Informing employees to file

Please inform all employees, including directors, about their obligation to file an Income Tax Return if they receive a letter, Form, or SMS from IRAS instructing them to do so. You can share the communication note below, which is available as a PDF, and accompanying infographics with your employees.

1. Communication note

Share this communication note (PDF, 1.2 MB) with your employees to help them meet their obligations on time.

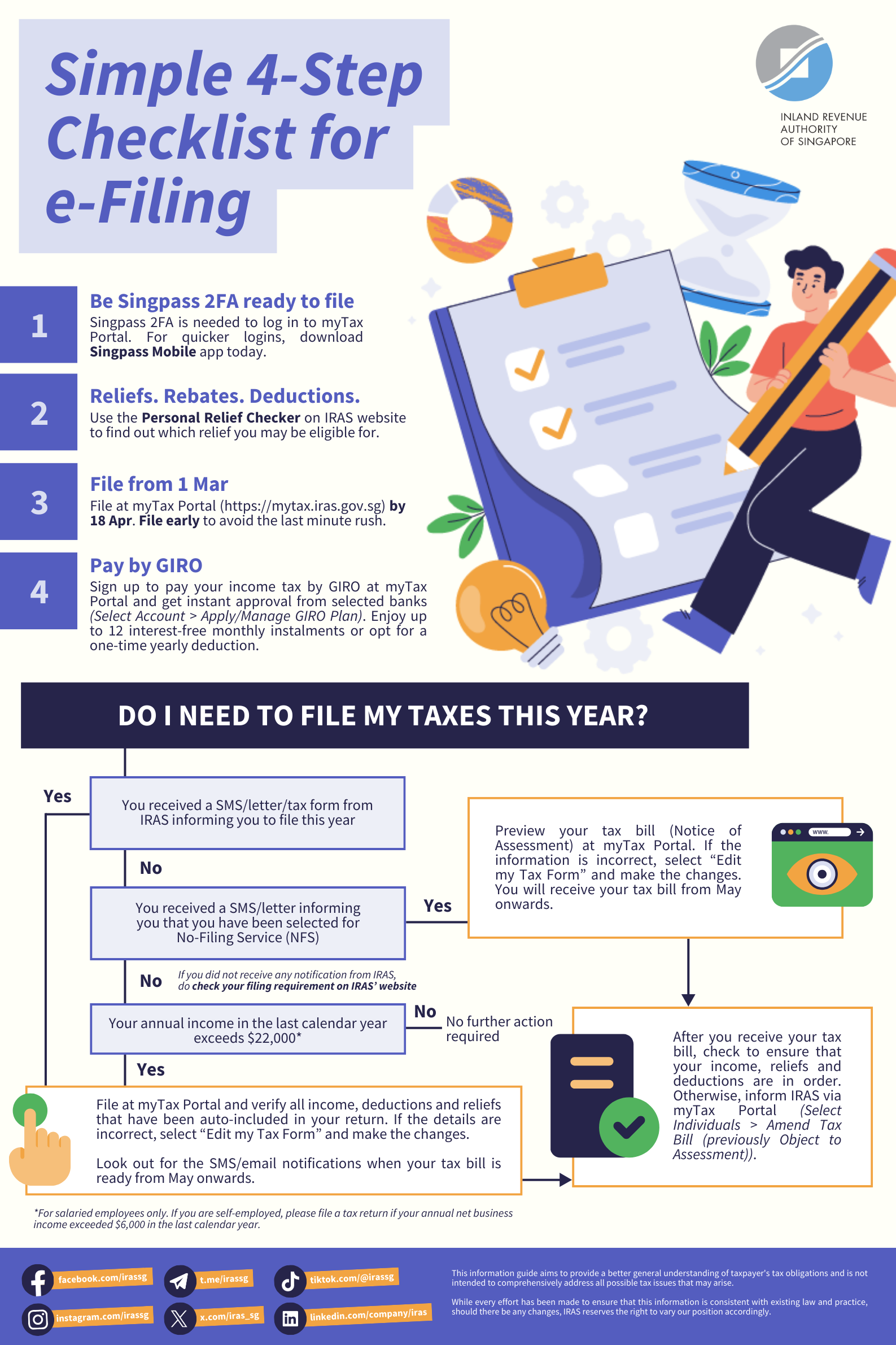

2. Infographic

Complement the communication note with an easy-to-understand infographic which highlights key information about tax filing in a simple and visual format.

FAQs

How do employees verify the amounts submitted by the employers?

Employees can verify their employment income information submitted by their employer at myTax Portal starting from 1 Mar of the year after the year the income is derived by the employee.

What should employees do if they have already declared their employment income and deductions, and their employers have also submitted their income information via the AIS?

If your employees have e-Filed their Income Tax Return, they may re-file their tax returns at myTax Portal (Individuals > File Income Tax Return) by 18 Apr.

If your employees have received their tax bill (i.e. Notice of Assessment), they may file an amendment using the 'Amend Tax Bill' digital service at myTax Portal within 30 days from the date of the tax bill.