Beware of impersonation scams

Do not automatically trust someone just because he/she has your personal information.

*Exceptions apply for National Service call-ups and emergency services. Read more about the exceptions.

For more information on how to protect yourself from scams, visit ScamShield Website

Every transaction is secure

For tax matters, transact safely on myTax Portal (mytax.iras.gov.sg).

myTaxPortal is a secured and personalised portal for you to view and manage your tax transactions with IRAS. SingPass authentication is also required before you can perform any transactions.

Email us via myTax Mail

Use myTax Mail to correspond with IRAS. We will notify you via SMS on your mobile phone when we have replied. For added security, we will respond to you via myTax Mail if your query contains confidential information.

Confidential documents are kept safe

We do not send out confidential documents such as tax return forms, notices of assessment, refund letters or other tax statements through unsecured emails. Confidential documents are deposited in myTax Portal.

Pay securely

GIRO is the preferred payment mode (except for casino tax, estate duty and gambling duties). For payments to IRAS made via internet banking, ATM bill payment and AXS mobile, select “IRAS” from the list of payees. You can also pay using PayNow QR in myTax Portal. Learn about payment modes for different tax types to IRAS.

Trust only gov.sg for SMS Sender ID

From 1 Jul 2024, all government agencies will send SMSes from a single gov.sg Sender ID. Check that gov.sg is in lowercase and ensure that the SMS begins with the full name of the agency that sent it e.g. "Inland Revenue Authority of Singapore".

Types of Scams

Updates and transactions must be done on myTax Portal (mytax.iras.gov.sg)

There is no capital gains tax on profits earned from the sale of investments and shares in Singapore

Visit the e-Stamping Portal to verify the authenticity of the stamp certificate given to you by a third party (lawyer or property agent)

