Generally, you will be required to submit your Income Tax Return if in the preceding calendar year:

- your total income is more than $22,000; or

- you have self-employment income with a net profit more than $6,000; or

- you are a non-resident who derived income from Singapore.

Filing due date

Extension to file tax

If you need additional time to file your Income Tax Return, an extension of up to 14 days may be granted. Please use the 'Apply Extension of Time to File' digital service at myTax Portal.

Check if you need to file an Income Tax Return

You must file an Income Tax Return if you have received a letter, form or an SMS from IRAS informing you to do so, regardless of how much you earned in the previous year or whether your employer is participating in the Auto-Inclusion Scheme (AIS) for Employment Income.

To file your Income Tax Return, please log into myTax Portal using your Singpass or Singpass Foreign user Account (SFA).

Find out if you need to file an Income Tax Return:

Non-resident individuals

Non-residents who derived income from Singapore in the preceding year are required to file an Income Tax Return, regardless of how much you earned in the previous year.Direct Notice of Assessment (D-NOA)

If you did not receive any filing notification, you may check your notification in myTax Portal using your Singpass or Singpass Foreign user Account (SFA).

If you receive a message saying “We will notify you once tax bill is ready or if any action is required from you”:

- No action is required from you at the moment.

- IRAS will inform you if any action is required from you.

- Otherwise, your Notice of Assessment (i.e. tax bill) will be finalised based your income provided by your employer

No-Filing Service (NFS)

If you receive a letter or SMS informing you that you have been selected for NFS, you are not required to file an Income Tax Return.

However, we encourage you to log in to myTax Portal using your Singpass or Singpass Foreign user Account (SFA) to verify that the auto-included information is correct. You may preview your tax bill from 1 Mar to 18 Apr. If you wish to make any changes to your income details or relief claims, you can select "Individuals" > "File Income Tax Return" to file your return at myTax Portal. No filing extension can be granted if you are under NFS.

If you wish to make changes to your income or reliefs after receiving your tax bill, you may do so via the 'Amend Tax Bill' digital service at myTax Portal within 30 days from the date stated in your income tax bill.

Your Notice of Assessment or tax bill (digital or paper format) will be sent to you from end Apr onwards. Your tax bill is computed based on your auto-included income and previous year's relief claims, which may be adjusted if you do not meet the eligibility criteria.

You may refer to the Frequently Asked Questions (FAQs) for more information on NFS (PDF, 167 KB).

Pre-filling of income for self-employed persons (SEPs)

For SEPs, with effect from Year of Assessment 2021, you may be selected for NFS if you are under the pre-filling scheme for SEPs with:

- Commission income of $50,000 and below; and/or

- Derived driving income as a private hire car/taxi driver for previous and current Years of Assessments.

If you are also in receipt of employment income, your employer must be participating in the Auto-Inclusion Scheme for Employment Income.

You will not be selected for NFS if you were in receipt of income from partnership and/or other sources of income which are not pre-filled and/or auto-included or claimed for employment expenses incurred in the previous Year of Assessment.

How can I verify that the information is correct before IRAS finalises my tax bill?

Verifying your Income Tax Return if you have been selected for NFS.

You may verify the details of your auto-included information and preview your tax bill at myTax Portal using your Singpass or Singpass Foreign user Account (SFA) from 1 Mar to 18 Apr.

What if I have changes to my income and personal relief claims?

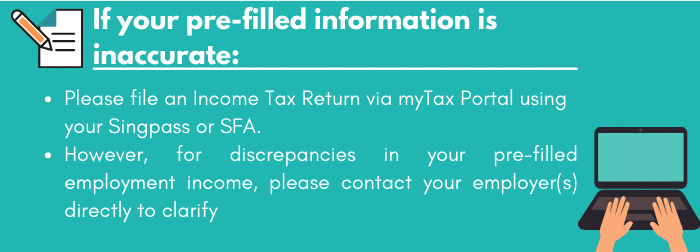

If your pre-filled information is inaccurate:

- Please file an Income Tax Return at myTax Portal using your Singpass or Singpass Foreign user Account (SFA).

- However, for discrepancies in your pre-filled employment income, please contact your employer(s) directly to clarify.

Auto-Inclusion Scheme (AIS) for employment income

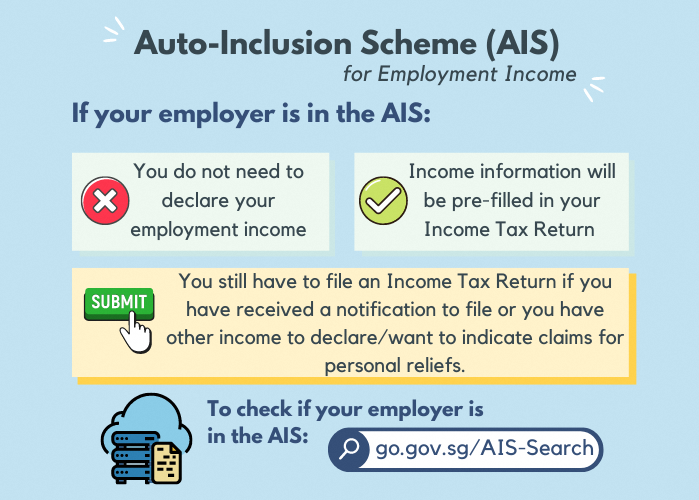

If your employer is in the AIS:

- You do not need to declare your employment income

- Income information will be pre-filled in your Income Tax Return

You still have to file an Income Tax Return if you have received the notification to file or you have other income to declare/ want to claim for personal reliefs.

