We understand that paying taxes can be challenging during difficult times. If you are facing difficulties paying your tax, do reach out to us before the payment due date. We will work with you to come up with a suitable payment arrangement that takes into account your unique circumstances.

Extended GIRO Scheme for Residential Property (Retirees)

As announced in Budget 2024, you may be eligible for an extended instalment plan of up to 24 months for the payment of property tax for your residential property, provided you meet the following criteria:

- All owner(s) of the property are aged 65 or above; and

- You are residing in the property (i.e. your property is taxed at owner-occupier tax rates); and

- Your assessable income must not exceed $34,000 in YA2024. With effect from 1 Jan 2026, the assessable income must not exceed $39,000 based on the latest tax assessment available; and

- There is outstanding property tax payable for the property.

Refer to the section below on arranging for a longer payment plan for the steps on how to apply for an extended instalment plan. You will be required to declare that you meet the above criteria in your application. Please note that your extended instalment plan will be reverted to the standard instalment plan of up to Dec 2025 if you are subsequently found to not have met the above criteria.

For individuals or businesses in financial difficulties

IRAS may offer a suitable payment arrangement, such as a longer instalment plan, if you are unable to pay your tax due to unexpected or extenuating circumstances including:

- High medical expenses

- Loss of employment or substantial reduction in income

- Business under financial distress (e.g. facing lawsuits from creditors or business closure)

You may be required to submit documentary evidence to support your request for a longer instalment plan.

Arranging for a longer payment plan

If you require more time to pay for your taxes, you may appeal for a longer payment plan via the ‘Apply/Manage GIRO Plan’ digital service at myTax Portal. Note that instalment plans are only available if you choose to pay via GIRO.

If you have an existing GIRO arrangement

For Individuals Paying Income Tax or Property Tax

You can revise your existing GIRO plan by:

- Editing your existing GIRO plan [Select “Account” > “View GIRO Plan” > View > Edit (under GIRO Plan Option)]. Your existing GIRO arrangement will be replaced by the revised arrangement.

- Viewing your new GIRO plan (Select "Account" > "View GIRO Plan").

Please refer to the section, "Make changes to GIRO Arrangement" of the "Apply/Manage GIRO Plan" guide (PDF, 1.77MB) for detailed instructions.

For Non-Individuals Paying Property Tax

You can revise your existing GIRO plan by:

2. Viewing your new GIRO plan. Select "Account" > "View GIRO Plan".

Please refer to the section, "Edit existing active Property Tax GIRO plan" of the "Apply/Manage GIRO Plan" guide (PDF, 1.72MB) for detailed instructions. To view your GIRO plan, please refer to the "View GIRO Plan" guide (PDF, 970KB).

For Non-Individuals Paying Corporate Income Tax or Goods and Services Tax

You can revise your existing GIRO plan by:

- Cancelling the existing plan via myTax Portal. Select "Account" > "View GIRO Plan" > "Cancel GIRO Plan".

- Re-activating your GIRO to create a new plan. Select "Account" > "Apply/Manage GIRO Plan". Please refer to the section, "Reactivating Corporate Tax/GST GIRO arrangement" of the "Apply/Manage GIRO Plan" guide (PDF, 1.72MB) for detailed instructions.

Login to myTax Portal with your Singpass now!

If you do not have an existing GIRO arrangement

For Individuals Paying Individual Income Tax or Property Tax

- Apply for eGIRO (using DBS/POSB, OCBC, UOB, Bank of China, Citibank, HSBC, Standard Chartered Bank or Maybank account) via myTax Portal.

- Edit your existing GIRO plan. Select “Account” > “View GIRO Plan” > View > Edit (under GIRO Plan Option).

- View your GIRO plan. Select "Account" > "View GIRO Plan".

Please refer to the "Apply/Manage GIRO Plan" guide (PDF, 1.77MB) for the detailed instructions to apply for eGIRO.

For Non-Individuals Paying Corporate Income Tax, Goods and Services Tax or Property Tax

- Apply for eGIRO (using DBS/POSB, OCBC, UOB, Bank of China and Maybank account) via myTax Portal.

- For Corporate Income Tax or Goods and Services Tax

- Cancel the existing plan. Select "Account" > "View GIRO Plan" > "Cancel GIRO Plan".

- Reactivate your GIRO to create a new plan. Select "Account" > "Apply/Manage GIRO Plan".

