Your post-tax filing FAQs answered

Where’s my tax bill? When do I need to pay? How do I fix errors in my tax bill? Why is IRAS making deductions when I haven’t received my tax bill?

Questions and more questions. Fret not! We have compiled the top four questions you may have after tax filing to help you stay informed.

Over 1.9 Million taxpayers to enjoy No-Filing Service (NFS) for Tax Season 2025

Over 1.9 million individual taxpayers are eligible for the No-Filing Service (NFS) with close to 500,000 of them to benefit from the Direct Notice of Assessment (D-NOA) initiative for Year of Assessment (YA) 2025.

The D-NOA further simplifies the tax experience and provides greater assurance and certainty to taxpayers on their tax liability, as they will receive their finalised tax bill earlier from mid-March 2025. Read on.

Tax Explainer: What’s in a working mother’s tax bill

Curious to know what a working mother’s tax bill is like? Get a sneak peek into her tax bill after reliefs.

Tax Explainer: What’s in the sole breadwinner’s tax bill

A sole breadwinner has heavy responsibilities both at the workplace and also at home. What’s his tax bill after reliefs and rebates?

Tax Explainer: What’s in the fabulous single’s tax bill

Reliefs and rebates let a single working adult live her best life. Curious to know what her tax bill is like after reliefs?

Tax Explainer: Tax savings from reliefs, rebates and expense claims

Find out how reliefs, rebates and expense claims can reduce your tax bill.

Give more. Pay less tax.

Want to know how you can pay less tax next year?

We’d let you in on some tips which will shave some off the tax bill. Be prepared to be surprised. The more you give and share, chances are the less tax you will pay as you will enjoy tax reliefs. Bet you didn’t know that.

Let’s deep dive to see how this works.

Simplified filing for self-employed

Self-employed individuals – including commission agents and delivery workers – will enjoy fuss-free tax filing during Tax Season 2024.

Learn how over 100,000 commission agents will enjoy pre-filled income information in their tax returns. For the first time, delivery workers will also benefit from the Fixed Expense Deduction Ratio which lets them claim business expenses based on a prescribed percentage of their gross income, instead of claiming tax deductions based on the actual amount of allowable business expenses incurred.

How to save money on your tax bill in 2024

Take a look at how a Singaporean family headed by a sole breadwinner earning a monthly salary of $5,197 or an annual income of $62,364 can reduce their tax bill, legitimately.

Top three tax reliefs just for working mums

To help working mothers remain in the workforce even after they have children, there are tax reliefs which lighten their load and indirectly, leaves more cash in mums’ pockets. Learn about the top three money-saving tax reliefs just for working mums.

How working mums can reduce their tax bill

Are you a working mother? Find out about tax reliefs available to you and claim them when filing your taxes. Read how working mum, Boon Hui, tapped on tax reliefs to reduce her tax bill.

Tax filing tips for freelancers

Running a side business or providing freelance services? You may be considered a gig worker. Check essential tax information for gig workers and read about TZ’s experience as a freelance designer.

Donation API cuts submission process to under 5 minutes

With the new Donation Submission API service (DON-API), all it takes is five minutes for Institutes of a Public Character (IPCs) to send their donation records electronically to IRAS. This frees up IPCs time to focus on charity work and also helps them to digitalise their operations.

To ease IPC’s adoption by 1 Jan 2024, IRAS has partnered digital service providers to offer DON-API-ready software to IPCs. If you are an IPC, read more on the DON-API.

Working in Singapore for the first time?

Congratulations if you are a foreigner who has just landed a job in Singapore.

As you settle into your new job and life here, learn about essential tax matters.

Preparing ahead for a fulfilling retirement

Do you know how savvy tax tips can help in your retirement plans? Learn how a couple in their late ‘50s are preparing for the golden period of their lives.

Employers, sign up for the Auto-Inclusion Scheme to enjoy five benefits

IRAS’ Auto-Inclusion Scheme (AIS) takes away the hassle of employers issuing paper Form IR8A to employees and simplifies tax filing. Learn about the five benefits of AIS and sign up between 1 Apr - 31 Dec 2023 to enjoy its benefits for Tax Season 2024.Do good deeds and pay less tax

The virtuous cycle of doing good can benefit not just the recipient but also the giver. Read about the benefits of doing good deeds.

In brief: Six types of donations which are tax deductible

In 2021, tax deductible donations received by Institutes of Public Character was $1.03 billion (Source: Commissioner of Charities Annual Report 2021), showing that the spirit of giving is strong in Singapore. Learn about the six types of donations which are tax deductible.

New to the working world? Find out how to adult with confidence

29-year old Eva Lin shares some of her joys and worries of finding her own path in the working world. Read about her journey as a young working professional and also new taxpayer.

5 tips for stress-free tax filing for married couples and families

Married couples and families, learn about the tax reliefs and deductions available to you. Read about 5 tips for a stress-free tax filing season for married couples and families.

