Compulsory cancellation of GST registration

You must apply for cancellation of your GST registration within 30 days when:

- You have stopped making taxable supplies and do not intend to make taxable supplies in future;

- Your business has ceased;

- Your business is transferred as a whole to another person (the buyer or transferee of your business needs to determine if it is required to register for GST); or

- The form of your business entity has changed (e.g. from a general partnership to a limited liability partnership, or from a sole-proprietorship business converted to a private limited company). You need not inform us if your business has been amalgamated, or your sole-proprietorship business has been converted to a partnership (or vice versa), as we will cancel your GST registration upon receiving the information from ACRA.

You will then need to determine whether the new business entity is required to register for GST.

Voluntary cancellation of GST registration

You may apply to cancel your GST registration if you are not liable for registration. However, if you were previously registered on voluntary basis, you must remain registered for at least 2 years before you can cancel your registration.

Example 1: Cancellation of registration (for supplies made before 1 Jan 2019)

| Company A | Past 4 quarters | Next 12 months |

| Taxable turnover | $1,200,000 | $500,000 |

You may cancel your GST registration. However, if you were previously registered on a voluntary basis, you are required to remain registered for at least 2 years before you can cancel your registration.

Example 2: Cancellation of registration (for supplies made on or after 1 Jan 2019)

| Company B | Past calendar year | Next 12 months |

| Taxable turnover | $1,200,000 | $500,000 |

You may cancel your GST registration if you are certain that the taxable turnover for the next 12 months will be $1 million or less due to specific circumstances such as termination of a high value sale contract from a major customer or large-scale downsizing of business and you are no longer liable under reverse charge. You will have to substantiate your projection of the taxable turnover for the next 12 months with supporting documentation.

However, if you were previously registered on a voluntary basis, you are required to remain registered for at least 2 years before you can cancel your registration.

Applying for cancellation

The person authorised to access myTax Portal to submit GST returns can log in to mytax.iras.gov.sg to apply for the cancellation of GST registration online.

Most online applications for the cancellation of GST registration are approved on the day of application, with exceptions of some that may take 1 to 10 working days to process.

Effective date of cancellation

You will be notified of the approval of the cancellation of GST registration and the effective date of cancellation.

With effect from the date of cancellation:

- You should not charge or collect GST as it is an offence to do so.

- You should not issue tax invoices. If you have any existing pre-printed tax invoices, you must add the remarks "GST cancelled with effect from (date)" and cancel your GST registration number and the words "Tax Invoice".

- If you were approved to operate the Tourist Refund Scheme (eTRS), you should also update your Central Refund Agency on the cancellation of your GST registration and stop issuing eTRS transactions.

- You will have to pay GST to Singapore Customs when you import goods as you will not be eligible for any of the following schemes:

- Major Exporter Scheme (MES)

- Import GST Deferment Scheme (IGDS)

- Approved Third Party Logistics (3PL) Scheme

- Approved Contract Manufacturer and Trader (ACMT) Scheme

- Approved Import GST Suspension Scheme (AISS)

- Approved Refiner and Consolidator Scheme (ARCS)

Please refer to the e-Tax Guides on these schemes for more details on the implications of cancelling your GST registration.

Filing your final GST return (GST F8)

A final GST return (GST F8) will be issued to you to file and account for GST up till the last day of the GST registration, which is one day before the effective date of cancellation of GST registration.

You are required to:

- Submit the GST F8 and account for GST within one month from the end of the prescribed accounting period stated on the return; and

- File all outstanding GST returns and make any outstanding GST payment.

Example: Filing final GST F8

You are under monthly filing frequency and your effective date of cancellation is 1 Jan 2021. The GST F8 will be issued for the period from 1 Dec 2020 to 31 Dec 2020 and you have to submit the GST F8 by 31 Jan 2021.

Filing of a GST F8 is similar to that of a GST F5 except that you need to:

- Account for GST on business assets held on the last day of registration; and

- Account for GST on supplies where goods/services are delivered/performed before your date of cancellation but invoice and payment is only issued/received after your date of cancellation.

For more information on the filing of GST returns, you may refer to the IRAS webpage on Completing GST Return.

Accounting for GST on assets in the final GST F8

In your final GST return (GST F8), you need to account for output tax (at the prevailing rate) on the value of the following business assets held on the last day of registration if their total value exceeds $10,000:

- assets for which input tax had been claimed when the assets were bought (input tax is deemed to have been claimed for goods imported under import GST suspension schemes such as the Major Exporter Scheme (MES) or Approved Third Party Logistics Company Scheme status (A3PL)); and

- any assets which were obtained by you as part of the business assets transferred to you as a going concern from a GST-registered person.

