Most IRAS notices have been digitised, with paper notices minimised. With digitised notices, you can view your notices via myTax Portal any time!

To receive timely notifications when your notices are ready for viewing, ensure your contact details with us are up-to-date. You may update your notification preferences via myTax Portal:

- For individuals and tax agents representing individual clients - Update Contact and Notification Preferences digital services;

- For companies/ businesses and tax agents representing business clients - Update Notice Preferences digital service.

Benefits

With digitised notices, you will enjoy greater convenience in the following ways:

Fast AccessConvenient and instant access of notices, anytime, anywhere |

Timely NotificationsNo more lost mails! Receive timely notifications when notice is ready for viewing |

Easy ManagementView up to 3 years’ of past notices without rummaging through physical files |

Safe and SecureAccess IRAS’ notices in myTax Portal, a safe and secured platform |

Subscribe to Notifications for IRAS Digital Notices

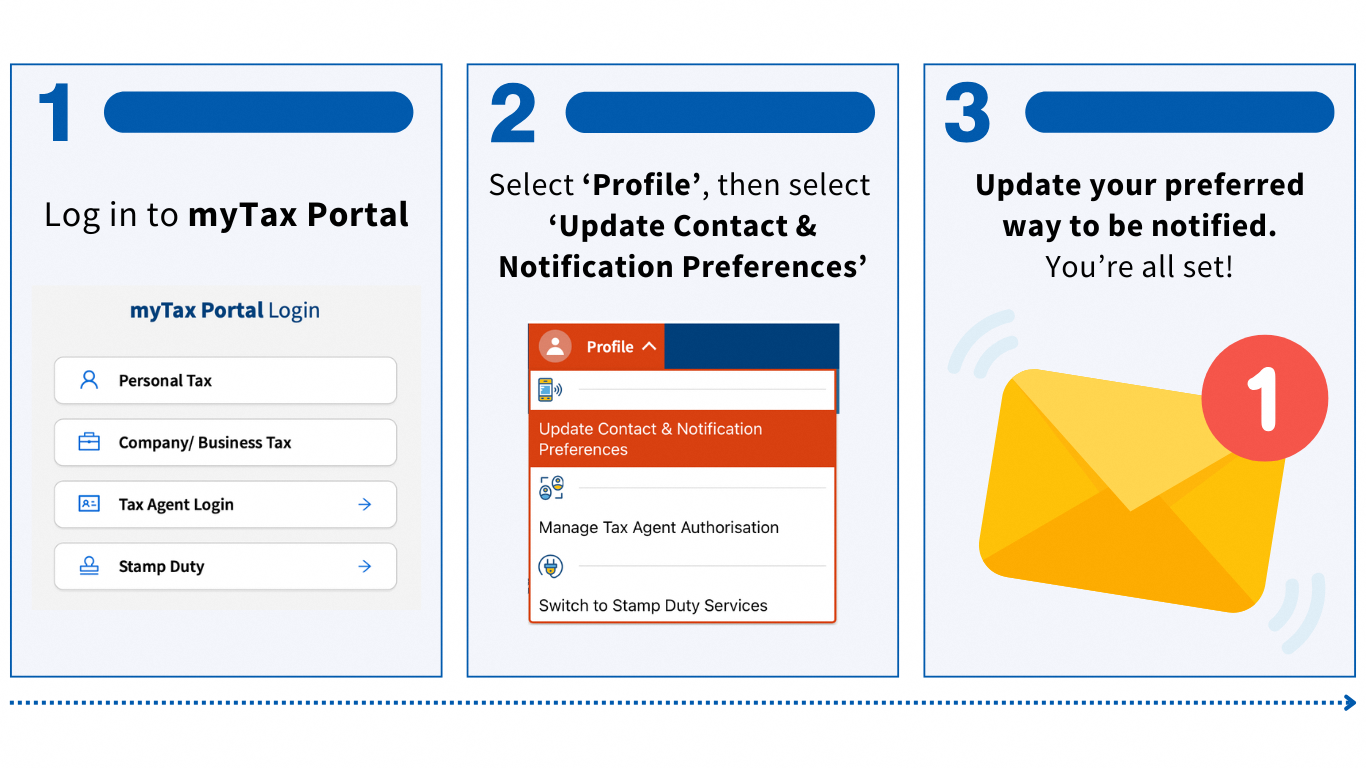

For Individuals/ Tax Agents Representing Individual Client

Most taxpayers have subscribed to receive SMS and/ or email notifications when their tax notices are ready for viewing on myTax Portal, instead of paper notices. If you are not receiving notifications for your tax notices yet, you can subscribe to them now in just 3 simple steps!

