Individual Income Tax

Applying for eGIRO

Apply for eGIRO easily and receive instant approval from your bank through one of these methods:

1. myTax Portal (Set up within minutes)

| 2. Bank Portal (Set up within 3 working days) | 3. AXS stations (Set up within 3 working days) |

|  |  |

DBS/POSB, OCBC, UOB, Bank of China, Citibank, HSBC and Maybank customers | DBS/POSB, OCBC and UOB customers | DBS/POSB customers using NETS card |

Sign up for eGIRO using your own bank account for tax payments and IRAS will automatically refund tax credits to your bank account.

If you are setting up a GIRO arrangement to pay taxes for a third party using your bank account, tax credits due to the third party will be refunded to their registered PayNow-FIN/NRIC account.

There are certain scenarios where you may be unable to apply for eGIRO:

- You do not have an account with any of the eGIRO participating banks listed above

- You do not have internet banking facilities or a DBS/POSB NETS card

- You are setting up a GIRO arrangement to pay for a third party but you do not have a bank account with the above listed banks

If you fall under these scenarios, you can submit a request for a GIRO application form.

Managing your GIRO arrangement

For a successful GIRO deduction, please make sure that your bank has enough funds on the deduction date and that you have set a suitable payment limit. Do note that some banks may impose bank charges for unsuccessful GIRO deductions.

Date of Deduction | Every 6th of the month. If the deduction date falls on a weekend or public holiday, deduction will be made the next working day. |

| If GIRO deduction is unsuccessful | If failed, the second deduction will be done on 20th* of the month. GIRO arrangement will be cancelled after consecutive 2 months of failed deductions ( 4 failed deductions in a row). You have to make full payment of outstanding tax at myTax Portal (Select “Account” > “Pay Taxes”) or re-activate for the GIRO arrangement (Select “Account” > “Apply/ Manage GIRO Plan”) to avoid penalties. Please comply with the GIRO arrangement granted, as failure to do so may result in the denial of future GIRO applications. |

| Provisional Instalment Plan (PIP) | Commences yearly from May, based on the previous year’s tax or current year’s estimated tax payable. Refer to "Understand how Provisional Instalment Plan (PIP) works" below for more details. |

Understand how Provisional Instalment Plan (PIP) works [for monthly GIRO]

If you join GIRO after May, the instalment deduction will commence in the month after your GIRO application is approved which ends in April of the following year.

In the following year, a PIP of 12 full months starting from May will be

prepared based on your previous year’s taxes or current year’s estimated tax payable. Once your current tax assessment has been finalised, your monthly GIRO arrangement will be revised based on actual tax payable.

Example:

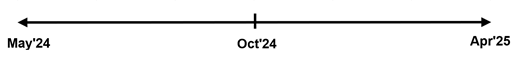

Mr Ong is on a monthly GIRO arrangement | 1. He received a PIP based on his Year of Assessment (YA) 2023’s tax of $1,680. A

monthly instalment of $140 from May’24 – Apr’25 (12 months) is set up for him. | 2. His assessment for YA 2024 was finalised in Aug’24 and the actual tax payable is $1,750. The monthly instalment was revised to $150 monthly from Oct’24 – Apr’25 (7 months). |

5 months x $140 = $700 7 months x $150 = $1,050 As at end of Sept’24, Mr Ong has paid $700. | ||

$1,750 - $700 = $1,050 | ||

Re-activate a GIRO arrangement

If your GIRO arrangement has been cancelled and you wish to re-activate any previous GIRO set up with IRAS, please log into myTax Portal (Select "Account" > “Apply/ Manage GIRO Plan”). Refer to step-by-step guide to re-activate GIRO

Upon successful re-activation, you may log in to myTax Portal to view your GIRO plan details (Select "Account" > “View GIRO Plan”).

Make changes to a GIRO arrangement

Changing bank account or GIRO plan duration

You can log in to myTax Portal to make the changes [Select “Account” > “View GIRO Plan” > View > Edit]. Refer to step-by-step guide to make changes to GIRO.

- Bank account changes: If you're changing your GIRO arrangement to a bank account that has never been registered with IRAS before, and the bank account is not under DBS/POSB, OCBC, UOB, Bank of China, Citibank, HSBC or Maybank, you will have to submit a new GIRO application (refer to Applying for eGIRO).

- Plan duration changes: You can edit the total duration of your GIRO plan (for monthly instalment only) or change your plan type (from monthly instalment to one-time yearly deduction or from one-time yearly deduction to monthly instalment).

Once edited, your existing GIRO arrangement will be replaced with the updated plan. You can view your updated GIRO plan details at myTax Portal (Select "Account" > "View GIRO Plan").

Cancel / Terminate GIRO arrangement

If you wish to terminate your GIRO arrangement with IRAS, please get in touch with your bank directly. Once your GIRO arrangement has been terminated, you will have to apply for a new GIRO arrangement for future tax payments (refer to Applying for eGIRO).

Do remember to settle any outstanding tax immediately after the cancellation/termination of GIRO arrangement to avoid late payment penalty.

Please log in to myTax Portal (Select "Account" > "View Account Summary") to view your latest tax balance and make payment via Pay Taxes (Select “Account” > “Pay Taxes”).