Qualifying for relief

CPF Cash Top-up Relief is given to encourage Singaporeans and Permanent Residents to set aside money for retirement needs either in their own CPF accounts or those of family members.

To qualify for the tax relief for Year of Assessment 2025, you must:

1. be a Singapore Citizen/Permanent Resident; and

2. have made cash top-ups in 2024 under the CPF Retirement Sum Topping-Up Scheme ("RSTU").

| Cash top-ups made to | Other condition(s) |

|---|---|

Self (By you and/or your employer)

| Not applicable |

* Incapacitated because of physical or mental infirmity. | Not applicable |

| Dependant must not have an annual income** of more than $8,000# in the year 2023 (i.e. the year preceding the year in which the top-up was made in 2024). ** Annual income includes:

New! #From the Year of Assessment 2025, the annual income threshold of $4,000 has been increased to $8,000. However, for Year of Assessment 2024 and before, the annual income threshold of $4,000 will remain. There is no change to the other conditions. For example, to qualify for tax relief for the Year of Assessment 2025, your dependant must not have an annual income of more than $8,000 in 2023 if you are making the top-up in 2024. |

CPF cash top-ups that attract matching grants under the Matched Retirement Savings Scheme (MRSS) will not be eligible for CPF Cash Top-up Relief from Year of Assessment 2026 (i.e. CPF cash top-ups received from 1 January 2025).

New! CPF cash top-ups to eligible members’ MediSave Accounts that attract the Matched MediSave Scheme (MMSS) matching grant will not qualify for CPF Cash Top-up Relief from Year of Assessment 2027, for cash top-ups made from 1 January 2026.

Individuals may continue to enjoy tax relief of up to $16,000 (maximum $8,000 for self and maximum $8,000 for family members) a year for eligible CPF cash top-ups that do not attract MRSS and/or MMSS grants.

For each Year of Assessment, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including any relief on cash top-ups made).

There will be no refund for accepted cash top-up monies. Please evaluate whether you would benefit from tax relief on your cash top-up before you make an informed decision on whether to make a cash top-up.

Top-up through transfer of funds

The tax relief is only for cash top-ups. The relief does not apply when the top-up is carried out by transferring funds from your own CPF Account to your own or a family member's Special/Retirement Account.

For more information on the procedures for topping-up the Special/Retirement Accounts under the CPF Retirement Sum Topping-Up Scheme, please visit the CPF website.

Example 1: Income threshold of spouse

In 2024, Mr Lee made a CPF cash contribution of $7,000 to his wife's Special Account. His wife's annual income in 2023 was $9,000. Mr Lee will not be able to claim for CPF Cash Top-up Relief as his wife had an annual income of more than $8,000 in the preceding year (i.e. 2023) to the year of top-up (i.e. 2024).

| Top-up amount to wife's Special Account in 2024 | $7,000 |

|---|---|

Wife's annual income in 2023 | $9,000 |

CPF Cash Top-up Relief for Year of Assessment 2025 | $0 |

Amount of relief

From Year of Assessment 2023 onwards

To make it simpler for employees to make top-ups to their MediSave Accounts (“MA”) and for parity with the RSTU scheme, the following changes take place for CPF cash top-ups made by all individuals on or after 1 Jan 2022:

- The tax relief for cash top-up is expanded to include cash top-ups made to self and family members’ MA (if the individual making a top-up is a self-employed person (SEP), he/she must be up-to-date with their MediSave payable).

- The maximum CPF Cash Top-up Relief per Year of Assessment is $16,000 (maximum $8,000 for self, and maximum $8,000 for family members).

Amount of cash top-up to own or family members' CPF Special/Retirement Account/MediSave Account

| Maximum allowable relief (please refer to limit on cash top-up amount for computing tax relief) |

|---|---|

Below $8,000 | Exact amount of cash top-up |

$8,000 or more | $8,000 |

For Year of Assessment 2022 and before

Amount of cash top-up to own or family members' CPF Special/Retirement Account

| Maximum allowable relief Allowable relief amount will also be subjected to Full Retirement Sum (FRS) |

|---|---|

Below $7,000 | Exact amount of cash top-up |

$7,000 or more | $7,000 |

Limit on cash top-up amount for computing tax relief

Although individuals may enjoy tax relief of up to $16,000 (maximum $8,000 for self and maximum $8,000 for family members) a year for eligible CPF cash top-ups, there is a limit on the amount of cash top-ups to self and your family members that qualifies for tax relief.