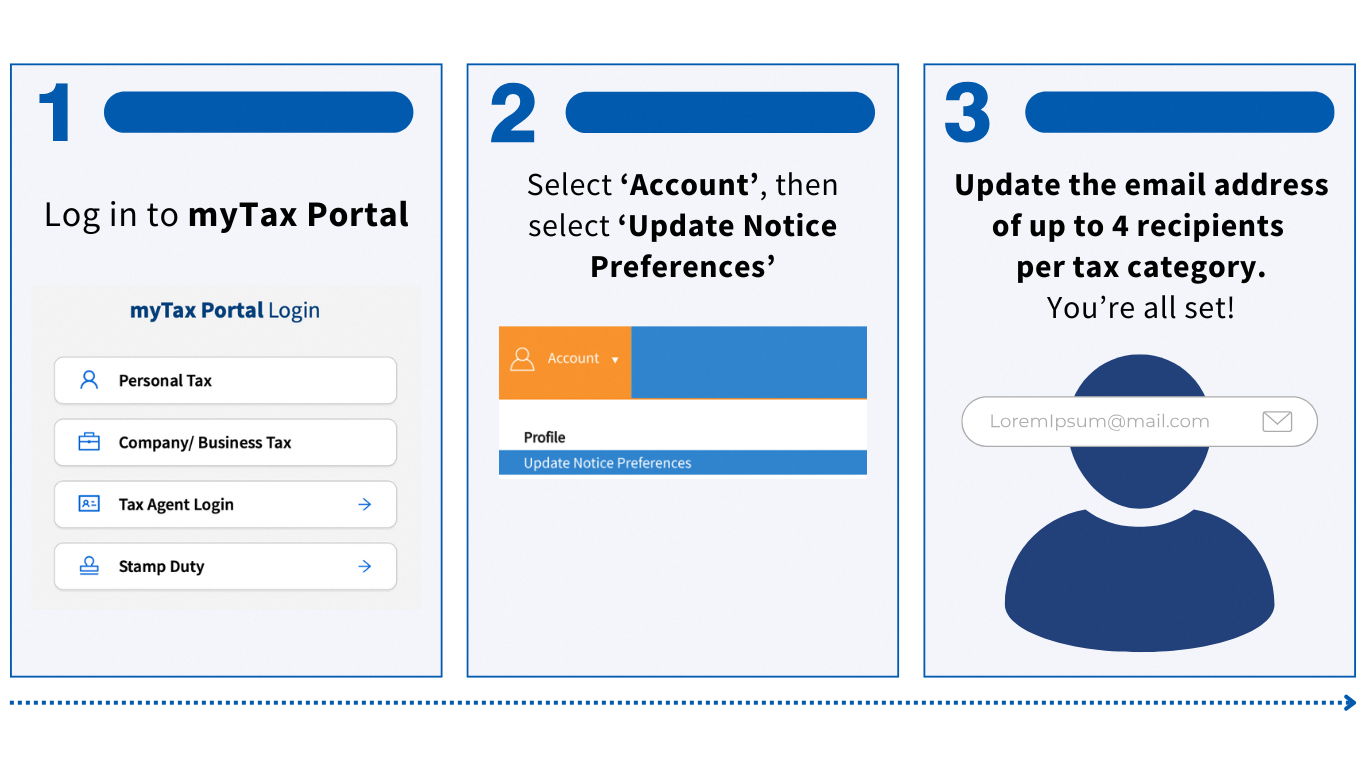

For Companies/ Businesses/ Tax Agents Representing Business Client

Companies/ businesses can now receive email notifications when their tax notices are ready for viewing on myTax Portal.

To ensure that your company/ business receives timely email notifications when your notices are ready for viewing, update the recipients’ email address(es) now in just 3 simple steps!

Note: Only Corppass-authorised ‘Approvers’ for IRAS’ digital services will be able to update the company’s/ business’ notification preferences for tax type(s) relevant to the company/ business.

FAQS

Q1. What does it mean for IRAS' notices to be digitised?

With digitised notices, you can view your notices via myTax Portal any time!

If you have subscribed to receive digital notices via the digital service, you will receive SMS and/ or email notifications when your tax notices are ready for viewing on myTax Portal, and no paper notices will be sent.

Q2. What notifications can I subscribe to?

Q3. After I have subscribed to SMS and/ or email notifications, when will my new preference take effect?

For individual taxpayer, changes to your notification preference will take effect immediately. For changes to your company’s/ business’/ your client’s notification preference, it will take effect within 7 days. Please note that you may still receive paper notice(s) that was/ were sent prior to updating your SMS and/ or email notification preference.

