Meet 33-year old Kwek Shi Yi who plunged into the world of tax investigation at IRAS after graduating from an accountancy course seven years ago. Shi Yi’s inclination for detective work coupled with her head for figures has kept her going even after chalking up 50 tax crimes.

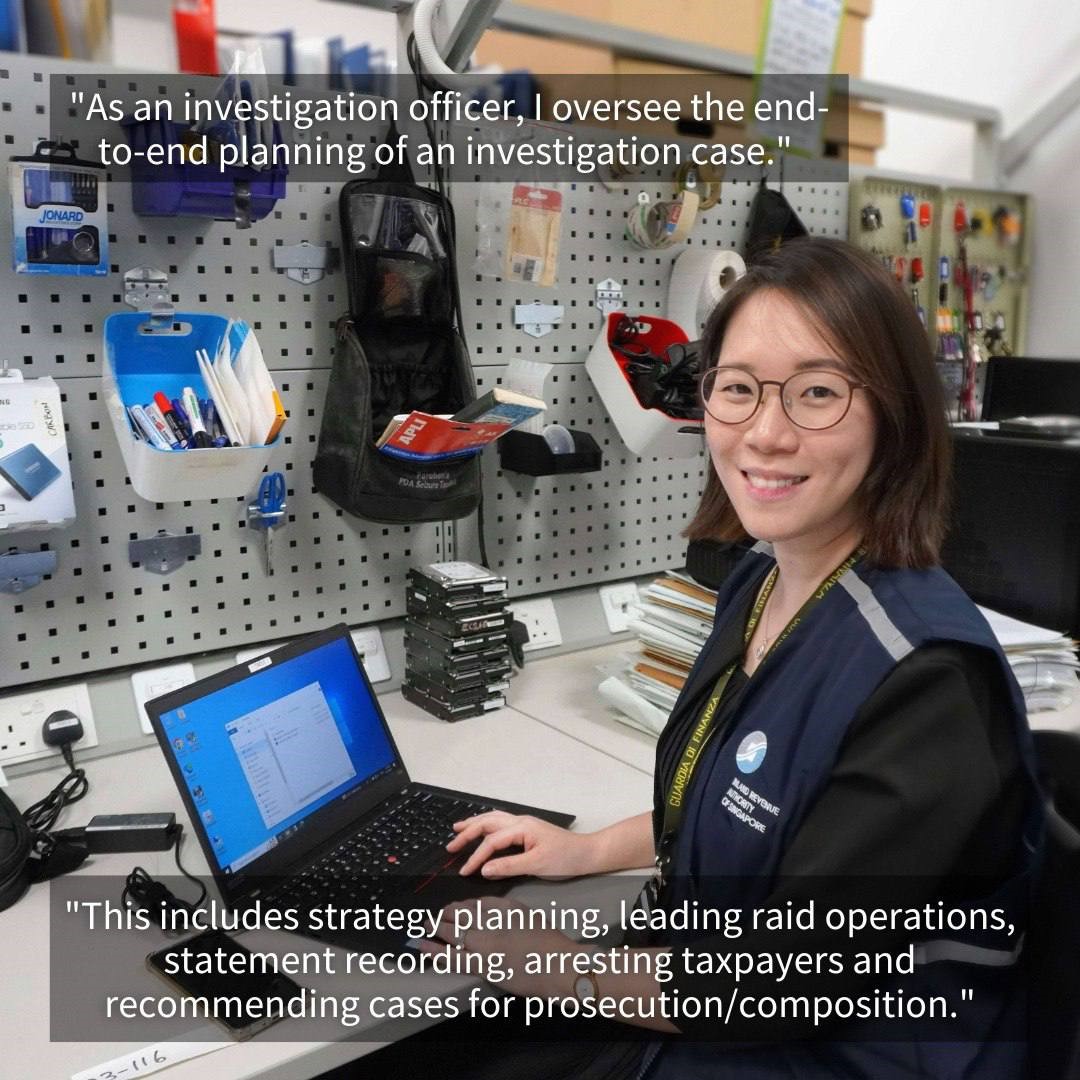

- Not many people are aware that there are tax investigators in IRAS. Can you share more about what you do?