| Age of recipients | Limit on cash top-up amount for computing tax relief |

|---|---|

For recipients below age 55 | (a) Top-up to Special Account (SA) under RSTU scheme: (i) is capped at the current year's Full Retirement Sum (FRS). (ii) Maximum allowed cash top-up: FRS – SA savings – Amount withdrawn from SA for investments* * Net SA savings withdrawn under CPF Investment Scheme (CPFIS) for investments that have not been completely disposed of (b) Top-up to MediSave Account (MA): (i) is capped at the Basic Healthcare Sum (if the individual making a top-up is a self-employed person (SEP), he/she must be up-to-date with their MediSave payable) (ii) Maximum allowed cash top-up: Basic Healthcare Sum ("BHS") - MA balance before the top-up |

For recipients aged 55 years and above | (a) Top-up to Retirement Account (RA) under RSTU scheme: (i) is capped at the current year's Full Retirement Sum (FRS) (ii) Maximum allowed cash top-up: FRS – RA** ** RA savings refers to the cash set aside in the RA (excluding amounts such as interest earned, any government grants received) plus amounts withdrawn (b) Top-up to MediSave Account (MA): (i) is capped at the Basic Healthcare Sum (if the individual making a top-up is a self-employed person (SEP), he/she must be up-to-date with their MediSave payable) (ii) Maximum allowed cash top-up: Basic Healthcare Sum ("BHS") - MA balance before the top-up |

To check your top-up limit you can make to your SA/RA under RSTU scheme, you may use the CPF Board's Retirement Dashboard.

For the Years of Assessment 2025 and 2026, the applicable Full Retirement Sum amounts/Basic Healthcare Sum are as shown in the table below. For more information, please refer to CPF Board’s website.

For CPF members below age 65, the BHS will be adjusted annually to keep pace with the expected growth in MediSave use by the elderly.

Once CPF members reach age 65, their BHS will be fixed for the rest of their lives (i.e. if you reached age 65 in 2024, your BHS will be fixed at $71,500).

| Year of Assessment | Applicable Full Retirement Sum (FRS) Amount | Basic Healthcare Sum (BHS) |

|---|---|---|

2025 (i.e. for CPF cash top-up made in 2024)

| $205,800

| $71,500

|

| 2026 (i.e. for CPF cash top-up made in 2025) | $213,000 | $75,500 |

You may refer to this quick summary of CPF Cash Top-up Relief (PDF, 729KB).

Example 2: Amount of cash top-up does not exceed the limit on cash top-up amount for computing tax relief