Q4. Can I request for the notifications to be sent to someone else?

For security purposes, we will only send the notifications to the registered mobile number/ email address in the digital service.

Q5. Will I continue to receive paper notices if I have subscribed to SMS and/ or email notifications?

Q6. Will I be able to view my past notices online?

Yes, you will be able to view your past notices of up to 3 back years in the digital service. You are also encouraged to download and retain the PDF versions of your digital notices from myTax Portal.

Some notices that were not digitised prior to May 2021 may not be available.

Q7. I do not want to receive SMS and/ or email notifications. How can I revert to paper notices?

We encourage you to try out the convenience of SMS and/ or email notifications. If you still prefer to receive paper notices, you can update your notification preferences at the digital service. You will no longer receive SMS and/ or email notifications informing you that your notice is ready for viewing on myTax Portal.

Q8. Can I still access a digital copy of my notice(s) if I have reverted to paper notices?

Yes. You may access a digital copy of most notice(s) in the digital service.

Q9. I did not subscribe to SMS and/ or email notifications. Why am I receiving them?

Eligible taxpayers will automatically be converted to receive SMS notifications and would have been duly notified of this change via a paper notice sent to their residential/ mailing address. A copy of this notice can also be viewed via the digital service.

Separately, IRAS also sends notifications, where appropriate, to help taxpayers fulfil their tax obligations more easily, e.g. educate or remind taxpayers to file or pay.

Q10. I have subscribed to SMS and/ or email notifications but am still receiving paper notices. Why?

Although you are subscribed to SMS and/ or email notifications, you may continue to receive paper notices as:

-Some notices will not be digitised due to legislative reasons (e.g. the relevant Tax Act requires service of the notice to be in paper format) or business reasons (e.g. if they relate to sunset schemes such as the Productivity and Innovation Credit Scheme, Jobs Support Scheme, hence is not cost effective to digitise them). However, we are continually reviewing and expanding the scope of digitised notices.

-Your IRAS-registered contact details (e.g. mobile number, email address) may be incorrect or out-dated. You may verify or update your contact details via the digital service.

Q11. Can I subscribe to receive both paper notices with SMS and/ or email?

Q13. IRAS’ notices look different. How can I verify the authenticity of these notices?

You’ve got sharp eyes! To provide you with a better user experience, IRAS has revamped our notices so that they carry a fresh new look and adopt a consistent layout. To verify the authenticity of IRAS’ notices, we encourage you to log in to myTax Portal using your Singpass/ Corppass and view your notice(s) in the digital service.

Also, be extra careful when you receive unsolicited notices or letters requesting that you provide confidential or personal information (e.g. credit card or banking details). For more information on how to recognise scams and how to report one, please visit IRAS’ Advisory on Scam & Fraudulent Activities.

Q13. Why are some of my paper notices printed in colour, while others are in black and white?

Q14. My email notifications are sent to my spam/ junk mailbox. What should I do to resolve this?

Please ensure that emails from IRAS are not marked as spam/ junk. This can be done by adjusting your email settings by adding ‘[email protected]’ or ‘[email protected]’ to your address book or safe sender list.

Q15. I have received a SMS/ email notification informing me that my notice is ready for viewing. How can I tell if it is a legitimate one from IRAS?

Q16. Will IRAS inform me if the SMS and/ or email notification is undelivered (e.g. if my mailbox is full)?

Yes. IRAS will send a paper notice to inform you of the failed delivery to the subscribed mobile number/ email address. You will also be informed to view the notice(s) on myTax Portal and to update your mobile number/ email address where necessary.

Q17. Who can update the recipients of email notifications for the company/ business?

Q18. Can I call IRAS to update the recipients of email notifications for the company/ business?

Q19. How can the company/ business authorise me in Corppass to update the recipients of email notifications and/ or to view the company’s/ business’ notices on myTax Portal?

Q20. Can I request for email notifications to be sent to more than one party/ email address?

Yes. Corppass-authorised ‘Approvers’ of the company/ business can update up to four email recipients per tax type in the digital service.

Q21. Which email address(es) should I update with to receive email notifications?

You are encouraged to update the email addresses of personnel who are authorised on Corppass for the relevant tax type, as only these personnel will be able to log in to myTax Portal to view and/ or follow up on the relevant digital notices. You may also consider to:

-include your tax agent’s email address as one of the four addresses for receiving email notifications, or

-create a corporate group email account to receive email notifications from IRAS. This way, more employees can potentially receive email notifications, if some employees are out of office.