You may start filing your Income Tax between 1 Mar to 18 Apr 2025. This page outlines the steps and information required when filing.

Need help with e-filing? Visit go.gov.sg/efilingguide to view our step-by-step e-Filing guides.

Use the filing checker below to determine whether you're required to file.

If you have questions on our filing process, the FAQs provide answers on key topics, including how to file your tax return, important deadlines, and where to find assistance if needed.

Generally, you may check if you are required to file for Year of Assessment (YA) 2025 using the filing checker:

Direct Notice of Assessment (D-NOA)

If you did not receive any filing notification, you may check your notification in myTax Portal using your Singpass or Singpass Foreign user Account.

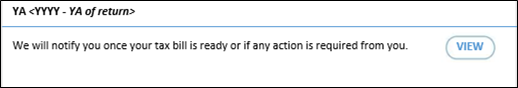

If you receive a message saying "We will notify you once your tax bill is ready or if any action is required from you.":

- No action is required from you at the moment.

- IRAS will inform you if any action is required from you.

- Otherwise, your Notice of Assessment (i.e., tax bill) will be finalised based on your income information submitted by your employer, eligible tax reliefs based on your previous assessment year's approved claims, and other relevant information available in our records.

If there is any inaccurate information (i.e. income and/or relief claims) in your Notice of Assessment (NOA), please use the 'Amend Tax Bill' digital service to make the necessary adjustments. Refer to IRAS|Tax Season 2025 - About your tax bill for more information.

Taxpayers have a legal duty to verify and amend their tax bill if there is any inaccurate information. There are penalties for failing to do so.

No Filing Service (NFS)

You may be selected for NFS scheme for Year of Assessment (YA) 2025, if you only had pre-filled income in the calendar year 2024.

If you are selected for NFS:

- You are not required to file an Income Tax Return.

- From 1 Mar to 18 Apr 2025: You may log in to myTax Portal using your Singpass or Singpass Foreign user Account to verify the pre-filled information.

- From end Apr to Sep 2025: You will receive your finalised NOA (i.e. tax bill) during this period. If there is any inaccurate information (i.e. income and/or relief claims) in your NOA, you may use the 'Amend Tax Bill' digital service to amend your tax bill once. Please note that it is your responsibility to ensure that your tax bill is accurate.

Refer to IRAS|Tax Season 2025 - About your tax bill for more information.

Your employer has submitted your income information for the year 2024 (Year of Assessment 2025) to us directly. For any discrepancy, please check with your employer directly. They will resubmit the information to us if there are errors in the original submission, and this will be included in your tax assessment.

If you satisfy/no longer satisfy the conditions for a relief, please e-File your income tax return to add/withdraw the claim. You can do so via myTax Portal using your Singpass or Singpass Foreign user Account (“Individuals” > “Filing Matters” > “File Income Tax Return” > “Deductions, Tax Reliefs and Rebates”).

* For child relief, select "Others" if your child does not have a FIN or passport no.

You are required to provide IRAS with the information if your rental income is incorrect/not shown under the "Other Income" Section in your income tax return.

Please log in to myTax Portal using your Singpass or Singpass Foreign user Account (“Individuals” > “Filing Matters” > “File Income Tax Return”) to declare your additional income.

Required to file

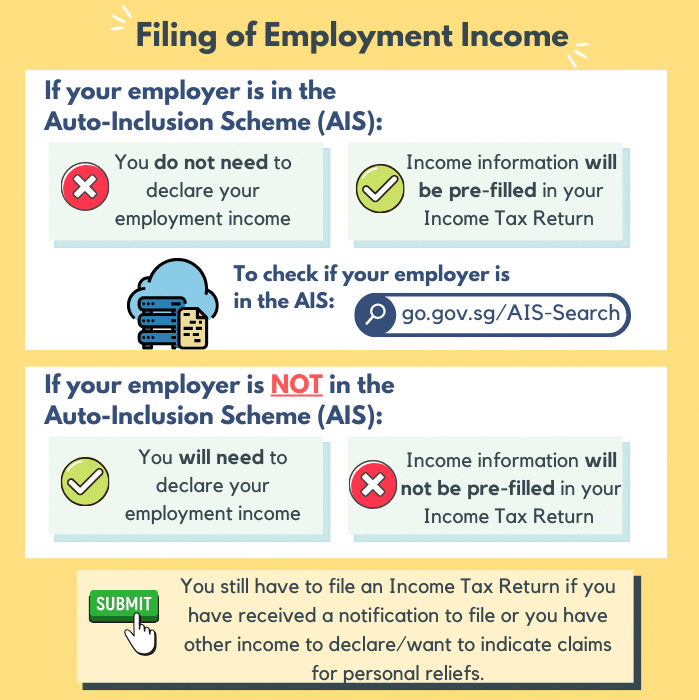

If your employer is participating in the AIS for Employment Income, they will submit your income information to IRAS by 1 Mar of each year. You do not need to declare your employment income information as this will be pre-filled in your Income Tax Return.

You may use the AIS Organisation Search to check if your employer:

- is in the AIS; and

- has submitted for Year of Assessment 2025.

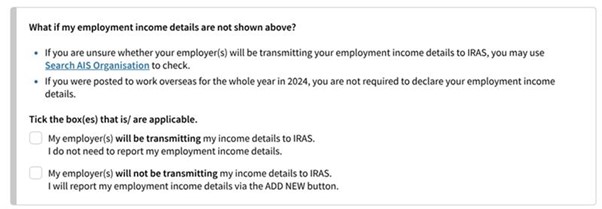

If the details are not shown in the Income Tax Return at myTax Portal:

Please tick the box(es) that is/are applicable:

Your employment income and deduction information will be automatically included in your income tax assessment when we receive the information from your employer.

Although your employer may have sent your employment income details to IRAS, you are still required to file your Income Tax Return if you receive a notification to file, have other income to declare or want to claim for personal reliefs. You do not need to declare your employment income that has been submitted by your employer.

If your employer is not participating under AIS, your employer should have provided you with the Form IR8A by 1 Mar. You should enter the details during your tax filing as per the information in your Form IR8A. If you do not have the Form IR8A, please request for it from your employer.

You are not required to submit your Form IR8A or other supporting documents unless specifically stated at the acknowledgement page after you e-File.

If you need additional time to file your Income Tax Return, an extension of up to 14 days may be granted. Please use 'Apply for Extension of Time to File' digital service in myTax Portal using your Singpass or Singpass Foreign user Account.

FAQs

You may claim personal reliefs and rebates if you are Singapore tax resident and have met the qualifying conditions for the respective reliefs/rebates in the preceding year (i.e. 1 Jan to 31 Dec 2024).

Find out the reliefs that you may be able to claim:

You may check your eligibility for Parenthood Tax Rebate using Parenthood Tax Rebate Eligibility Tool (XLSM, 67KB).

To simplify the tax filing for rental expenses, you may opt to claim the rental expenses based on 15% of the gross rental income derived from the tenanted residential property, instead of the actual amount of deductible expenses incurred. In addition to the 15%, you may claim a deduction on interest paid on the loan taken to purchase the property. Please use the Rental Calculator(XSLM, 146KB) to decide if it is beneficial to claim 15% deemed rental expenses or to claim based on actual rental expenses incurred. Find out more about the Simplification of Claim of Rental Expenses for Individuals.