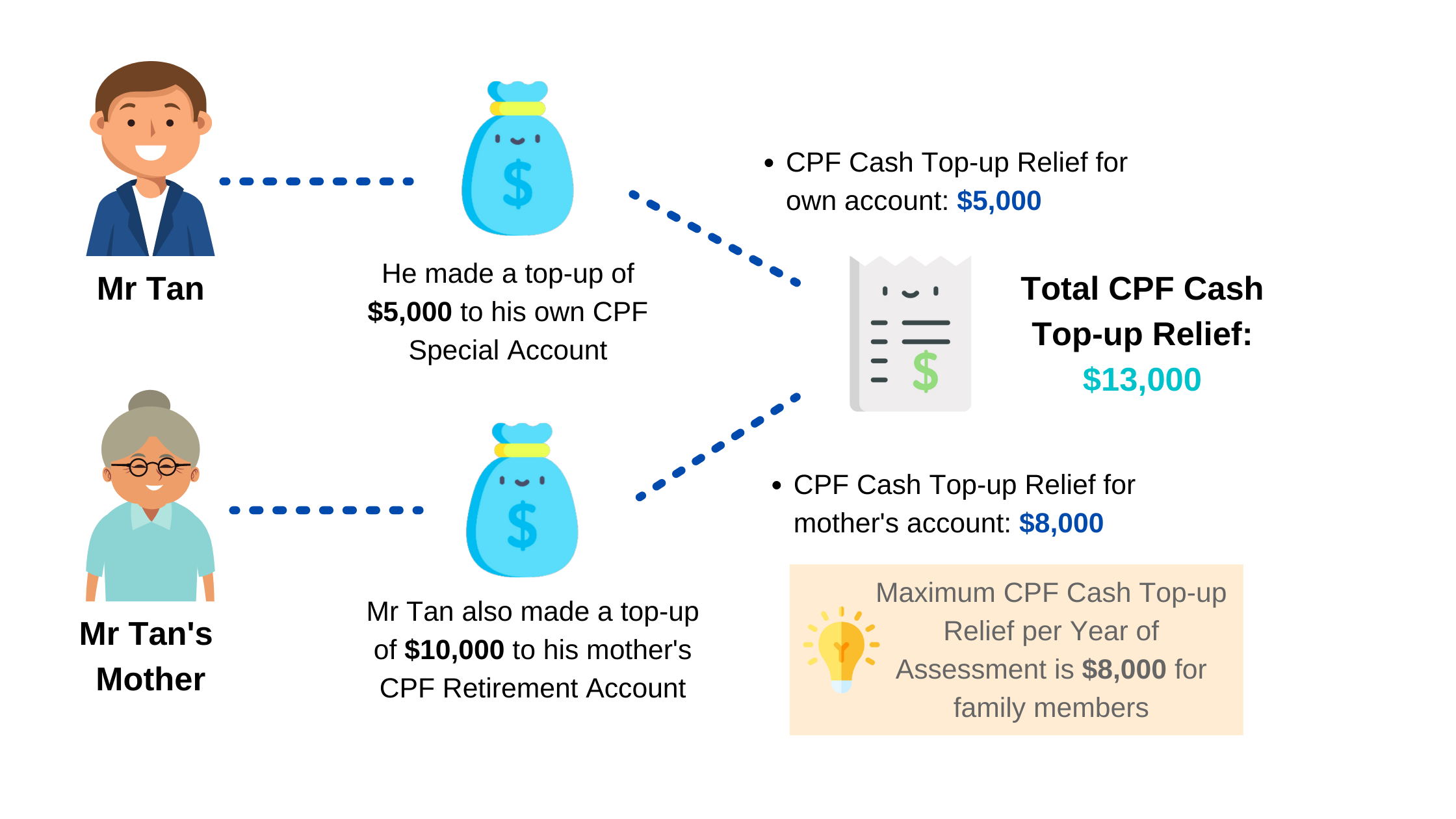

Mr Tan is under 55 years old. He makes cash top-ups of $5,000 to his own CPF Special Account and $10,000 to his mother's CPF Retirement Account in 2024 to enjoy tax relief for Year of Assessment 2025.

For Year of Assessment 2025, Mr Tan may claim a total CPF Cash Top-up Relief of $13,000 ($5,000 + $8,000).

| Top-up amount to Mr Tan's own CPF Special Account in 2024 | $5,000 |

| Top-up amount to mother's CPF Retirement Account in 2024 | $10,000 |

| CPF Cash Top-up Relief (own account) | $5,000 |

| CPF Cash Top-up Relief (mother's account) | $8,000 (The maximum CPF Cash Top-up Relief per YA is capped at $8,000 in total for family members) |

Example 3: Amount of cash top-ups for multiple family members do not exceed the limit on cash top-up for computing tax relief

Mr Tan wishes to make cash top-ups of $5,000 to his father’s CPF Retirement Account and his mother's MediSave Account respectively in 2024 to enjoy tax relief for Year of Assessment 2025.

| Top-up amount to father's CPF Retirement Account in 2024 | $5,000 |

| Top-up amount to mother's MediSave Account in 2024 | $5,000 |

| Total CPF Cash Top-up Relief | $8,000 (The maximum CPF Cash Top-up Relief per YA is capped at $8,000 in total for family members) |

For Year of Assessment 2025, Mr Tan may claim a total CPF Cash Top-up Relief of $8,000.

Example 4: Amount of cash top-up exceeds the limit on cash top-up amount for computing tax relief

Mr Ong is under 55 years old. He wishes to make cash top-up in 2024 as follows:

| S/N | Cash top-up amount Mr Ong wishes to make | Top-up to: | Information on CPF account to be topped-up |

|---|---|---|---|

| a (i) | $8,000 | his own CPF Special Account | His total Special Account savings, including net Special Account savings withdrawn under CPF Investment Scheme (CPFIS) is $203,800. |

| a (ii) | $8,000 | his own CPF MediSave Account | His MediSave Account balance before the top-up is $64,500. |

| b (i) | $8,000 | his mother’s CPF Retirement Account | His mother's Retirement Account savings is $207,000. |

(a) Cash top-up to own CPF account

(i) For cash top-ups to Mr Ong’s own Special Account:

| Full Retirement Sum (FRS) in 2024 | $205,800 |

| Mr Ong's total Special Account (SA) savings and Net SA savings withdrawn under CPFIS for investments that have not been completely disposed of | $203,800 |

| Amount of cash top-up allowed to be made in 2024 (As Mr Ong is under 55 years old, the maximum top-up amount he can receive in his SA is an amount determined by "Current FRS – SA savings – Net SA savings withdrawn under CPFIS for investments that have not been completely disposed of") |

$2,000 ($205,800 - $203,800) |

| CPF Cash Top-up Relief for Year of Assessment 2025 | $2,000 |

While Mr Ong would like to make a cash top-up of $8,000 to his own CPF Special Account, the amount of top-up allowed to be made is only $2,000. $2,000 will be eligible for tax relief in view that in respect of CPF Special Account, the limit on the amount of cash top-up that qualifies for tax relief is the same as the amount of top-up allowed to be made.