Input tax is deemed as claimed for goods imported under import GST suspension schemes such as the Major Exporter Scheme (MES) or Approved Third Party Logistics Company Scheme status (A3PL).

Business assets include:

- Non-residential properties;

- Fixed assets (such as computers, machinery and vehicles); and

- Unsold inventory.

The value of an asset refers to the price of a similar, if not identical, asset of the same condition that could be purchased from the open market.

Exceptions:

You are not required to account for output tax on the value of your business assets on the last day of registration in the following two scenarios:

- The total value of the following business assets is $10,000 or less

- assets on which input tax has been claimed; and

- any assets which were obtained by you as part of the business assets transferred to you as a going concern from a GST-registered person;

- You have transferred the whole of your business as a going concern to another GST-registered person.

Example: Accounting for GST on business assets

You have previously claimed input tax on an equipment (costing $100,000) and a non-residential property (costing $800,000). On the last day of your GST registration, the same equipment can be purchased at a price of $120,000 and the open market value of the non-residential property is $1,000,000. As the open market value of the assets held by you on the last day of your GST registration exceeds $10,000, you will have to account for output tax of S$100,800 on the total value of the assets (i.e. 9% of $1,120,000) in your GST F8. You should report the value of assets in Box 1 (Total value of standard-rated supplies) and the value of GST in Box 6 (Output tax due) of your GST F8.

| Assets held at de-registration | Open Market Value |

|---|---|

| Equipment | $120,000 |

| Non-residential property | $1,000,000 |

| Total assets | $1,120,000 |

| Value to be reported in Box 1 of the GST F8 = $1,120,000 GST to be reported in Box 6 of the GST F8 = $100,800 | |

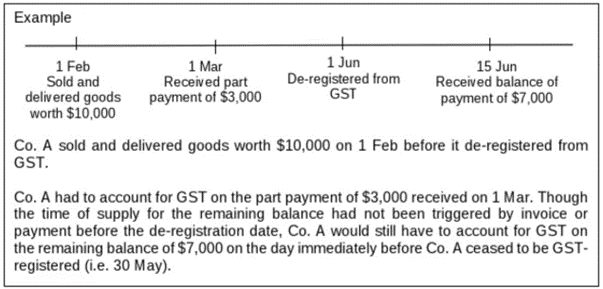

Accounting for GST on supplies spanning the date of cancellation in the final GST F8

In your final GST return (GST F8), you need to account for full output tax (at the prevailing rate) on the supplies you have made where goods/services are delivered/performed before your date of cancellation but invoice and payment is only issued/received after your date of cancellation.

If you had partially accounted for output tax on the supply in earlier GST returns (e.g. part payment was made earlier), you only need to account for output tax on the remaining value of your supply in your GST F8. You may refer to the example below.

Record keeping requirements

You are required to maintain proper records of all business transactions for at least 5 years from the date of the business transaction, even after if your GST registration has been cancelled before the end of the 5-year period.

FAQs

I am not making any sales but I am still GST-registered. Do I need to submit my GST returns?

As long as you are GST-registered, you are required to submit GST returns.

When you do not have any business transactions for the accounting period covered in your GST return, you should submit a Nil return (i.e. fill in "0" in the boxes).

When you have ceased your business and you have stopped making taxable supplies, please apply for cancellation of GST registration online via mytax.iras.gov.sg.

I am a sole-proprietor registered on a compulsory basis. The sales of my sole-proprietorship business for the past 4 quarters have reduced to less than $1 million. Can I cancel my GST registration?

You can apply for cancellation of GST registration via mytax.iras.gov.sg if your total taxable turnover will be less than $1 million in the next 12 months and on the condition you are no longer liable under reverse charge.

For a sole-proprietor, your total taxable turnover includes:

- Turnover of all your sole-proprietorship business(es); and

- Income from any profession or vocation that you carry on as a self-employed person such as taxi driver, hawker, commission agent (e.g. insurance agent, real estate agent or multi-level marketing agent), freelancer (e.g. fitness instructor or book-keeper, accountant with own business practice, etc.)

I own two GST-registered partnership businesses of which my wife and I are the partners. We are certain that both of the partnership businesses will be making less than $1 million in the next 12 months. Can I cancel my GST registration?

You may apply for cancellation of GST registration via mytax.iras.gov.sg if the combined taxable turnover of both partnership businesses will be less than $1 million in the next 12 months and on the condition both are no longer liable under reverse charge.

The GST registration of both partnership businesses will be cancelled. You cannot choose to cancel only one of your partnership businesses as they are both owned by the same composition of partners (in this case, you and your wife).