PayNow for prompt, secure refunds from IRAS

From July 2022, IRAS will be introducing PayNow as a new refund mode for Individual Income Tax. Taxpayers who are not on GIRO can receive their refunds promptly and securely via PayNow into their bank accounts if they are registered with PayNow.

If you are not on GIRO, register PayNow as your preferred mode of refund today. Simply link your NRIC/FIN to your personal bank account via internet banking. Do contact your bank if you need further assistance.

Find out more about PayNow.

Simplifying the Tax Filing Process

New Filing and Relief Checkers on the IRAS Website

You can check on both your filing requirements and the tax reliefs you are eligible for this year using the filing checker and relief checker on the IRAS website, which features personalised content tailored to different individual profiles. Employees and directors whose employers are not on the Auto-Inclusion Scheme (AIS) are reminded to report your employment income as your income will not be automatically included.Greater Convenience with Digital Tax Bills and Payment/Refund Modes

9 in 10 to Receive Digital Tax Bills

More than 90% of taxpayers will be receiving digital tax bills via myTax Portal this year. Ensure that your contact details and notification preferences on myTax Portal are up-to-date, so that you can receive timely notifications when your tax bills are ready for viewing.

GIRO or PayNow for Easier Tax Payments and Refunds

Sign up for GIRO for safe and seamless tax payments and refunds and enjoy up to 12 months of interest-free instalment payments. IRAS will also be introducing PayNow as a new tax refund mode from July 2022 for taxpayers who are not on GIRO. With this, you will be able to receive tax refunds into your bank accounts promptly and securely following any overpayments or wrongful payments.Everyday transactions are a breeze with Singpass

Managing your taxes and need a faster way to access myTax Portal?

Here’s a tip: Simply tap on the Login Shortcut on the Singpass app, verify your identity using fingerprint or face, and you are logged in. Don’t have a smartphone? Just use Singpass Face Verification on a desktop with a web camera. Accessing key services takes just 5 seconds.

Additionally, you can view your important information, such as Digital IC and CPF balance, in your Singpass app profile.

Did we also mention that you can use your Digital IC at more places and switch to your preferred language for key transactional pages in Singpass by the end of the year?

Enjoy easy access to more services. Download or update your Singpass app!

For details, please visit https://app.singpass.gov.sg.

Tax Filing Made Easy For The Self-Employed

Pre-filling and Fixed Expense Deduction Ratio Initiatives for Self-Employed Individuals

Are you a self-employed individual such as a commission agent or private-hire car (PHC)/taxi driver? Have your commission agencies participated in pre-filling and have you opted-in to pre-fill your gross driving income if your PHC/taxi operators have participated in pre-filling? If so, you will be able to enjoy more convenience when filing your income tax return as gross income information has been pre-filled.

Don’t forget that qualifying commission agents and PHC/taxi drivers can also choose to deduct a deemed amount of expenses based on a prescribed percentage of gross income earned.

Want to find out more information? Click here.

No-Filing Service for Eligible Commission Agents and Taxi/Private-Hire Car Drivers

Eligible commission agents and taxi/private-hire car drivers who have joined the Pre-Filling of Income Scheme will enjoy the benefits of the No-Filing Service (NFS) from 2021 onwards.

You will be informed via a SMS notification from IRAS that you need not file a tax return unless you wish to make any adjustments to your income details or relief claims. Your tax bill will be sent to you from May 2021.

Other qualifying criteria for the NFS include:

- Earning a commission income of not more than $50,000 and/or deriving driving income as a private-hire car/taxi driver;

- Employment income, if any, has been submitted to IRAS by your employer under the Auto-Inclusion Scheme (AIS) for Employment Income.

Receiving Digital Tax Bills

Did not receive a Notification Letter informing you that you that you have been selected to receive an electronic tax bill also known as a Notice of Assessment (NOA)? Fret not! You can opt in to receive digital notices by signing up here.

Tax obligations of online sellers and service providers

If you are selling goods or providing services and content online, income derived from these online activities are taxable. You will need to file a tax return between 1 March and 18 April if your total annual net trade income exceeded $6,000 (or your total annual taxable income exceeded $22,000) last year. The income earned from your online activities should be reported under "Trade, Business, Profession or Vocation" in your individual income tax form.

Find out more at go.gov.sg/tax-guide-online-sellers-service-providers.