Latest Scam Advisories

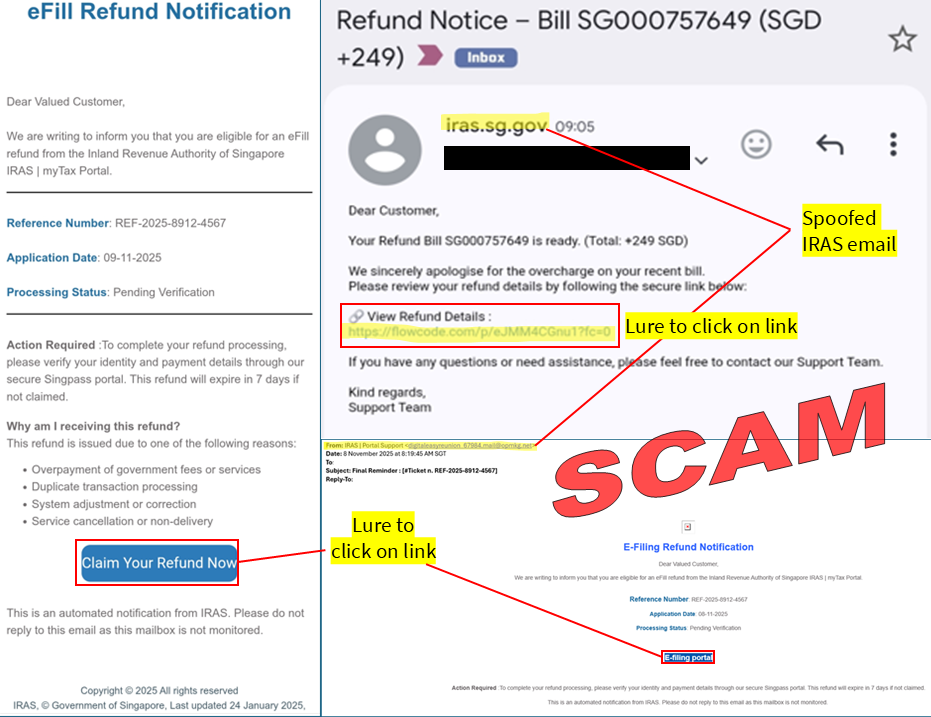

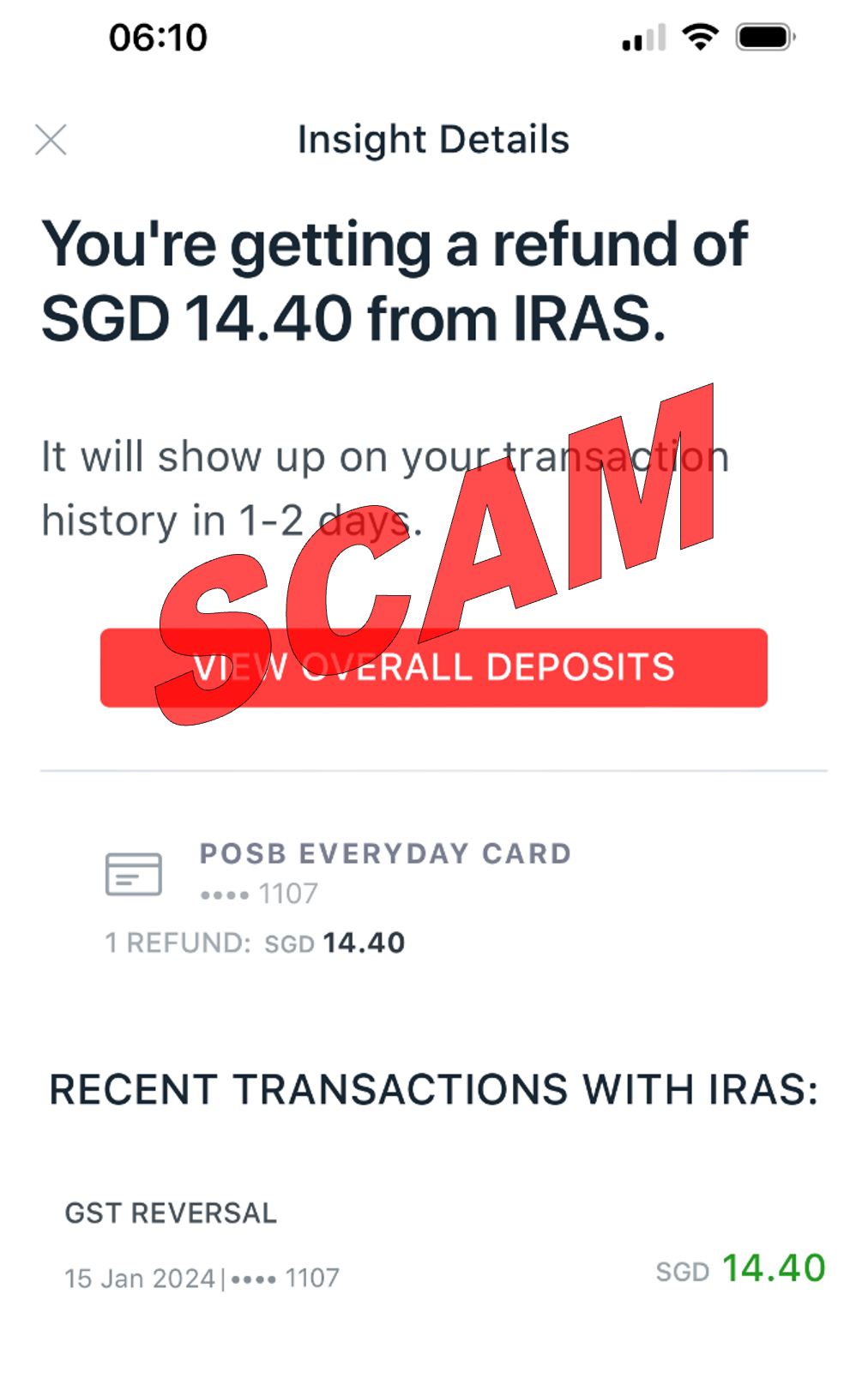

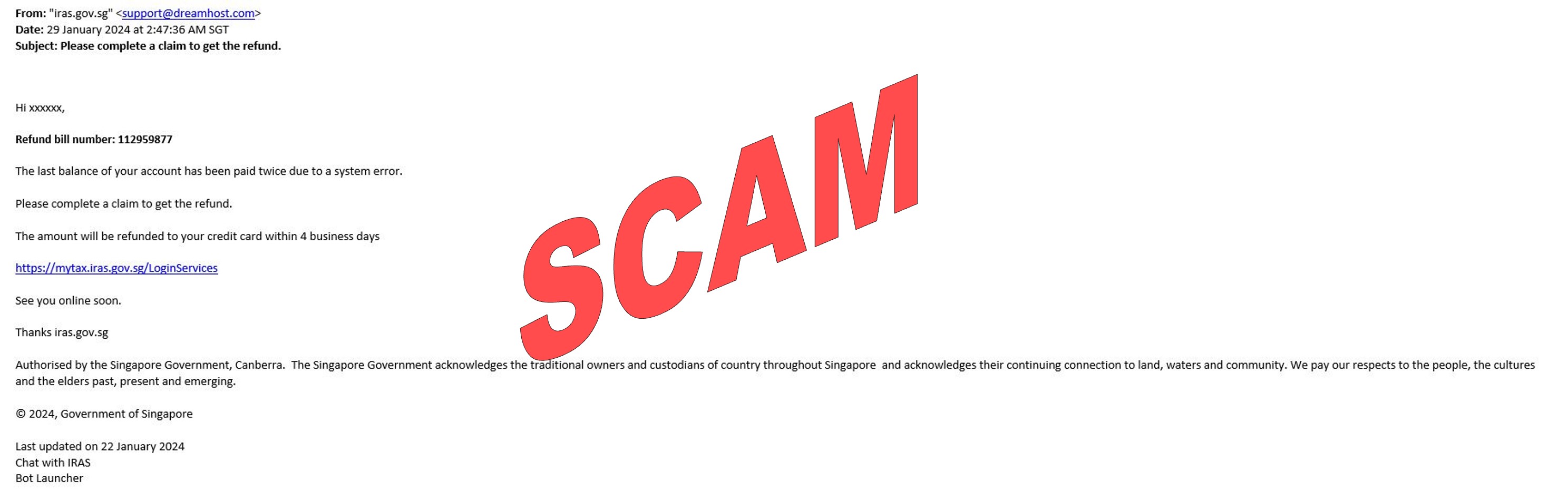

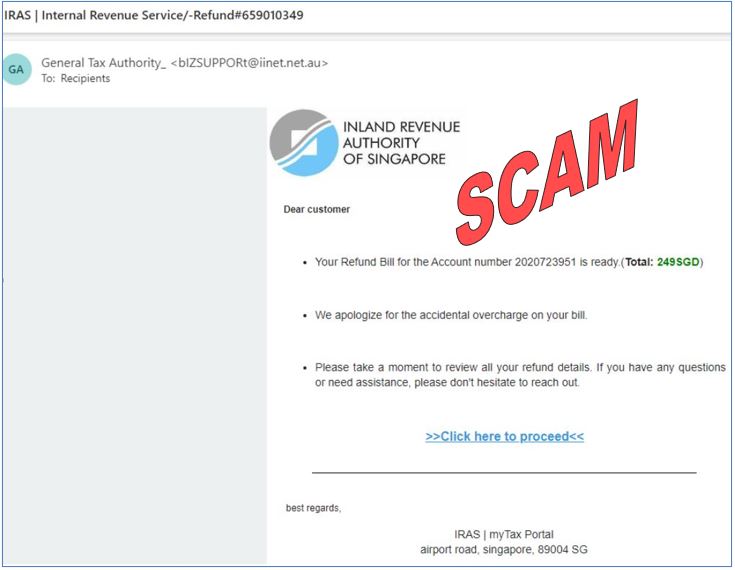

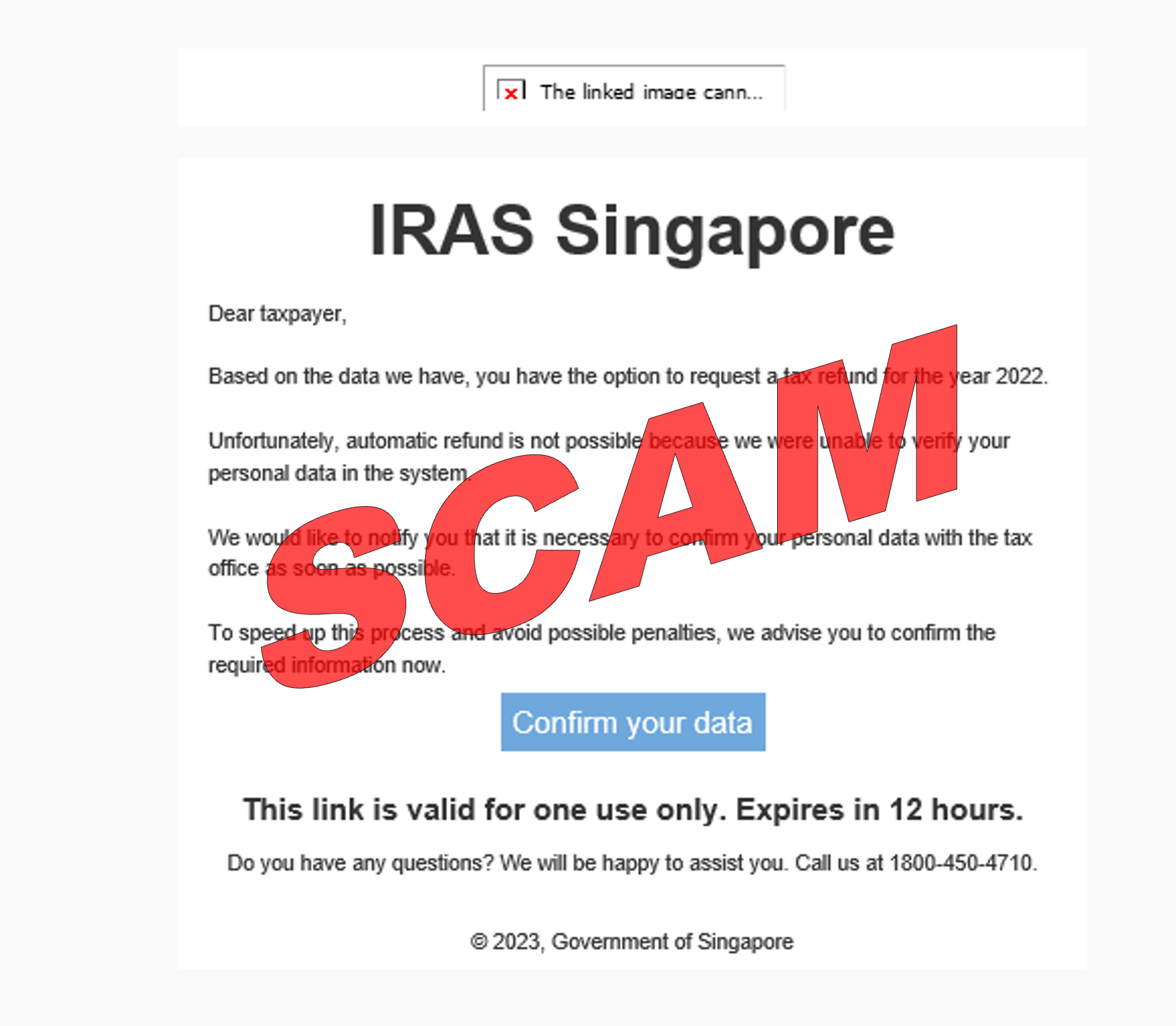

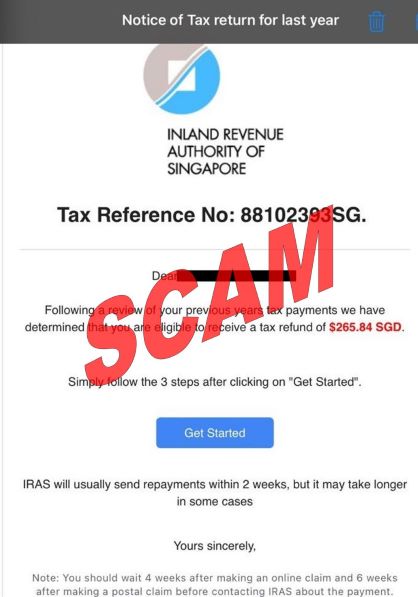

IRAS has received reports from members of the public on tax refund emails purportedly from “IRAS”. Under the pretext of offering a 'tax refund', scammers are using various tactics to lure taxpayers into clicking suspicious links and providing their credit card details.

IRAS will not

• send you emails on your tax refund amount.

• process refunds to credit/debit cards. Instead, any tax refunds are automatically credited into taxpayers’ bank accounts registered with IRAS or PayNow (NRIC/FIN/UEN) accounts.

Taxpayers can check for updates on any refund in myTax Portal.

Learn more about tax refund scams.

Learn how IRAS protects you from scams.

Various forms of tax refund scam emails

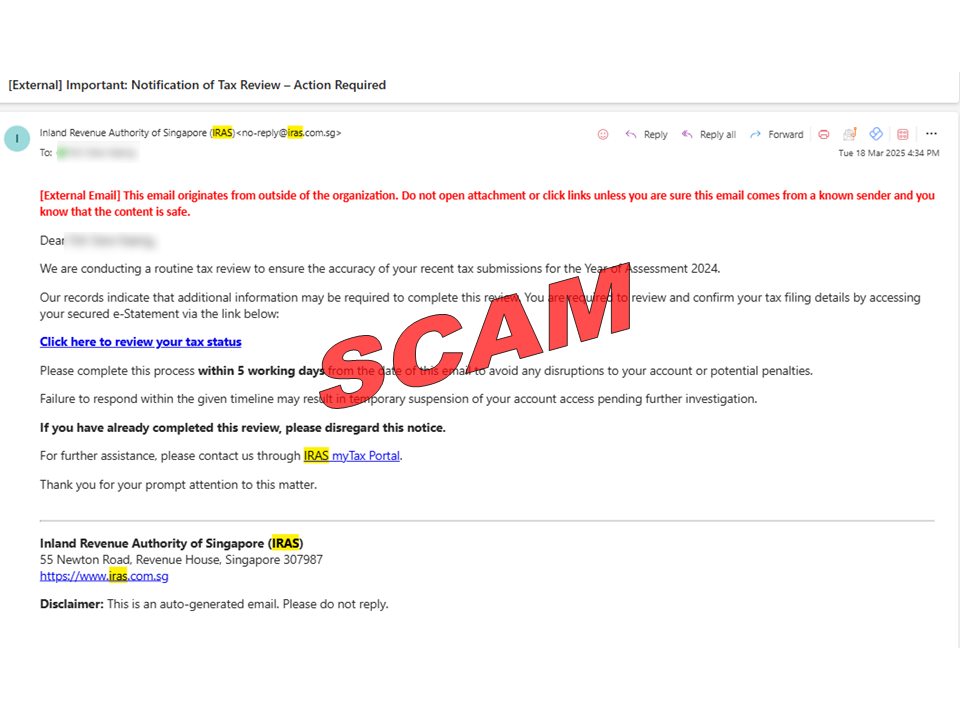

If you receive an email purportedly from IRAS claiming that a “routine tax review” is being conducted, do not click on the URL link – “Click here to review your tax status”. This is a phishing email scam where fraudsters spoof IRAS’ identity to trick taxpayers into clicking a suspicious URL link.

The phishing email requests that taxpayers provide additional information in order to complete a “routine tax review” to ensure the accuracy of their recent tax submissions for the Year of Assessment 2024.. Taxpayers are threatened with “temporary suspension” of their accounts or “potential penalties” if they fail to respond within 5 working days.

IRAS does not send any notices on tax matters via unsecured emails. All tax transactions and notices are deposited on mytax.iras.gov.sg. myTax Portal is a secured and personalised portal for you to view and manage your tax transactions with IRAS. Singpass authentication is also required before you can perform any transactions.