You may use the AIS Organisation Search to check if your employer is in the AIS.

If your employer is in the AIS, they will submit your income information to IRAS by 1 Mar of each year. You may view the auto-included information in the 'Income, Deductions and Reliefs Statement' at myTax Portal. Otherwise, you may approach your employer for a copy of the Form IR8E.

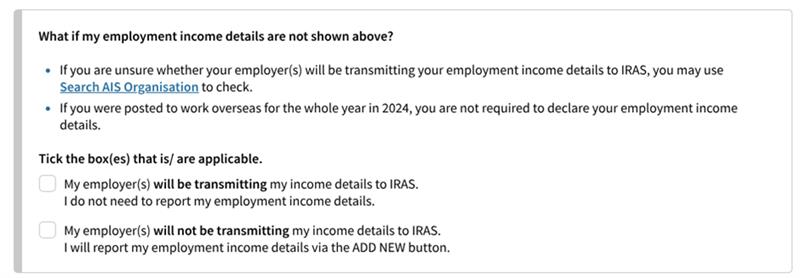

What should I do if my employment income or deductions are not reflected?

If the details are not shown in the Income Tax Return at myTax Portal and your employer is in the AIS:

For e-Filing:

Please tick the box(es) that is/are applicable:

Your employment income and deduction information will be automatically included in your income tax assessment when we receive the information from your employer.

For paper filing:

Please fill in '0' for your employment income and deductions that were made through your salary.

Your employment income and deduction information will be automatically included in your income tax assessment when we receive the information from your employer.

How to file tax

1. e-Filing

Find out more on how to e-File your Income Tax Return at myTax Portal using your Singpass or Singpass Foreign user Account (SFA).

2. Paper filing

Find out more on how to file your paper Income Tax Return.

Where can I find help to file my Income Tax Return?

- Step-by-step guidance at myTax Portal

- Chatbot Assistant

- Live Chat

FAQs

What should I do after receiving my tax bill?

You need to check your tax bill to ensure that it is correct. If you have any other income that is not shown in the tax bill, or your relief claims in the tax bill are incorrect, you may use the 'Amend Tax Bill' digital service at myTax Portal to amend your tax bill once.

Please note that it is your responsibility to ensure that your tax bill is accurate.

I hold a work permit to work as a confinement nanny in Singapore. How do I file tax?

You should declare your salary as a confinement nanny as employment income. If you did not receive any filing notification, please email us the following information at myTax Portal using your Singpass or Singpass Foreign user Account (SFA).

- A copy of the work permit letter issued by the Ministry of Manpower;

- Your mailing address;

- Validity period of your latest Singapore work pass;

- Total number of days you were physically present in Singapore in the preceding year (see note below);

- Your total income in the preceding year (see note below);

- Date of departure/expected date of departure from Singapore.

Note:

If you have ceased employment in Singapore, please provide the relevant information for the preceding year and the year of cessation of employment.

For example: You worked as a confinement nanny from Jun 2024 until Aug 2025. The relevant periods are Jun 2024 to Dec 2024 and Jan 2025 to Aug 2025.

I retired in March 2025 this year and have no income since then. However, I received a notification to file for the Year of Assessment 2025. What should I do?

What should I do if my employer is not under AIS and I need to submit my Income Tax Return?

If your employer is not participating in the AIS, your employer should have prepared and provided you with the Form IR8A by 1 Mar. Otherwise, you may approach your employer for a copy of your Form IR8A. You should enter the details during your tax filing as per the information in your Form IR8A.The IR8A form contains information of your remuneration of the preceding year, you should enter the details during your tax filing according to it.

You are not required to submit your Form IR8A or other supporting documents unless specifically stated at the acknowledgement page.

My employer is in AIS but I have mistakenly submitted my employment income and deductions to IRAS when filing my Income Tax Return. What should I do?

If you have submitted the income information via e-Filing, you may re-file once. Re-filing must be done by 18 Apr.

If you are unable to re-file by 18 Apr, please file an amendment upon receiving your Tax Bill for the current Year of Assessment. You may file the amendment via the 'Amend Tax Bill' digital service at myTax Portal within 30 days from the date of your tax bill.

I was employed under 2 employers during the year. However, only 1 employer is in the AIS. How should I file my Income Tax Return?

You have to manually include the employment income and deductions made through your salary (e.g. CDAC or Mendaki) for the employer that is not participating in the AIS when filing your Income Tax Return.

I have forgotten to report my income earned in previous years. What should I do?

Please provide us with the following details under “Income Not Previously Reported” when e-Filing your Income Tax Return:

- Nature/type of income (e.g. salary, bonus, allowance, commission);

- Period for which the income is earned (i.e. period from/period to);

- Date that you received the income;

- Amount of income;

- For director’s fees, please provide the date that the fees were approved at the company’s Annual General Meeting or Extraordinary General Meeting.

I am a self-employed person and have not been filing my income tax return as my income is below the income filing threshold requirements. However, I need my tax bill (i.e. Notice of Assessment) for the Year of Assessment (YA) 2025 to apply for government assistance scheme. How can I get my tax bill?

You can e-File your Income Tax Return for the YA 2025 at myTax Portal between 1 Mar 2025 and 31 Oct 2025 . This only applies to self-employed persons who did not receive any notification to file but require the tax bill.

If you encounter any issue when trying to e-File your Income Tax Return, please chat with us or call us from Monday to Friday, 8:00 am to 5:00 pm (except Public Holidays). Alternatively, you can email us via myTax Portal using your Singpass or Singpass Foreign user Account (SFA).