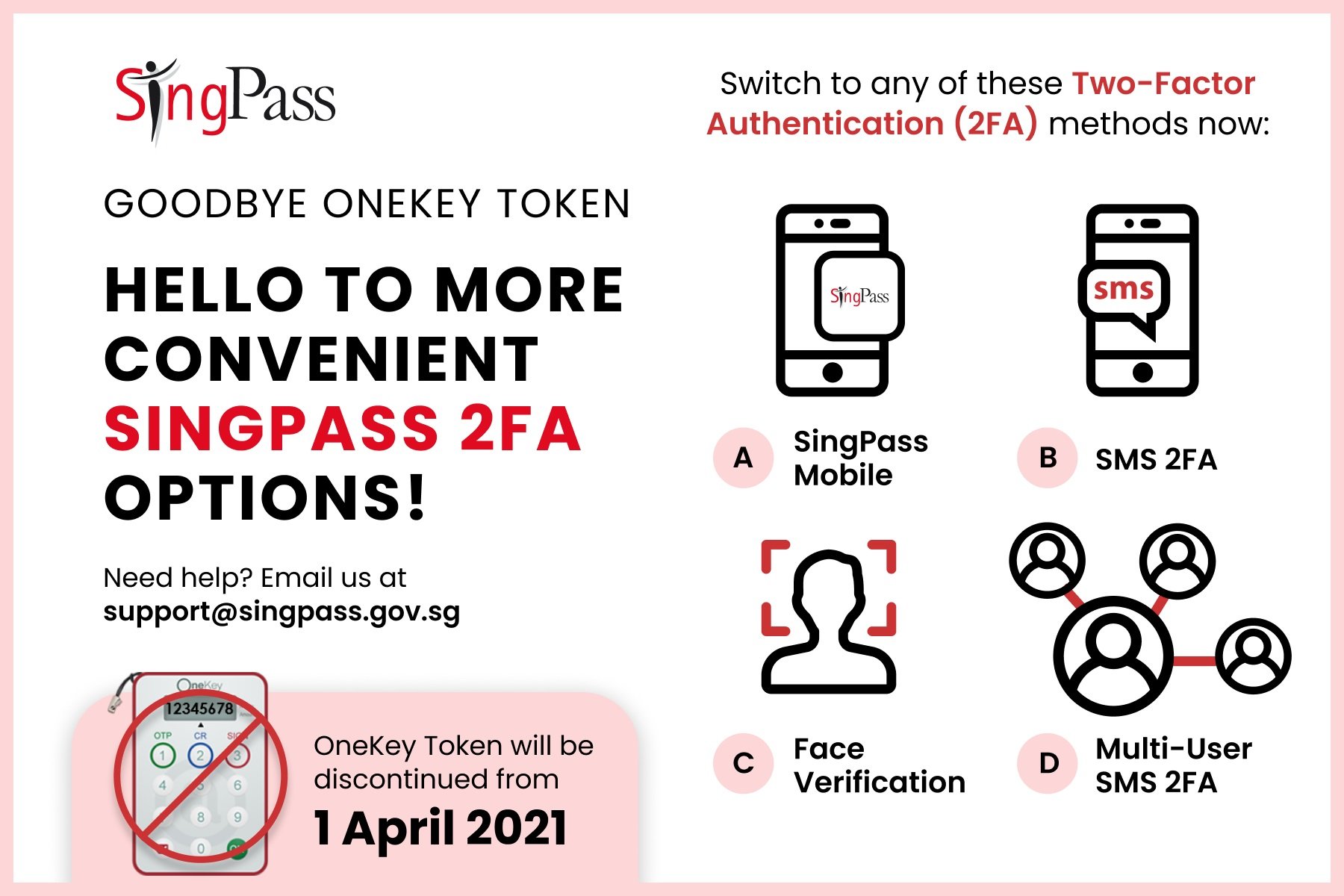

Discontinuation of the OneKey Token from 1 Apr 2021

From 1 April 2021, you will not be able to access government digital services using your OneKey Token. Even so, fret not!

Simply switch to these convenient Two-Factor Authentication (2FA) modes for seamless access to services:

A. Download Singpass Mobile on your smartphone to log in without passwords

B. Using a mobile phone that cannot download apps? Receive SMS One-Time Passwords (OTP) at your mobile number via SMS 2FA

C. Transacting on a desktop/mobile internet browser? Authenticate using a face scan matched against the Government’s biometrics database

D. Consent to have your SMS-OTP sent to the mobile number of a trusted Singpass user

Applying for Alternative Payment Arrangements

Facing difficulties in paying your tax? Do not hesitate to reach out to IRAS early to work out a suitable payment arrangement.

Tax Guidance on Tax Residency for Companies and Individuals

Due to the travel restrictions relating to COVID-19, IRAS has provided a set of tax guidance on tax residency for companies and individuals. Please read details here.

Are you under the 'No-Filing Service' scheme?

Received a letter or SMS informing you of your eligibility for the 'No-Filing Service'(NFS)? This means that you do not need to file a tax return. Simply log in to myTax Portal to preview your tax bill.

From end Apr 2020 onwards, your tax bill will be sent to you. Take note to ensure the accuracy of the contents and file an objection if you have any other income that is not shown in the bill, or if your relief claims in the bill are incorrect.

Pay by GIRO

Enjoy seamless payment of your income tax when you sign up for GIRO at myTax Portal. For DBS/POSB, OCBC, UOB, Bank of China, Citibank, HSBC and Maybank customers, the request is approved within minutes.

Simply log in, select 'Account', and then click on 'Apply/Manage for GIRO Plan'. Simple, fuss-free and you don’t have to worry about missing the due date!

e-Filing of Form M now available for Non-Residents

Been issued a paper Form M? From 1 Mar to 18 Apr 2020, e-File your tax return at myTax Portal using your Singpass or IRAS Unique Account (IUA).