Members of the public are advised to ignore the phishing email and not to click on the suspicious URL link. Do not provide any banking or credit card details, make payments or follow any instructions in the email. Those affected by the scam are advised to lodge police reports.

Learn how IRAS protects you from scams.

For more information on how to protect yourself against scams, visit ScamShield Website.

An image of the scam email is attached:

We are aware of scam calls impersonating IRAS officers. Members of the public are advised to be on the alert to such scam calls.

Beware if you receive calls where callers claim to be IRAS officers informing that you have outstanding taxes or that you need to attend an interview due to tax evasion involving unreported income. If you do not have any outstanding tax matters with IRAS, be alert to such calls as they could be scams.

IRAS officers will not ask you to provide any personal, credit card or bank account details to make payment over the telephone. For tax matters, we will direct you to transact safely on myTax Portal (mytax.iras.gov.sg) to check if you have any outstanding taxes. myTax Portal is a secured and personalised portal for you to view and manage your tax transactions with IRAS, including payment of taxes. Singpass authentication is also required before you can perform any transactions.

To verify or to report scams or phishing attempts, chat with us or call the IRAS hotline at 1800 356 8300 from Monday to Friday, 8:00am to 5:00pm (except Public Holidays). Alternatively, you may call the police hotline at 1800 255 0000, or submit a report at I-Witness e-Service.

Learn how IRAS protects you from scams.

