Types of income tax bills

| Types of tax bills | Description |

|---|---|

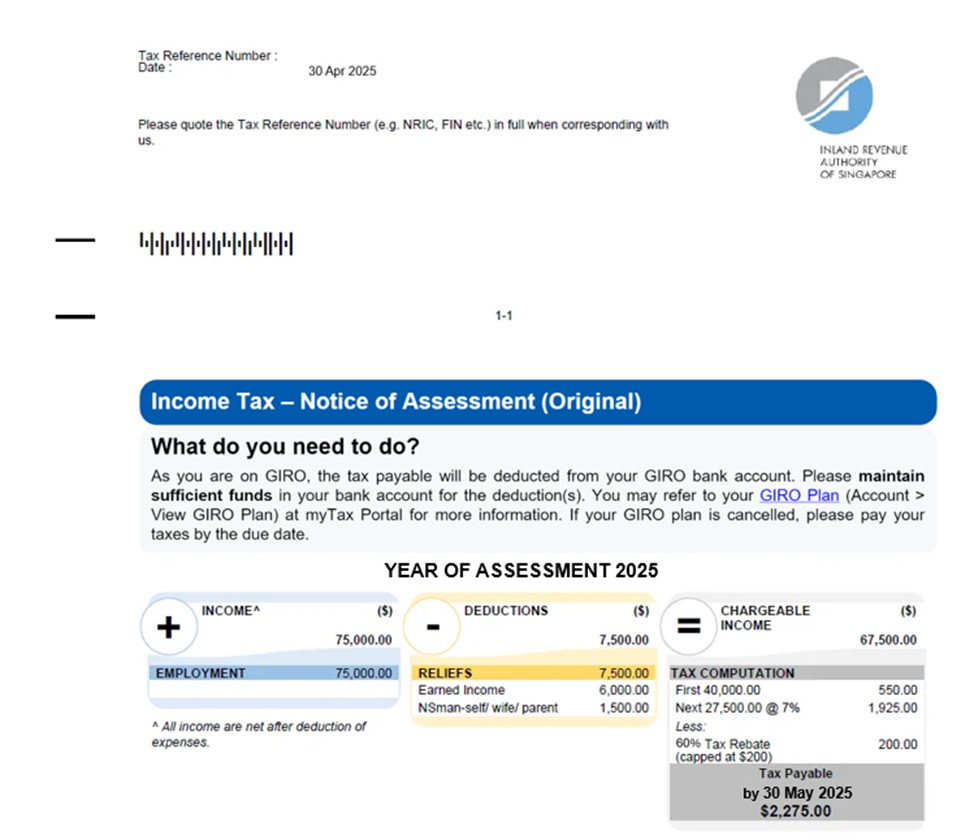

| Notice of Assessment (Original) | This is the tax bill computed based on the tax form(s) that you have submitted and/or information sent by organisations participating in the Auto-Inclusion Scheme. |

| Notice of Assessment (Amended) | The Notice of Assessment (Amended) is issued when your assessment is amended downwards resulting in a reduction in tax payable. For example, due to the inclusion of reliefs or reduction in income. The 'Previous assessment' shows your tax payable from your previous tax bill. |

| Notice of Assessment (Additional) | The Notice of Assessment (Additional) is issued when your assessment is amended upwards resulting in additional tax payable. For example, due to the withdrawal of reliefs or inclusion of additional income. The 'Previous assessment' shows your tax payable from your previous tax bill. |

| Notice of Assessment (Estimated) | If you have not filed your Income Tax Return by the due date, we may estimate your tax based on information available and send you Notice of Assessment (Estimated). The estimated tax is shown as 'Estimated Tax Payable'. You must still file your Income Tax Return for us to issue a Notice of Assessment (Amended/Additional). |

Tax terms on tax bills

| Tax terms | Explanation | Example |

|---|---|---|

| Year of Assessment (YA) | This refers to the tax year in which your income tax is calculated and charged. The assessment is for income you have earned in the preceding calendar year. | Income taxed in Year of Assessment 2025, refers to income earned from 1 Jan 2024 to 31 Dec 2024. |

| Income | The amount reflected under 'Income' is your total income after deducting allowable expenses. The total income includes:

|

|

| Deductions | Deductions like donations and reliefs can help lower your income subject to tax. | |

| Chargeable income | This refers to your 'Income', after subtracting 'Deductions'. | |

| Tax payable | This refers to the amount of tax that you need to pay. | 'Tax payable by 30 May 2025 $2,275.00' means you must pay $2,275.00 to IRAS by 30 May 2025, unless you are paying your taxes via GIRO. |

| Tax repayable/discharged | This refers to the amount of tax that will be refunded to you. | 'Tax repayable/discharged $300' means $300 will be refunded to you. |

General income tax glossary

| Tax terms | Explanation | Example |

|---|---|---|

| Basis period | This refers to the period of income relevant to the Year of Assessment (YA). The basis period for a YA is the year preceding that YA. The basis period for YA 2025 is 1 Jan 2024 to 31 Dec 2024. If you receive business income, the basis period may be different if your accounts are made up to a date other than 31 Dec. | Example 1: Employment income Mr Tan has employment income from 1 Jan 2024 to 31 Dec 2024. This income is earned in the basis period from 1 Jan 2024 to 31 Dec 2024 and hence, it will be assessed in the Year of Assessment 2025. Example 2: Business income Mr Lee is a sole-proprietor. His business financial year ends on 31 Mar 2024. His business income is earned in the basis period from 1 Apr 2023 to 31 Mar 2024 and hence, it will be assessed in the Year of Assessment 2025. |

| Assessable income | This is your total income after deducting allowable expenses and approved donations. Total income includes:

Note: Chargeable income is the remainder of your assessable income after deducting personal reliefs. | Mr Lim has: Employment income = $50,000 Allowable expenses and donations = $5,000 Assessable income = $50,000 - $5,000 = $45,000 Personal reliefs = $10,000 Chargeable income = $45,000 - $10,000 = $35,000 |

| Personal reliefs | There are deductions which can help you save tax. These are allowable if:

| |

| Personal Income Tax Rebate | As part of the SG60 package, a Personal Income Tax Rebate will be granted to all tax resident individuals for Year of Assessment 2025. The rebate will be 60% of tax payable, capped at $200 per taxpayer. |