Shi Yi: Many people have the misconception that we only crunch numbers behind our desks or just interview taxpayers. Others may think we are always chasing “bad guys” who have evaded taxes. However, these do not paint the full picture of our role.

I lead a team of five to plan and investigate tax fraud cases. From developing the approach to take, deciding where and when to launch a raid, assessing if we should make arrests, conducting investigations (which includes reviewing and analysing evidence) and finally moving to the prosecution process, we work as a tight-knit team to ensure that we get to the bottom of every tax fraud case.

On a strategic level, we also review the current tax legislations and their limitations and propose amendments to these legislations during the annual legislation cycles. For example, we reviewed the GST Act which led to its amendment so that criminal sanctions were introduced from 1 January 2023 to counter Missing Trader Fraud schemes.

- What are some common tax frauds?

Shi Yi: We see a range of tax frauds for income tax.

Some frauds are one-man shows – perpetuated by single individuals. Others could be perpetuated by syndicates, such as those relating to the GST Missing Trader Fraud scheme where fraudsters used counterfeit goods or created fictitious invoices to inflate transaction values to claim a higher amount for GST refunds.

For complex syndicated fraud, the masterminds typically try to distance themselves from the fraud by using layers of companies and individuals as their runners. The masterminds are like puppet masters who are pulling many strings at any one time. They hire runners do the leg work for them and also recruit directors of companies to be the fall guys.

We have to uncover the layers to find the mastermind so that the “brain” is prosecuted along with the runners and directors of companies who are sometimes puppet directors.

- How do you uncover the tax frauds?

Shi Yi: By analysing our existing data pool and also relying on informants.

We tap on data analytics and advanced statistical tools to run through tax reporting data from taxpayers. This allows us to flag out high-risk or fraudulent cases not easily picked up by humans.

We also regularly refresh and update our system to account for evolving risk factors.

We also receive tip-offs from informants. The identities of the informants are properly safeguarded, and we ensure their confidentiality. All information/documents provided by informants are also kept confidential.

Here’s a fun fact. Informants get a reward at 15% of the tax recovered, but capped at $100,000, if the information and documents provided by them lead to the recovery of taxes that would otherwise have been lost. The maximum reward of $100,000 has been claimed before.

- In your seven years as a tax investigator, what have you seen which really surprised or shocked you?

