all the information required in a simplified tax invoice can also be used to claim the input tax incurred for entertainment expenses exceeding $1,000 (including GST). You must also keep alternative documentary payment evidence and information on entertainment details (such as name of person

entertained, purpose of entertainment, person incurring the expenses, etc.) to support your claim. This concession is applicable only to expenses on food and drinks. In the event that an expense comprises of items other than food and drinks (e.g. rental of yacht), a proper tax invoice is still required to support the full claim. However, if you provide meals to your company team members, you should classify these as fringe benefits rather than entertainment expenses. |

| Invoices issued to Company A care of (c/o) B | One of the conditions for input tax claims is that local purchases are supported by valid tax invoices addressed to you, or simplified tax invoices, at the time of claiming of the input tax. Example: The invoice is addressed to Company A c/o Company B. Can Company A claim input tax if all other input tax claiming conditions are met? The invoice is addressed to Company A if the customer’s name is “Company A c/o Company B”, or “Company A payable by Company B”. As such, Company A will be able to claim the GST incurred if the conditions for claiming input tax are met. |

Common errors on input tax claims

Every year, around 3,000 GST-registered businesses are selected for audit and the most common mistakes discovered are incorrect input tax claims. On average, more than $18,000 in GST and penalties are recovered yearly from each business due to such errors.

Get to know the common input tax errors made by businesses and learn how you can avoid them through our series of videos!

FAQs

I satisfy all the conditions for input tax claim. How do I declare my purchases and input tax in GST return (F5)?

Total value of taxable purchases (Box 5):

Declare the value of all your imports, standard-rated and zero-rated purchases and expenses (excluding the GST amount) made in the course or furtherance of your business.

Input tax and refunds claimed (Box 7):

Declare the input tax (i.e. GST amount) incurred for your imports, standard-rated purchases and expenses made in the course or furtherance of your business.

The import permit shows me as the importer. I also receive an invoice from my supplier. Should I declare the value of taxable purchases and input tax based on the import permit or the invoice in my GST return (F5)?

You should declare the GST reflected in the import permit issued by Singapore Customs as your input tax in Box 7 of the GST return. Please ensure that there is no duplicate claim on the same purchase/ import.

However, for the value of taxable purchase in Box 5, you may declare either:

- The value of imports reflected on the import permit; or

- The value of goods reflected on your invoice.

Where the value reflected in the invoice issued by your supplier is different from the value reflected in the import permit, you should be able to reconcile the two values.

I have over-declared/under-declared my value of imports. What should I declare in my GST return (F5)?

Please refer to our webpage on Importing of Goods (Mistakes on import declarations).

I purchase goods from my local suppliers and they bill me in foreign currencies. Do I claim GST based on the amount converted using my own exchange rates?

Where purchases are negotiated in foreign currencies, your supplier has to indicate the GST payable on the tax invoice in Singapore dollars at a rate of exchange determined by him.

You should claim GST incurred on such purchases based on the Singapore dollar GST stated in the tax invoice. This requirement is still applicable even though you may have recorded the Singapore dollar value of the purchases in your own books at a rate of exchange different from that used by the supplier.

Can I claim input tax if I am not GST-registered?

No, you cannot claim any input tax if you are not GST-registered.

My business has stopped making taxable supplies and is in the process of winding down. I have incurred input tax on expenses (i.e. rental, utilities) which does not relate to any taxable supplies made earlier. Can I claim the input tax incurred as I am still GST registered?

One of the conditions for input tax claim is that the input tax incurred is directly attributable to the making of taxable supplies. As you do not satisfy this condition, you cannot claim the GST incurred on such expenses.

You should also cancel

your GST registration since you have stopped making taxable supplies. Refer to our webpage on Cancelling GST Registration.

My company has organised a series of events as part of our corporate social initiatives. Can I claim the input tax incurred on

(A) organising visits to places of interests for beneficiaries and

(B) sponsoring courses (e.g. educational or sustainability courses) for beneficiaries?

One of the conditions for input tax claim is that the input tax is incurred for the purpose of your business. As the expenses incurred are for the direct benefit of the beneficiaries (i.e. third parties unrelated to the business), they are not regarded as incurred for the purpose of your business.

Hence, you cannot claim the GST incurred on such corporate social initiatives since you do not satisfy the input tax claiming conditions.

My company reimburses employees for their utility bills, home telephone bills and monthly subscription fees for broadband incurred while the employee works from home ("WFH"). Can I claim the input tax incurred?

No, GST is not claimable on household expenses including those incurred on utility, home telephone and broadband subscription as they are personal and private expenses. GST would also not be claimable even if your company allows or requires your employees to WFH.

However, an exception was given to allow input tax on a reasonable proportion# of such expense incurred during the COVID-19 period up to and including 12 Feb 2023*. To claim input tax on such expenses during COVID-19, your business should have reimbursed the expenses incurred by your employees and the expenses must have been contracted in your employee's name, and not any other person living in the same household.

#Utilities and Home Telephone Bill

The reasonable proportion can be taken to be the difference in the amount of expenses your employee incurred before and after working from home and apportioned equally between the working individuals in the same household. For example, if your employee's utilities bill has increased by $107 (inclusive of $7 GST) and both your employee and another individual in his household work from home, you may claim $3.50 as your input tax.

Broadband subscription fees

If the broadband subscription were used for both business and private purposes during the COVID-19 period, you may claim input tax:

(i) For full reimbursements, based on 4/7 of the GST incurred on the expenses.

(ii) For partial reimbursements, based on tax fraction (e.g. 7/107) of the amount reimbursed or 4/7 of the GST incurred on the expenses, whichever is lower.

*This is based on when the DORSCON level was adjusted to green (from 13 Feb 2023 per MOH's press release), and Singapore has transitioned to an endemic COVID-19 new norm.

My company provides car rental services. I paid GST on the purchase of a used car from a second-hand car dealer. The used car was added to my fleet of rental cars for letting on hire. Can I claim the input tax incurred on the purchase?

My business provides private hire car services (e.g., limousine services) to chauffeur customers from point-to-point in Singapore. Can I claim input tax incurred on the running expenses of my limousines?

I am a GST-registered sole-proprietor selling clothes. I also hold a Private Hire Car Driver’s Vocational Licence (PDVL). As a vocation, I provide chauffeured ride services using a Private Hire Car (“PHC”) via mobile applications/platforms operated by booking service operators. Can I claim input tax incurred on the running expenses of my PHC?

I am a GST-registered individual. I hold a Private Hire Car Driver’s Vocational Licence (PDVL). I own 3 Private Hire Cars (“PHCs”). I provide chauffeured ride services using one of my PHCs via mobile applications/platforms operated by booking service operators. I also employ staff to drive my PHCs via the mobile applications/platforms. Can I claim input tax incurred on the running expenses of the PHCs?

Yes, you can claim input tax on the running expenses of your PHCs incurred on or after 1 Jan 2023 in the course of providing the chauffeured ride services for a fee. As an individual who carries on a business of providing chauffeur services, you can also claim input tax incurred on the cost of purchasing the PHCs only if you satisfy the following conditions, in addition to the normal input tax claiming conditions:

- You maintain a minimum fleet of 3 PHCs;

- You employ a minimum of 2 PHC drivers, in addition to yourself, to provide chauffeured ride services; and

- Your business is registered as a sole-proprietorship with the Accounting and Corporate Regulatory Authority of Singapore (ACRA).

As a GST-registered person, you will have to continue to account GST at the prevailing tax fraction on the fees pre-and post-1 Jan 2023.