(ii) For cash top-ups to Mr Ong's own MediSave Account:

| Basic Healthcare Sum (BHS) in 2024 | $71,500 |

| Mr Ong's MediSave Account (MA) savings | $64,500 |

| Amount of cash top-up allowed to be made in 2024 (The maximum top-up amount he can receive in his MA is an amount determined by "Applicable BHS – MA balance before the top-up") |

$7,000 ($71,500 - $64,500) |

| CPF Cash Top-up Relief for Year of Assessment 2025 | $7,000 |

For Year of Assessment 2025, Mr Ong may claim a total CPF Cash Top-up Relief of $8,000 (While there is $2,000 from the cash top-up to his own Special Account + $7,000 from the cash top-up to his own MediSave Account, the total is capped at the $8,000 deduction limit in respect of Mr Ong’s cash top-up to his own CPF accounts).

(b) Cash top-up to family member's CPF account

(i) For cash top-ups to his mother's Retirement Account:

| Enhanced Retirement Sum in 2024 | $308,700 |

| Full Retirement Sum in 2024 | $205,800 |

|

Mother’s Retirement Account savings [Refers to the cash set aside in the Retirement Account (excluding amounts such as interest earned, any government grants received) plus the amounts withdrawn.] |

$207,000 |

| Amount of cash top-up allowed to be made in 2024 |

$8,000 (As mother’s RA savings would not reach the Enhanced Retirement Sum after the cash top-up)

|

| CPF Cash Top-up Relief for Year of Assessment 2025 (mother’s account) | $0 (No tax relief for cash top-up as the recipient’s Retirement Account savings have already reached the Full Retirement Sum.) |

As Mr Ong’s mother is above 55 years old, cash top-up will be allowed up to the Enhanced Retirement Sum. While Mr Ong would like to make a cash top-up of $8,000 to his mother’s CPF Retirement Account and the amount of top-up allowed to be made is $8,000, no tax relief is given for the cash top-up as her Retirement Account savings have already reached the Full Retirement Sum.

The maximum top-up amount a recipient aged 55 years and above can receive in his/her Retirement Account is determined by the "Current Enhanced Retirement Sum – Retirement Account savings". This is to allow such recipients to commit higher amounts to CPF LIFE (i.e. up to the Enhanced Retirement Sum), if they choose to receive higher payouts under CPF LIFE.

However, there is no tax relief for any amount of cash top-up which exceeds the limit on cash top-up amount for computing tax relief (i.e. Current Full Retirement Sum – Retirement Account savings).

Even though the Enhanced Retirement Sum has been increased from 3 times of Basic Retirement Sum (BRS) to 4 times of BRS from 1 Jan 2025, the qualifying conditions for CPF cash top-up relief remains unchanged and individuals will continue to enjoy tax relief for cash top-ups up to the prevailing Full Retirement Sum. This ensures the tax benefits remain focused on incentivising Singapore Citizen or Singapore Permanent Resident (PR) with lower retirement saving who have yet to reach their Full Retirement Sum to top-up their Special/ Retirement Account.

Please refer to CPF Board’s website for information on the Full Retirement

Sum and Enhanced Retirement Sum.

How to claim

You do not need to claim the CPF Cash Top-up Relief as it is granted automatically to those who are eligible based on records sent to us by the CPF Board.

FAQs

I have received my tax bill for Year of Assessment 2025. The amount of CPF Cash Top-up Relief is incorrect. What should I do?

Please check if any of the following scenarios apply:

- For contributions made in 2025, CPF Cash Top-up Relief will be granted in the Year of Assessment 2026.

- For cash top-up made to spouse’s and/or sibling’s CPF account, you should check that their annual income does not exceed the threshold.

- If your CPF savings have reached the Full Retirement Sum (FRS), you will not be eligible for the CPF Cash Top-up Relief.

You may also wish to seek advice from the CPF Board directly.

Can I obtain a refund of the cash top-ups that I have made, if the total amount of personal reliefs which I can claim is more than $80,000, even without any tax relief on cash top-ups I made?

There will be no refund for accepted cash top-up monies. As such, please note the overall personal income tax relief cap and evaluate whether you would benefit from the tax relief on your cash top-ups before you decide whether to make a cash top-up.

My sibling has also topped up to the same family member. Will I still be eligible for the CPF Cash Top-up Relief?

My employer has contributed to my Special/Retirement/MediSave Account on my behalf. Will I be eligible for the relief?

Yes. However, do note that you will be subject to tax on the contributions made by your employer as a source of employment income.