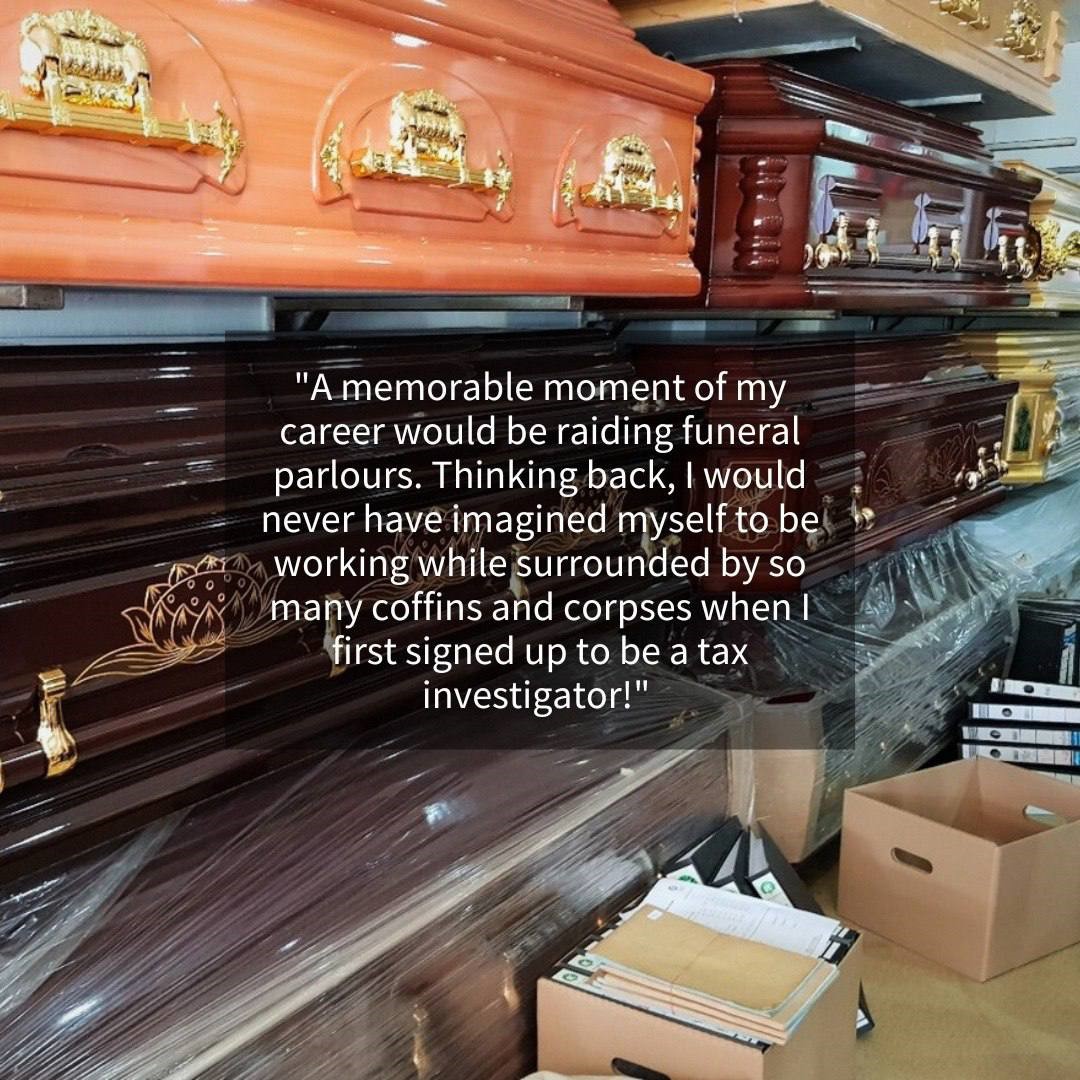

Shi Yi: Corpses and geckos!

One of the more unforgettable cases would be raids in a funeral palour. We had to go on-site to take the statement of a witness who was a funeral director. Seeing bodies being carried into the funeral parlour to be embalmed before being transferred into the coffins made me a little nervous. Nonetheless, I steeled my nerves and remained firm and professional during the investigation.

The geckos are another story! I raided a suspect’s home and discovered that he kept many different species of geckos in his HDB bedroom. Imagine seeing close to 50 geckos of varied sizes, caged up in a small bedroom, with some of them staring at you as you reached out to the documents close to their cages! I felt goosebumps as I navigated around the bedroom to search for documents which were later used as evidence.