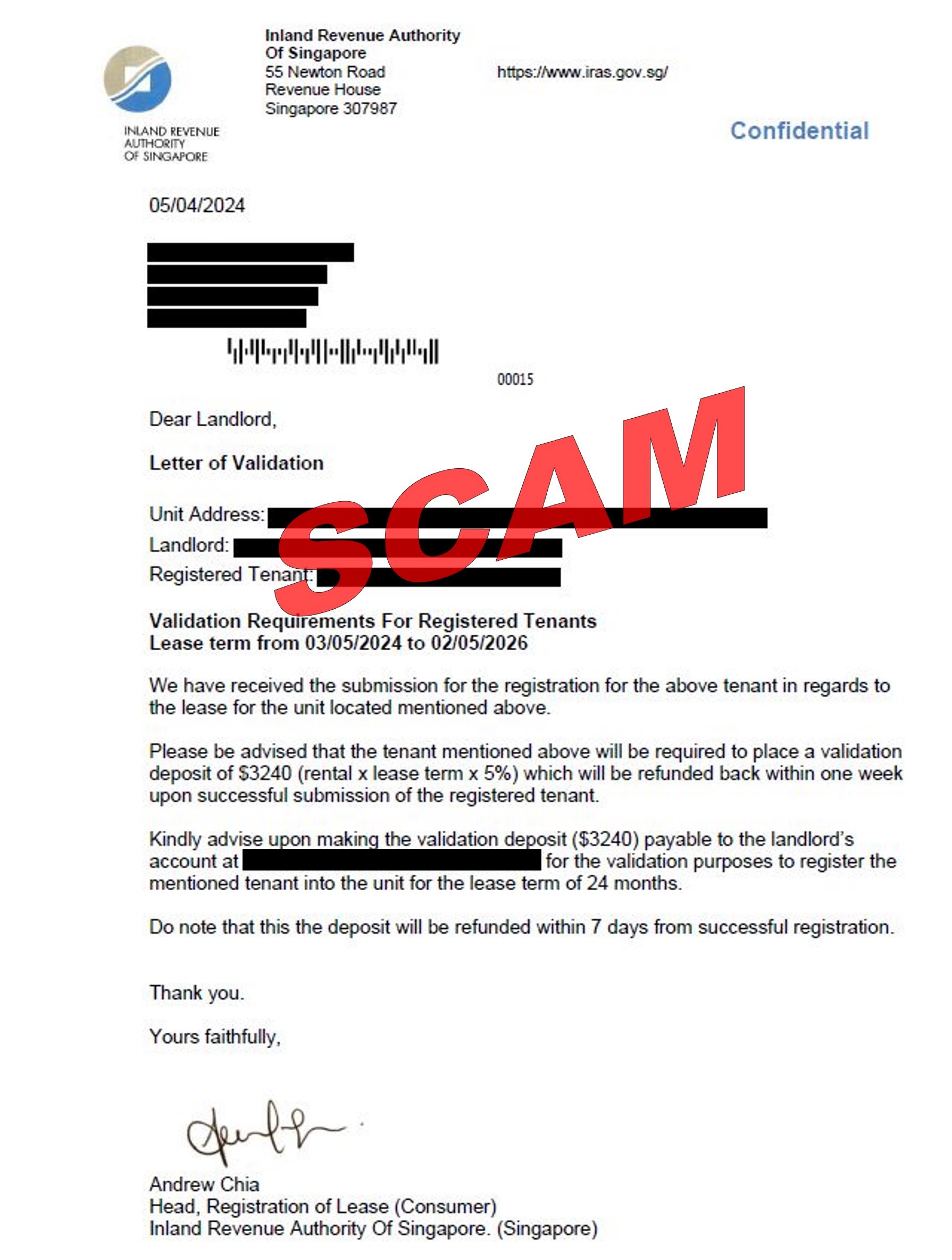

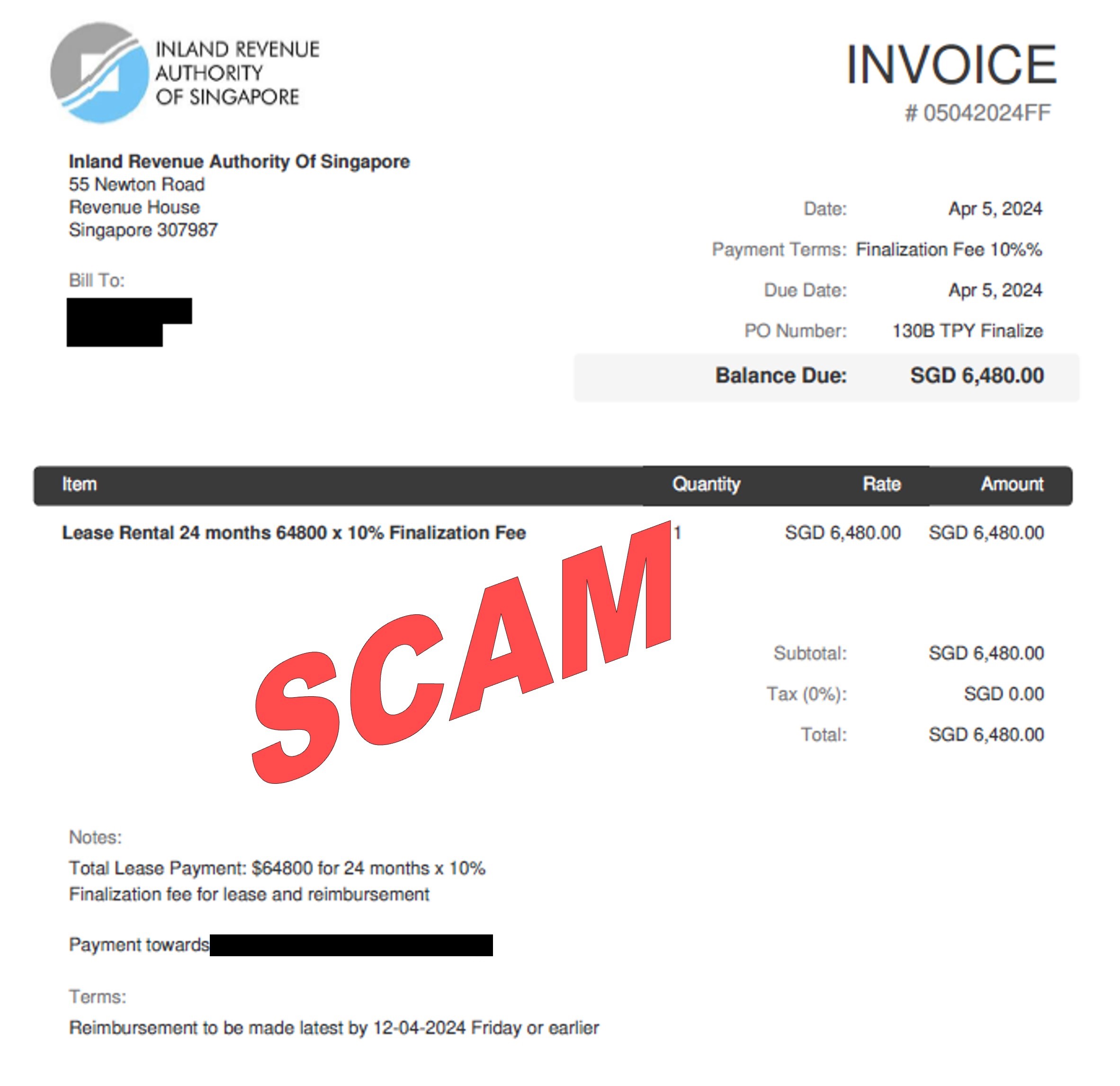

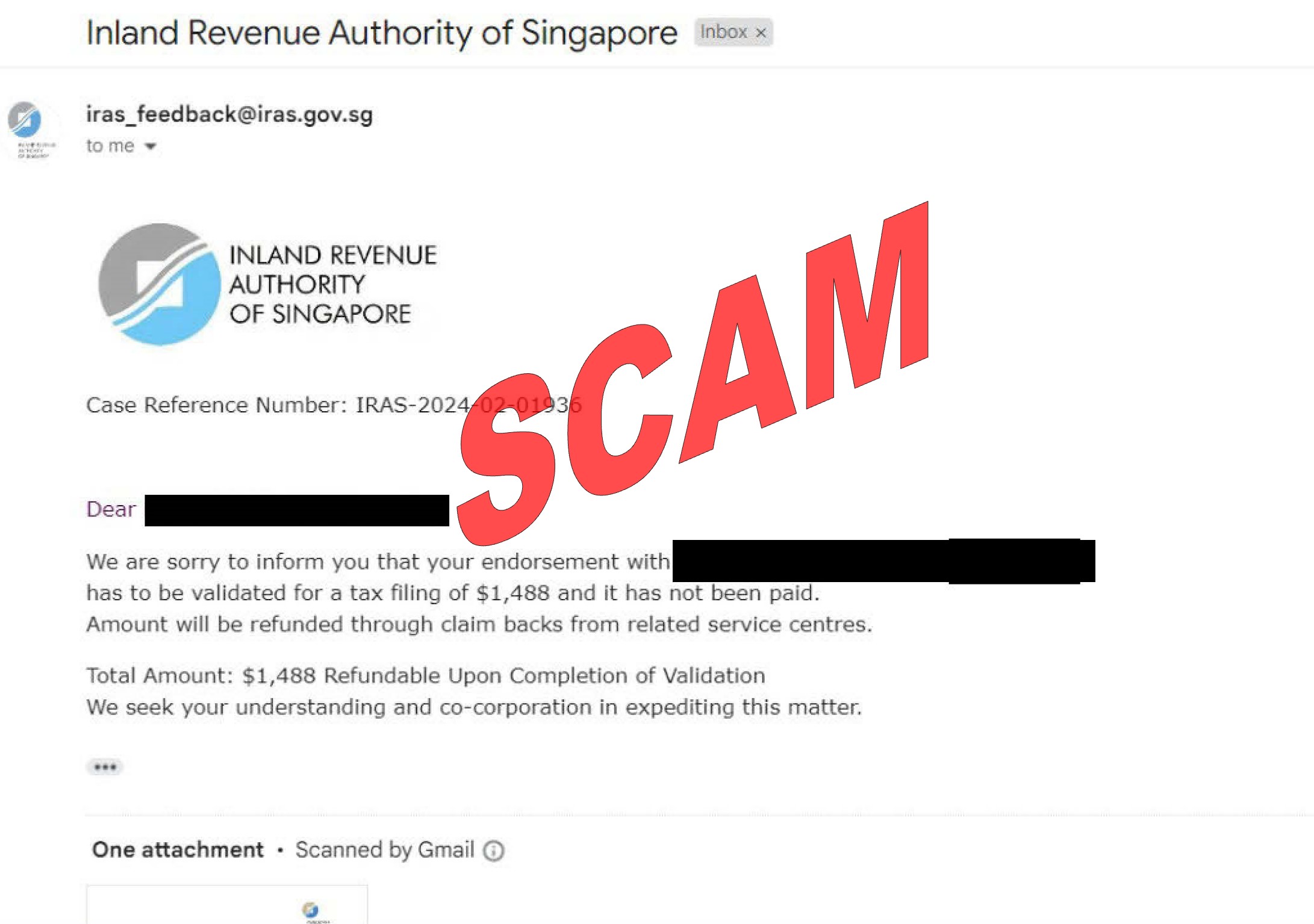

If you receive an email purportedly from IRAS claiming that prospective tenants are required to pay a “validation deposit” to their landlords’ accounts, do not make payment to the scam account.

This is a scam where fraudsters spoof IRAS’ identity as a tax authority to trick recipients who are prospective tenants to make payment so that their rental unit can be successfully registered. The scam letter, sent together with a scam invoice, instructs recipients to pay a “validation deposit’ to a designated bank account masquerading as the landlord’s bank account. The letter further claims that the “validation deposit” will be refunded upon “successful registration” of the tenant.

Although landlords may ask tenants to make a downpayment or security deposit to secure their rental property, such payments should be made directly to their landlords as this is a private arrangement between the landlord and tenant. IRAS does not require tenants to be registered or validated with us, and we will not send letters to either tenants or landlord instructing that a “validation deposit” is to be made to a designated bank account.

Members of the public are advised to ignore scam letter and not to make payment. Do not provide any personal, credit card or bank account details, make payments or follow any instructions in the email. Those affected by the scam are advised to lodge police reports.

Learn how IRAS protects you from scams.

Copies of the scam email and scam invoice are attached:

We have been alerted to a resurgence of scam phishing emails impersonating IRAS. Under the pretext of offering tax refunds, the scam emails attempt to trick taxpayers to click on a link in the email that directs them to a fake website to provide their personal information including SingPass credentials and credit card details.

How IRAS processes tax refunds

IRAS will not ask taxpayers to give their online banking username or password, or their credit/debit card details, for purposes of tax refunds. Tax refunds are automatically credited to taxpayers’ registered bank accounts or via PayNow accounts (NRIC, FIN, UEN). We do not process tax refunds to credit/debit cards. Taxpayers can check for tax credits due to them on myTax Portal. Please visit IRAS Website for more details.

Members of the public are advised to ignore the phishing scam and not to provide any personal, credit card or bank account details, make payments or follow any instructions in the email. Those affected by the scam are advised to lodge police reports.

Screenshots of the variant of phishing scams are provided below for reference:

Read how IRAS protects you from scams.