For Property Tax

Edit your existing GIRO plan. Select "Account" > "View GIRO Plan" > Proceed > View > Edit (under GIRO Plan Option). - View your GIRO plan (Select "Account" > "View GIRO Plan").

Please refer to the "Apply/Manage GIRO Plan" guide (PDF, 1.72MB) for the detailed steps to apply for eGIRO.

For other banks, customise your payment plan in 2 simple steps:

- Complete the hardcopy Corporate Tax GIRO form (PDF, 3.9MB) or GST GIRO form (PDF, 1.3MB) and send it to IRAS; and

- Submit your payment proposal online within the same day.

- Corporate Income Tax and PIC Recovery

- Goods and Services Tax

IRAS will review your request and inform you of the outcome within 15 working days. You may also be asked for more information for IRAS to better understand and assess your situation.

Financial and other support services

If you require other forms of assistance specific to your circumstances, you may wish to approach the following agencies:

For social assistance

For employment assistance

For enterprise assistance

Enterprise Singapore provides companies with various financial and non-financial assistance schemes.

FAQs

IRAS will consider granting extended instalments only if you are in financial difficulty due to the following reasons:

For Individuals

- Loss of job/business failure

- Reduction in income or business cashflow

- No steady source of income

- High medical expenses incurred for yourself or your immediate family members

For Businesses

- Slow collections from debtors

- Reduction in sales

- Increase in overheads

For Individuals Paying Individual Income Tax or Property Tax

You can revise your existing GIRO plan by:

- Editing your existing GIRO plan. Select “Account” > “View GIRO Plan” > View > Edit (under GIRO Plan Option). Your existing GIRO arrangement will be replaced by the revised arrangement.

- Viewing your new GIRO plan. Select "Account" > "View GIRO Plan".

Please refer to the section, "Make changes to GIRO Arrangement" of the "Apply/Manage GIRO Plan" guide (PDF, 1.77MB) for detailed instructions.

For Non-Individuals Paying Property Tax

You can revise your existing GIRO plan by:

- Editing your existing GIRO plan. Select “Account” > “View GIRO Plan” > Proceed > View > Edit (under GIRO Plan Option). Your existing GIRO arrangement will be replaced by the revised arrangement.

- Viewing your new GIRO plan. Select "Account" > "View GIRO Plan".

Please refer to the section, "Edit existing active Property Tax GIRO plan" of the "Apply/Manage GIRO Plan" guide (PDF, 1.72MB) for detailed instructions. To view your GIRO plan, please refer to the "View GIRO Plan" guide (PDF, 970KB).

For Non-Individuals Paying Corporate Income Tax or Goods and Services Tax

You can revise your existing GIRO plan by:

- Cancelling the existing plan via myTax Portal. Select "Account" > "View GIRO Plan" > "Cancel GIRO Plan".

- Re-activating your GIRO to create a new plan. Select "Account" > “Apply/ Manage GIRO Plan”. Please refer to the section, "Reactivating Corporate Tax/ GST GIRO arrangement" of the "Apply/Manage GIRO Plan" guide (PDF, 1.72MB) for detailed instructions.

If you cancel your existing GIRO plan, you need to apply for a new GIRO plan immediately to avoid having to make full payment of the tax.

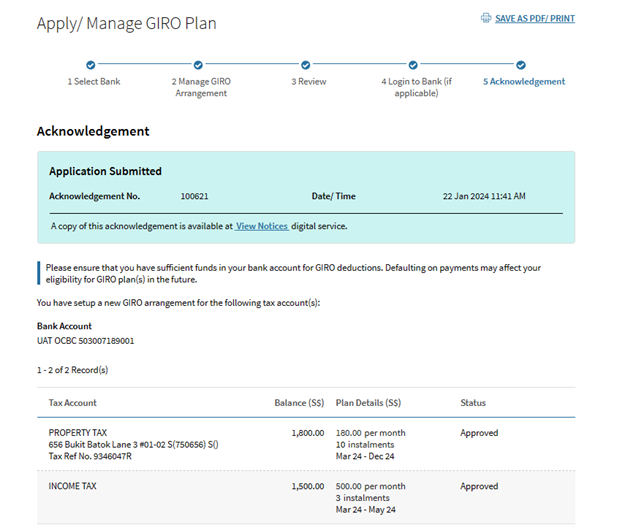

To ensure that you have revised your GIRO plan, you should see the Acknowledgement page showing your payment plan details and application status as ‘Approved’. For requests pending approval, IRAS will review your appeal and inform you of the outcome within 15 working days.