Businesses that are not registered for Goods and Services Tax (GST) are not allowed to charge and collect GST from their customers. This includes businesses that are in the process of registering for GST but the application for GST registration has not yet been approved.

Heavy penalties may be imposed on those found guilty of unauthorised GST collection. The business may face a penalty of 3 times the amount of tax unlawfully collected and a fine not exceeding $10,000 and/or imprisonment for a term not exceeding 3 years. IRAS conducts regular audits and checks on businesses to identify instances of non-compliance.

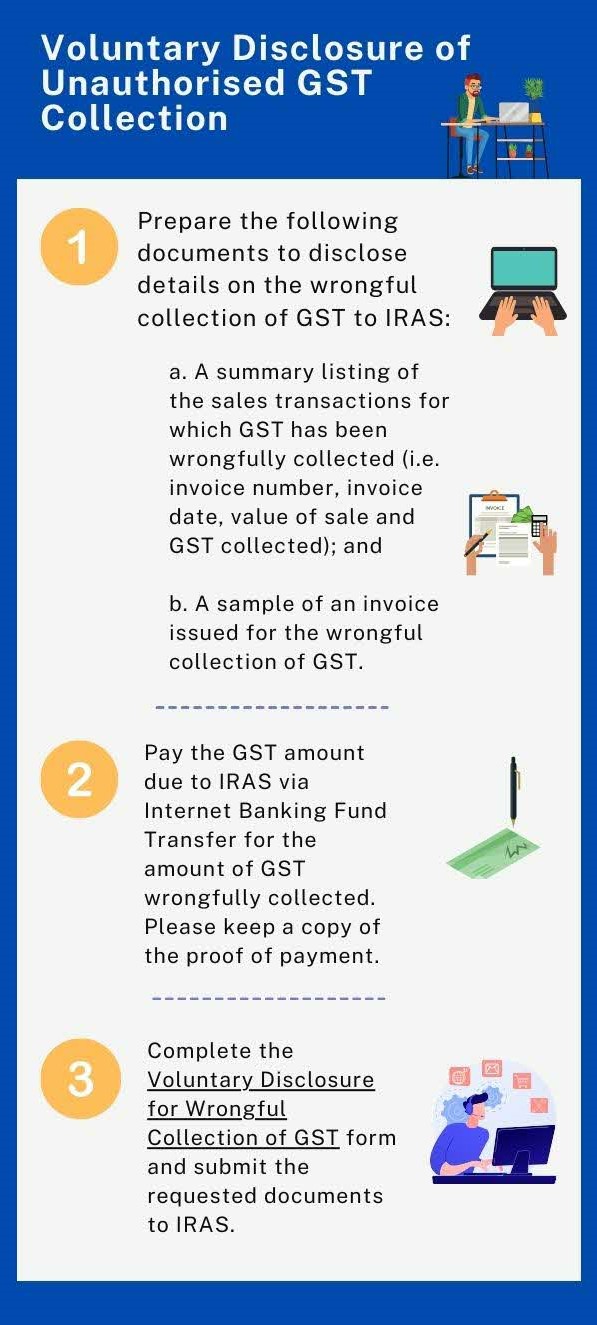

Discovered an instance of wrongful GST collection?

Mr Start-Up has discovered that his business has wrongly charged and collected GST from his customers even though his application for GST registration has not yet been approved. By making a voluntary disclosure, he may qualify for reduction of penalties.

What if my supplier who is not GST-registered collects GST from me?

Ms Baker found out that her non-GST registered supplier had been charging and collecting GST from her when the supplier was not authorised to collect GST. She should seek a refund from her supplier and should not include such claims as input tax in her GST returns.

To avoid making unauthorised GST payments to suppliers in future, she can use IRAS’ Register of GST-Registered Businesses to determine if a business is GST-registered.