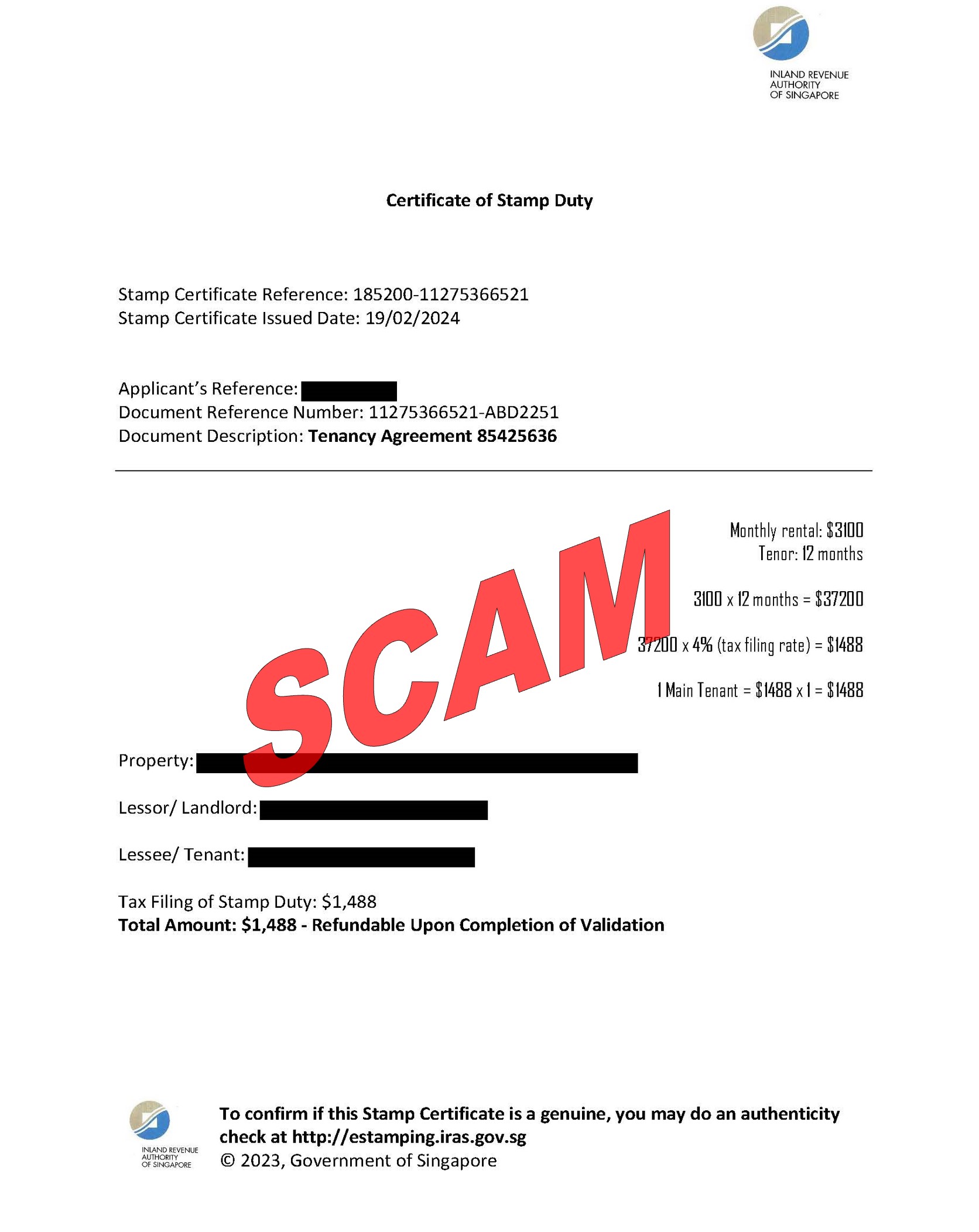

We have been alerted to a fake Stamp Duty scam where bogus property agents attempt to trick Members of the Public to pay alleged “stamp duty fees” for their “tenancy agreements”.

Scammers impersonating as property agents communicated with Members of the Public under the pretext of helping them to secure rental properties. The scammers sent WhatsApp messages with screenshots of a fake Stamp Duty certificate and a bogus email from [email protected] pressuring them to make payment for “stamp duty fees”. The bogus email claimed that the alleged “stamp duty fees” should be made to the property agent’s company and that these fees were refundable.

IRAS would like to advise that Stamp Duty for tenancy agreements are payable via the e-Stamping Portal on myTaxPortal (https://mytax.iras.gov.sg). Please also refer to Verifying the Authenticity of Stamp Certificate (iras.gov.sg) for more information on how to verify the authenticity of stamp certificate.

Taxpayers are advised to stay vigilant against scams. Do not be deceived by fake SMSes, emails and WhatsApp messages in spoofing scams. To avoid getting scammed, click only links with “iras.gov.sg” or ”go.gov.sg”. For tax transactions including filing and payments, taxpayers should use relevant forms and digital services in myTax Portal secured by Singpass login. IRAS will also not solicit taxpayers’ personal details or any confidential information via email or unsecured web links.

Members of the public are advised to ignore the scam and not to provide any personal, credit card or bank account details, make payments or follow any instructions. Those affected by the scam are advised to lodge police reports.

Read how IRAS protects you from scams.

Screenshots of the fake documents are provided below for reference:

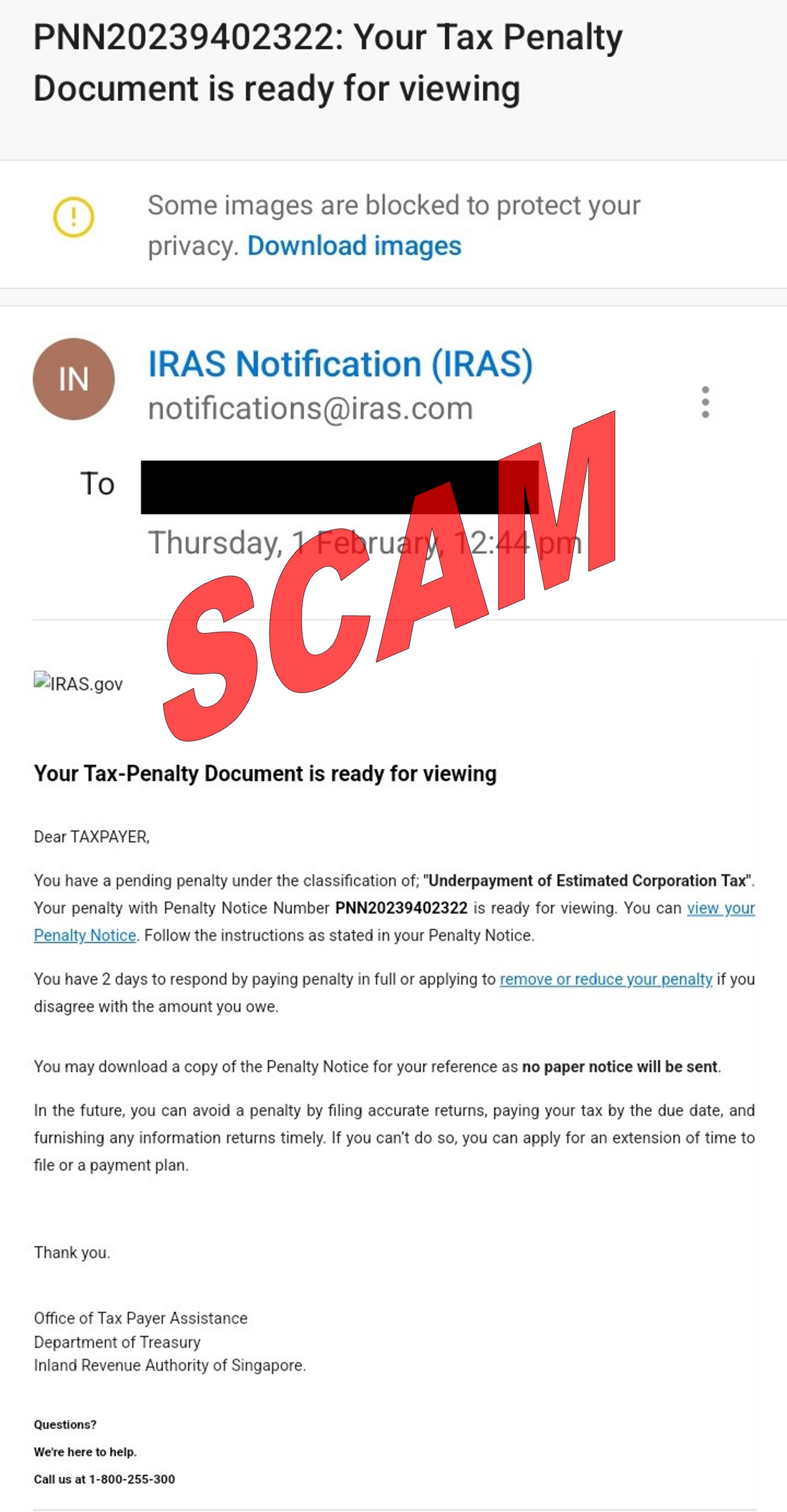

If you receive an email purportedly from IRAS claiming that you have a pending penalty for “Underpayment of Estimated Corporation Tax”, do not click on the URL link. This is a new phishing scam where fraudsters spoof IRAS’ identity to trick users into clicking a suspicious URL link.

The phishing email requests users to respond by paying the penalty in full or applying to remove or reduce their penalty if they disagree with the amount owed. Do not click on the URL link to view or download the “Penalty Notice”.

IRAS does not send any notices on tax matters via unsecured emails. All tax transactions and notices are deposited on myTax Portal. myTax Portal is a secured and personalised portal for you to view and manage your tax transactions with IRAS. SingPass authentication is also required before you can perform any transactions.

Members of the public are advised to ignore the phishing email and not to click on the suspicious URL link. Do not provide any personal, credit card or bank account details, make payments or follow any instructions in the email. Those affected by the scam are advised to lodge police reports.

Learn how IRAS protects you from scams.

A copy of the scam email is attached:

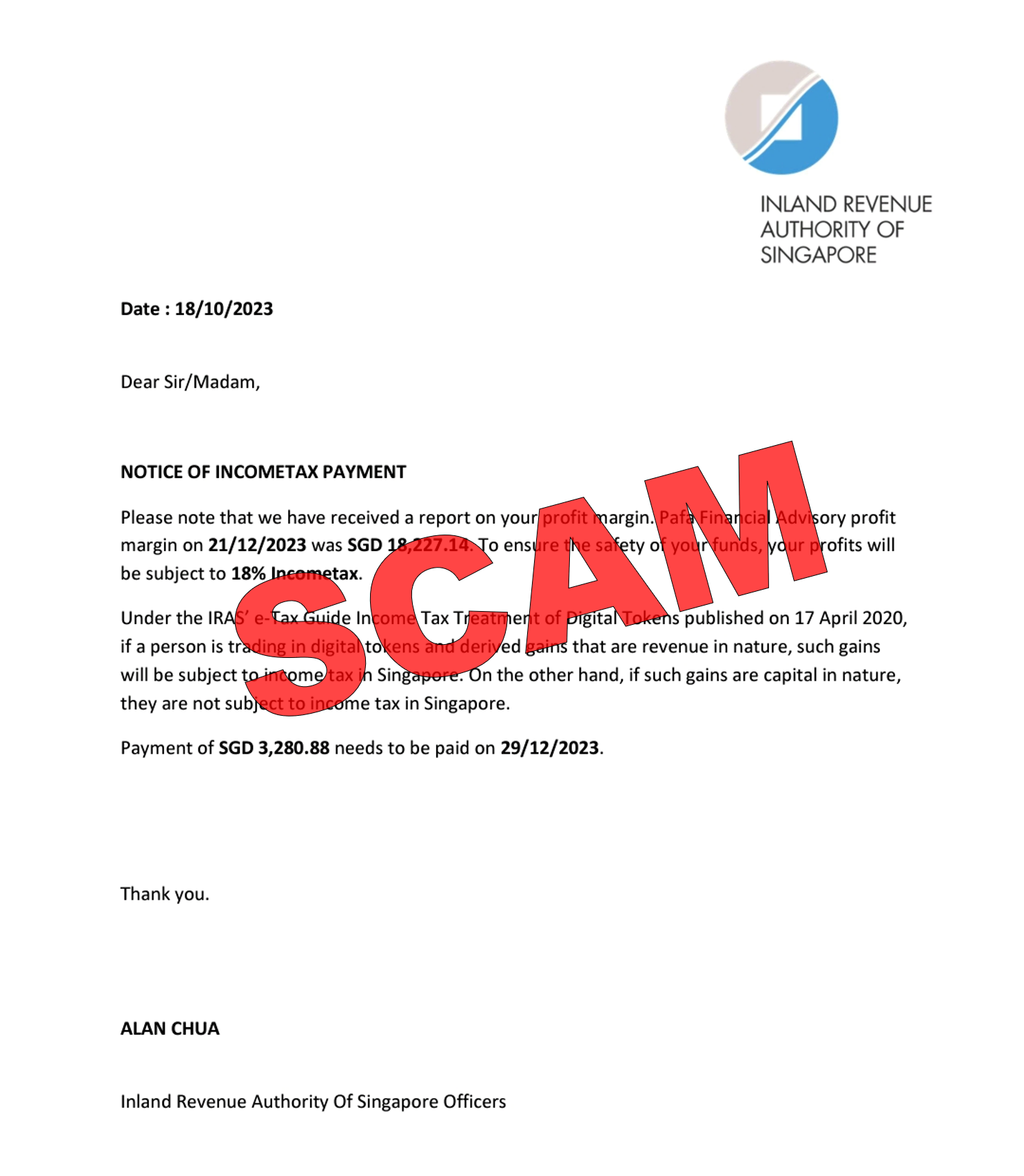

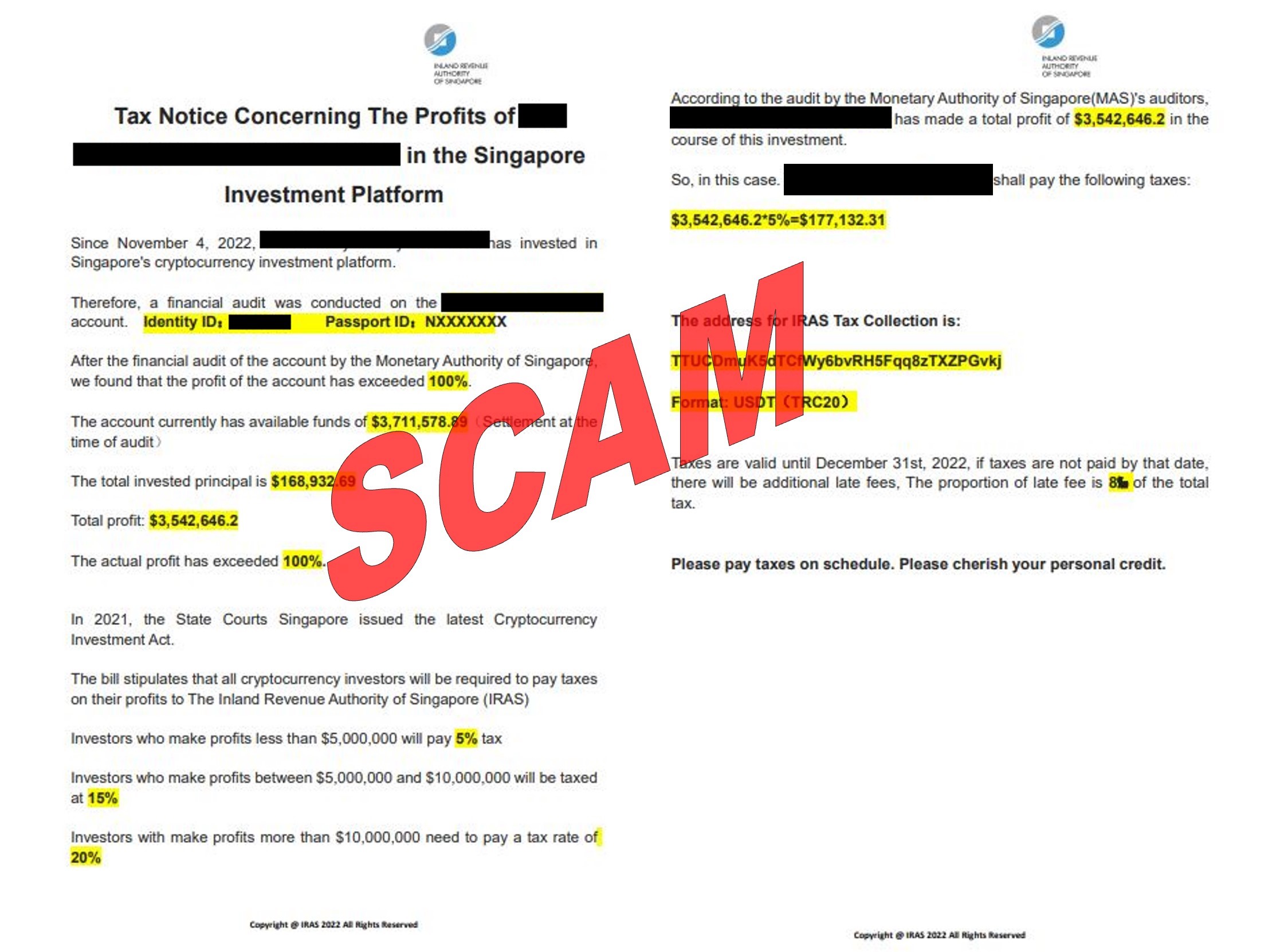

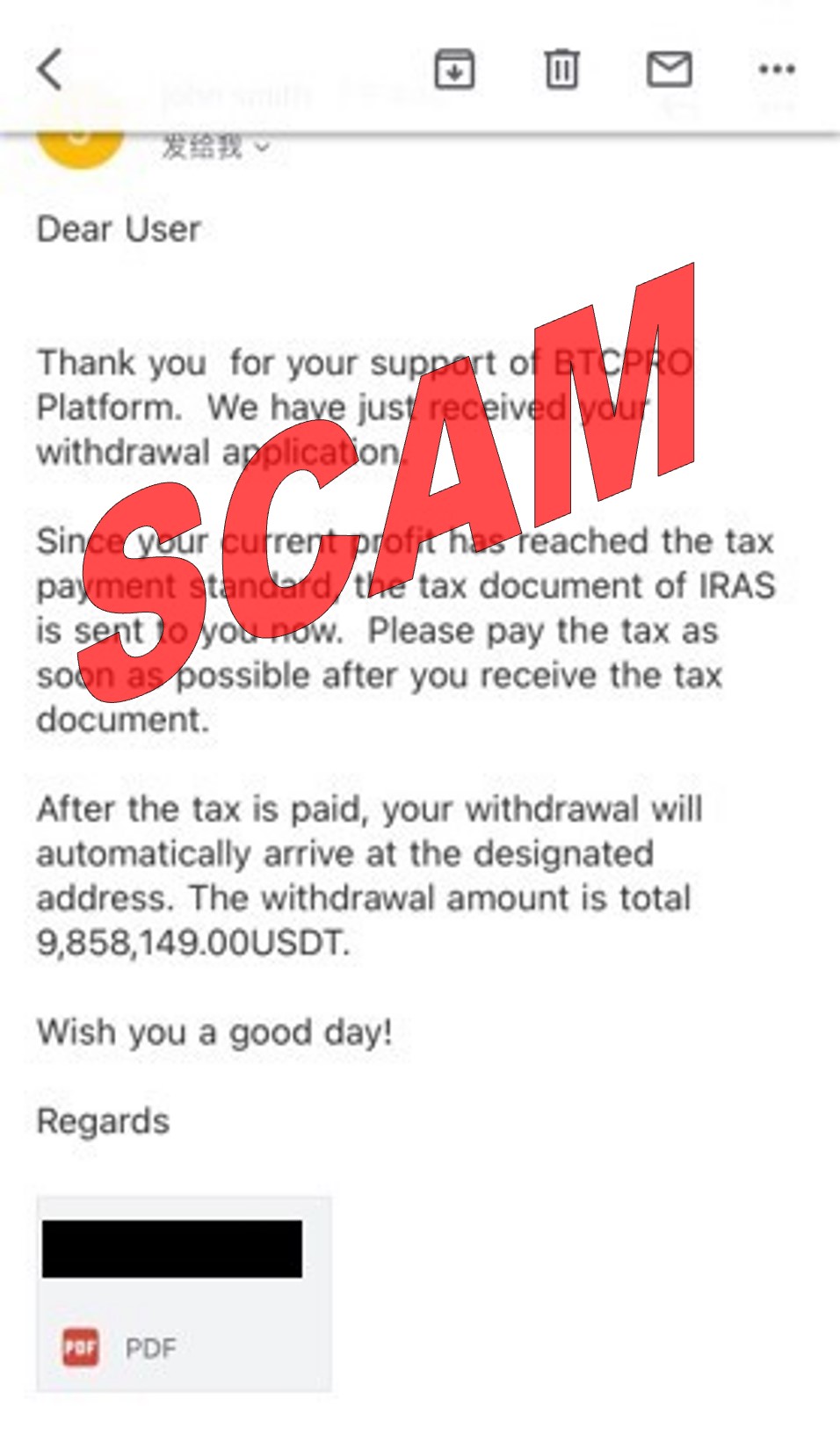

We have been alerted of a scam variant where victims receive an attached letter via email, purportedly from IRAS, instructing them to pay income tax on their investment profit.

The scam letter claims that cryptocurrency investors are required to pay taxes on their investment profits or dividends in an attempt to mislead them that income tax is payable on the profit or dividends. The recipient is then instructed to make payment to avoid late fees or penalties.

Screenshots of the email and scam letter are provided below for reference:

IRAS would like to advise that the authority does not receive reports of private investments made by taxpayers. Taxpayers are required to file their tax returns at mytax.iras.gov.sg using SingPass login. IRAS’ letters and notices are deposited in the secured tax portal at mytax.iras.gov.sg and taxpayers may log in to the portal to retrieve them.

Members of the public are advised to ignore such emails and not to provide any personal, credit card or bank account details, make any payments to a third party’s bank account or follow any instructions by the sender. Those who have been affected by the scam are advised to lodge police reports.