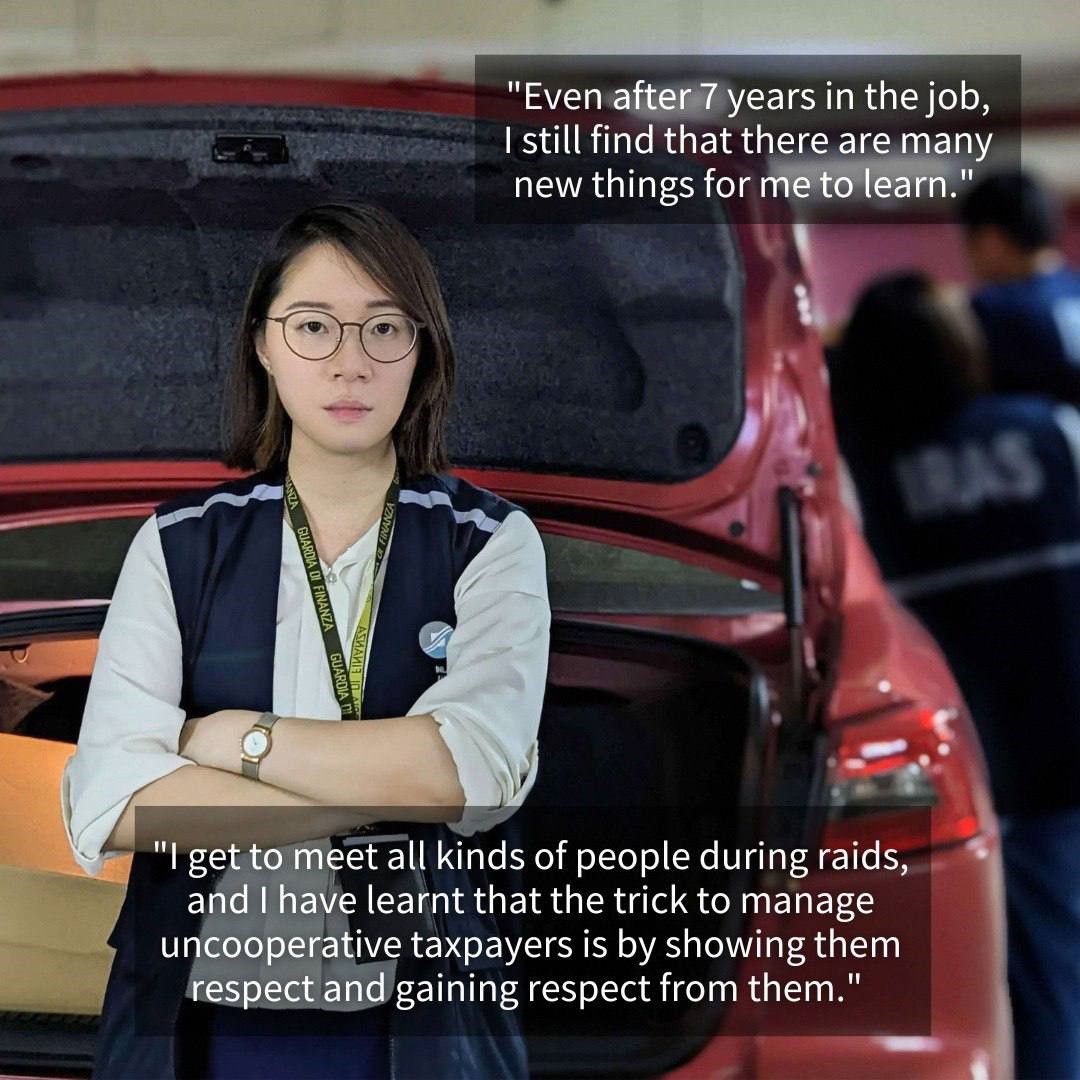

- If you can turn back the clock, what would you tell the young Shi Yi so that she is mentally prepared for the role?

Shi Yi: Be patient and grow a thick skin.

In our line of work, it is common to meet uncooperative taxpayers who raise their voices at us or question our authority as tax investigators.

During a statement recording with a taxpayer, I was reviewing his mobile phone to search for evidence. As I was scrolling, I saw that he saved my number as “Idiotic IRAS officer, don’t answer”. I was honestly quite affected when I first saw. However, I calmed myself so that we could continue with the statement recording smoothly

Anatomy of an investigation

- A surprise visit to the business premise of the suspect to obtain evidence e.g accounting records, source documents and other relevant records;

- A surprise visit which may be conducted simultaneously to the residence of the suspect and to the premises of the suspect’s tax agent or representative and any relevant third parties;

- Searches are sometime conducted during the surprise visits;

- Interviews with the suspect, family members, staff, tax agent or representative, suppliers and any relevant third parties; and

- Obtaining information from or verifying information with other third parties such as counterparties of taxpayers, or other government agencies, banks and financial institutions, foreign tax authorities etc.